Briefings

Autonomous Shipping: Strength in Diversity

Developments in maritime autonomous surface ships (MASS) technologies continue to take diverse forms, ranging from increasingly large warships to small subsurface robotic drones. Stakeholders continue to adopt these technologies with the consummation of new partnerships and contract procurements. From a “macro” perspective, the value of the global autonomous ships market is expected to triple in size by 2030.1

Reflecting the geopolitical instability worldwide, we note that there has been an increase in the use of autonomous technology and MASS for defence purposes. In fact, this bulletin surveys more developments in the defence and weapons segments than any other we have so far published. We pay particular attention to the impact of the Red Sea crisis on autonomous technologies where we spotlight developments in the sub-section, “MASS and the Red Sea Crisis”. At the global level, we see defence manufacturers moving more aggressively into the space to accommodate the growing interest of global naval, coast guard, and port authorities incorporating MASS technologies into their operations. This includes the US Navy, which envisages autonomous warships becoming a crucial component to its long-term tier force strategy.

From a regulatory perspective, this bulletin also briefly touches upon the UK’s Workboat Code, Edition 3 (the Code), which became effective in December 2023.2 Specifically, we consider how the Code creates a new regulatory regime for certain types of MASS and the options owners and operators have to comply with in accordance with the Code or under alternative regimes.

Finally, we welcome David Savage to the MASS team and look at the issue of sanctions and how, in light of developments in Russia and the Red Sea, greater restrictions are being imposed on the use of technology in autonomous underwater vehicles (AUVs) and MASS for commercial and defence purposes. We provide an overview of the US, EU and UK restrictions and some practical advice to ensure compliance to mitigate potential exposure.

Industry updates3

ZULU MASS 200 TEU design advances

Belgian maritime company Zulu Associates announced in December 2023 that its ZULU MASS design intended for short sea voyages will feature auxiliary wind assistance to supplement its modular zero-emission electrical propulsion system. 4 Zulu Associates and Conoship International, the design’s shipbuilder, intend to finalise the construction in time for the design to traverse waterways including the English Channel and North Sea by 2026. ZULU MASS’s developers envision that its maiden voyage will be manned, with subsequent voyages unmanned and the vessel remotely operated.5 Eventually, Zulu envisages that one person will be able to monitor and operate 5-10 vessels simultaneously.6

Lloyd’s Register granted approval in principle to ZULU MASS’s design in December 2022. 7

Fugro obtains MCA approval for latest unmanned surface vehicle (USV)

Fugro, a Dutch geodata group, has secured Category 0 approval for its FUGRO VAQUITA USV from the Maritime and Coastguard Agency (the MCA), which is the highest level of certification for autonomous vessels in the UK. Accordingly, FUGRO VAQUITA can now operate fully remotely and without restriction in European waters.8 This will enable it to be deployed for offshore projects and undertake subsea surveys, which will reduce the operations’ carbon footprint and replace personnel that would otherwise be exposed to a high-risk environment.

Marine technology startup Clearbot targets more funding and growth

Clearbot, a startup founded in 2019 by graduates from the University of Hong Kong, continues to expand its capabilities in 2024 following on from its success in 2022, winning the Captain’s Table shipping start-up pitch competition, and the 2023 launch of its unmanned battery-powered autonomous robotic service vessel, which removes plastic waste and oil spills from water bodies. 9 According to a Lloyd’s Register feature, Clearbot has manufactured a total of 11 bots in recent months with plans to produce as many as 100 in the near future.10 Clearbot is increasing the size of its bots, and its modular design enables operators to configure the bots for specific projects, such as Clearbot’s most recent project to remove invasive hyacinth growth from certain waterways.

To facilitate its growth, Clearbot intends to secure another round of financing despite nearly breaking even in FY 2022-23. 11

HFW are working closely with Clearbot following its Captain’s Table win and are proud to support the company’s achievements.

Ocean Infinity’s Armada fleet

US-UK marine technology company Ocean Infinity is scaling up its autonomous survey vessels to be used by offshore wind farms. The autonomous “Armada” fleet will survey the seabed for offshore windfarm operators and check underwater infrastructure for the oil and gas industry. Ocean Infinity is building a fleet of 23 vessels that will eventually be capable of unmanned operation. During recent tests off the coast of Norway, Ocean Infinity managed to reduce the total number of crew on board to as few as 16 for a 78m long vessel which would otherwise ordinarily require 40 to 50 crew members. 12

New developments

Market analysts predict global “Autonomous Ships” market to triple in size by 2030

A capital market report by PrimeIQ predicts that the global “Autonomous Ships” market will have grown from US$ 29m in 2022 to US$ 91m by 2030, reflecting a compound annual growth rate of 18%. The report defines the Autonomous Ships global market to include the activities of manufacturers, designers and shipbuilders like Kongsberg and Rolls-Royce, liners and logistics groups such as NYK Line and Mitsui OSK Lines, and defence agencies like DARPA, all of whom are scaling up their investments in autonomous shipping technologies. 13

Autonomous navigational systems to transform ECDIS and S-100 framework

A report by TradeWinds evaluating S-100, an international framework which governs electronic chart display and information systems (ECDIS), quotes several experts unanimous in their opinion that autonomous technologies will be one of the most transformative forces for the future of ECDIS. Part of the S-100 framework now includes certain agreements backed by the International Maritime Organization (IMO) to facilitate data sharing between vessels, ports and maritime authorities. This will in turn shape the future of autonomous navigational systems. For instance, by enabling machine-to-machine information exchange, ECDIS systems may be capable in the future of automatically making route amendments based on real-time conditions without any human input.14

Oceaneering presents its Floating Wind Solutions

Texas-based marine engineering group Oceaneering International, Inc. presented on its remote technologies and connectivity capabilities at this year’s Floating Wind Solutions conference in February 2024. 15 Oceaneering surveyed the asset management services it provides for offshore wind installation owners and operators, which includes unmanned surface and subsurface inspection vehicles commanded from an onshore remote operations centre. One key service is its Liberty E-ROV which provides its customers with an all-in-one deployable mobile docking station to service their offshore assets.16

The 2024 Floating Wind Solutions conference was well-attended, with HFW Autonomous Shipping partners Paul Dean and Tom Walters in attendance.

HydroSurv to commercialise USV platforms with automated data processing

UK USV manufacturer HydroSurv announced in February that it had secured UK funding from the Department for Environment, Food and Rural Affairs ( DEFRA). HydroSurv will use the funding to scale and commercialise efforts to combine HydroSurv’s USV platforms with an automated data processing system. The aim of this project is to use the robotic solution as an effective way to monitor and map seagrass meadows off the coast of the UK, which serve an important ecological role. HydroSurv will demonstrate the robotic solution over 40 days of on-water testing in the spring and summer of this year off the southwest coast of England.17

Norway orders four battery-powered autonomous ferries

The Norwegian Public Road Administration has awarded a contract to ferry operator Fjord1 to supply and operate battery-powered autonomous ferries between the villages of Lavik and Oppedal. Fjord1 has since ordered four double-ended RoRo ferries from Turkish shipbuilder Tersan Shipyard, which are due to enter service in 2026. These ferries are designed to operate autonomously, though Fjord1 will phase in autonomous navigation and operation over a series of trials with a goal to achieve full autonomous operation in 2028. 18

Maritime autonomous technologies and the Red Sea Crisis

Middle Eastern defence groups respond to threat posed by Houthis

Elbit Systems Emirates, an Israeli defence company, unveiled at the January 2024 UMEX drone fair in Abu Dhabi a USV design variant based on a pre-existing platform, which it has recently sold to an undisclosed naval force in the Asia-Pacific region for US$ 56m. Given the current state of affairs in the Red Sea, the new variant will be larger (up to 17-18m), will have greater manoeuvring capabilities as well as the capacity to remain at sea for 10 days rather than 6. 19

Separately, though details are scant, Emirati defence manufacturer Edge Group’s board chairman announced that it is moving into the autonomous submarine segment in response to the Red Sea troubles. The platform is targeted specifically as a cost-effective countermeasure for merchant vessels to guard against Houthi attacks, with Edge’s chairman noting, “Let’s say you have a cargo ship flowing through the Red Sea. Trying to put manned patrol boats that can escort it is an expensive exercise… But if you have your USV that is unmanned, that possesses a weapon and ISR [intelligence, surveillance, reconnaissance] capability, when that other [Houthi] boat is coming in to threaten the cargo ship, the USV can deal with it very effectively and is less costly.”20

Edge Group’s announcement follows on from a 2021 agreement between Edge Group and Israel Aerospace Industries to co-create a USV primarily to address Iranian naval threats. 21

Orca AI’s autonomous tech for defensive purposes in the Red Sea

Using its AI technologies, Orca AI has developed a tool to safeguard maritime operations traversing the Red Sea, specifically by screening for aerial drone threats. Orca AI’s SeaPod platform uses AI-assisted automated computer vision to scan for airborne targets including Houthi drones. When SeaPod identifies airborne threats, it notifies the crew through an audio alarm. 22

Houthi rebels arsenal also includes seaborne drones

The Houthi rebels, who began their assault against merchant vessels in the Red Sea in November 2023, have demonstrated that autonomous marine technologies can be used as weapons against the merchant marine trade and Western naval forces. In February 2024, US naval forces reported that the Houthi rebels are using underwater drones and USVs as part of their ongoing attack of merchant vessels traversing the Red Sea. 23

Other defence applications

The role of lightly manned autonomous warships in the US Navy’s long-term strategy

The US Navy currently has three developed “tiers” of force: (1) aircraft carriers (reinforced by large amphibious ships); (2) guided missile destroyers; and (3) its extensive submarine fleet. What is needed is a better developed fourth tier of smaller warships. The US Naval Postgraduate School in California is now researching the design and operations of a Lightly Manned Automated Combatant Capability ( LMACC) vessel to see if it can fulfil the role of a potential fourth-tier force.24

The LMACC is designed to be 67m in length with a range of 7,500nm at speeds of 12 knots, enabling it to operate free of logistics vessels. It will be equipped at all times with a full suite of weapons – surface-to-ground, surface-to surface and anti-missile/air capabilities – rather than armed on a “plug and play” basis. But at the core of the LMACC’s design is the emphasis on decreasing the number of personnel necessary to operate the vessel through the creation of autonomous engineering systems, enabling the vessel to operate “semi-autonomously”. This translates to lower design and production costs as well as operational expenses. 25

Mexico port authorities purchase nine underwater drones

The Mexico Port Authorities have taken delivery of nine underwater drones designed by Californian marine robotics company, Oceanbotics Inc. The subsurface drones, SRV-8, will enable the Mexico Port Authorities to undertake hull inspections, oversee environmental conditions, and otherwise increase threat detection capabilities. 26 According to the manufacturer’s website, SRV-8s are also employed by other police and border forces in locations including California, Australia, and Florida.27

MILKOR’s hybrid manned/USV catamaran capabilities

MILKOR, a South African defence group, unveiled at the World Defence Show ( WDS) 2024 exhibition in Riyadh its new autonomous-capable catamaran platform designed for near-shore operations. The MILKOR inshore patrol vessel (IPC) can operate both in crewed and uncrewed modes and is intended for coast guard and surveillance operations. The vessel measures 12m in length, 4.8m in beam, with a draught of 0.87m and a displacement of 13 tonnes and is powered by two 450 hp engines with outboard propulsion. It accommodates up to four people and is capable of cruising at speeds ranging from 25 to 35 knots. While capable of reaching maximum speeds of 50 knots, it can sustain a loiter speed of 7 knots to achieve an operational range of 650 to 750nm. MILKOR is in procurement discussions with an undisclosed Middle Eastern country’s defence force for the supply of the IPC.28

Chinese shipbuilder exhibits war USV concept at WDS

Also attending the WDS was the China State Shipbuilding Corporation (CSSC), which exhibited its new Thunderer A2000 design concept. The concept envisions a USV weighing 280gt, 45m in length, sporting twin diesel engines with a top speed of 35 knots. It will employ stealth technology but interestingly will not feature any anti-ship missiles, though it will carry short and medium-range surface to air missiles and can command smaller USVs and launch small aerial drones. When deployed, it is intended to give China force multiplier capabilities in littoral waters. 29

Defence giant Northrop Grumman to trial autonomous shipping and electronic warfare payload technologies

Defence technology company Northrop Grumman’s “Project Scion” will participate in two trials to demonstrate its advances in unspecified autonomous and electronic warfare payloads, including exhibiting Project Scion at the Association for Uncrewed Vehicle Systems International Xponential 2024 event to be held in California in April. These technologies were first incorporated in a USV designed by MARTAC, the Devil Ray T38, which “autonomously identified, chased and surveyed a target in the Chesapeake Bay” in December 2023, while fitted with Northrop Grumman’s autonomous technology system. 30

South Korea celebrates launch of autonomous containership

South Korean shipbuilder Hyundai Mipo Dockyard floated out the POS SINGAPORE in March 2024. South Korea’s Ministry of Oceans and Fisheries refers to the vessel’s design as being the first large ocean-going vessel intended to achieve IMO Level 3 autonomous capabilities. If achieved, this means the vessel will be approved to undertake full autonomous seaborne navigation without any onboard crew. POS SINGAPORE, which was built for and delivered to Pan Ocean, will now begin outfitting and testing her autonomous systems. 31

Legal update

Sanctions implications for MASS and UAV’s

The use of autonomous, unmanned underwater vessels has recently been under the spotlight after the Houthi rebels were accused of launching Iranian-made autonomous underwater vessels against ships for the first time. This followed previous indications that such vehicles were being supplied to the rebels.

Autonomous vehicles have also become an increasingly important weapon for both Russia and Ukraine. Because of this, there has been a gradual increase in the prohibitions linked to the provision of such vessels, associated technology and software and technical assistance, to Russia. In this section we provide an overview of the US, EU and UK restrictions and provide some practical advice to ensure compliance and mitigate potential exposure.

During the past 14 years there have been successive export controls and sanctions in relation to the export to Russia of autonomous submersible vessels. The US, the EU and the UK have all legislated to restrict Russia’s ability to source submersible vessel hardware and software. Examples of the types of items that are subject to these restrictions include equipment and components for submersible vehicles, sensors, navigation equipment, underwater equipment, underwater camera equipment, marine engines, propulsion equipment, “Software” specially designed or modified for the “development”, “production” or “use” of controlled equipment and components, “Software” specially designed for the operation of unmanned submersible vehicles and “Technology” for the “development”, “production” or “use” of controlled equipment and components.

With the Ukraine/Russia war looking set to continue for the foreseeable future and with the focus of UK, EU and US regulators now turning to enforcement of suspected breaches of Russian-related restrictions, it remains incredibly important for those engaged in international business to ensure compliance with this complicated area of regulation.

It is therefore imperative that companies in the autonomous submersible sector, especially those who have previously sought to engage in business where there is any form of Russian nexus ensure that any trade is in compliance with various sanctions and export controls that are currently in place.

In order to ensure compliance with the restrictions, there are a number of steps that can be taken:

- Review classifications of products being supplied to or for use in Russia. Any products with an 8A001, 8A002, 8A992. 8D992, 8D999, or 8E992 classification should be considered, in the first instance, to require further due diligence to ensure that sanctions and export controls regulations are not being breached. Classification code analysis can be complex and requires a detailed understanding of both the export control lists and the technical specifications of the items in question.

- Consider whether there is evidence indicating that the items may be intended for a controlled end use.

- Review counterparties to ensure that products do not ultimately end up being received by or for use in Russia.

- Consider including contractual terms, including warranties, indemnities, rights of termination and sanctions and export control compliance, to minimise exposure for breaches.

- Consider seeking end-user certifications or other documentation to ensure that products will not be used for nefarious purposes.

- If you have exposure to the Russian energy, defence and financial sectors, consider taking steps to manage sanctions-related and export-related legal and business risks. This may include updating policies and procedures, rolling out training, or undertaking annual risk assessments.

- Consider whether a licence is needed and available for the relevant export.

- Be alive to red flags in transactions. The Bureau of Industry and Security (BIS) recently provided a list of twenty-two red flags that may be indicative of attempts to evade the Russia export controls and sanctions, including: transactions involving a change in shipments or payments that were previously scheduled to go to Russia or Belarus; rapid shifts to new purchasers in transactions involving restricted luxury goods; parties that have shared owners or addresses with Russian state-owned entities or designated companies; and payments being made from entities located in third-party countries not otherwise involved with the transactions and known to be a potential transshipment point for exports to Russia and Belarus.

- Be alive to jurisdictions known to assist in sanctions and export controls circumvention. BIS has identified several countries as transshipment points through which restricted or controlled exports have been known to pass before reaching destinations in Russia or Belarus, including, Armenia, Brazil, China, Georgia, India, Israel, Kazakhstan, Kyrgyzstan, Mexico, Nicaragua, Serbia, Singapore, South Africa, Taiwan, Tajikistan, Turkey, United Arab Emirates, and Uzbekistan.

Our previous MASS bulletin, published in November 2023, can be accessed here.

Past events

Maritime Autonomous systems Regulatory Conference 2024

16-17 January 2024

IMO: Implications, challenges and opportunities of Maritime Autonomous Surface Ships (MASS) for ports and public authorities

11 April 2024, London, UK

The Seminar provided an opportunity to understand the future impact of MASS on ports and may assist ports in preparing their plans and preparations before MASS operate in ports in the coming years.32

Future events

IMO: Sailing together: Striving for a future-proof IMO MASS Code

14 May 2024, London, UK

The Symposium “Sailing together: Striving for a future-proof IMO MASS Code” is co-sponsored by IMO and the Republic of Korea. The event is intended to support the ongoing effort of the IMO to develop a goal-based, non-mandatory MASS Code by expert presenters introducing the ongoing research and development of autonomous systems in the maritime sphere, as well as on successfully conducted MASS trials. 33

Warship 2024

18-19 June 2024, Adelaide, Australia

In June, the Royal Institution of Naval Architects will host in Adelaide, Australia its upcoming Warship 2024 conference. The agenda is focussed on future surface combatants. In terms of autonomous technology offerings, the preliminary programme includes design opportunities created by autonomous technologies, large uncrewed surface vessels, and the transition from unmanned ships to fully autonomous vessels.34

Autonomous Ship Expo

18-20 June 2024, Amsterdam, Netherlands

The Autonomous Ship Expo will connect autonomous technology developers with ship designers, operators, classification societies and other key stakeholders over a three-day event. 35

MTEC/ICMASS 2024

29-30 October 2024, Trondheim, Norway

The International Maritime and Port Technology and Development Conference (MTEC) and the 6th International Conference on Maritime Autonomous Surface Ship (ICMASS) 2024 will be held in Norway. The conference aims to bring together academia and industry from around the world showcasing cutting-edge research and development within maritime technology, autonomous ships and port operations.

With the world’s first test area for autonomous ships, Trondheim has gained a leading position in the field of autonomous ship technology through collaboration between maritime stakeholders. This year’s conference topics include: Green shipping and ports, Smart and autonomous ship and port operations, Maritime safety and Maritime digitalization, connectivity and cybersecurity.36

Autonomous Ships 2024

20-21 November 2024, Copenhagen, Denmark

In December 2024, the IMO will host the 109th session of the Maritime Safety Committee (MSC) where the MASS group will meet again. The Royal Institution of Naval Architects and IDA Maritim, a professional network at Danish Society of Engineers are organising the 3rd Autonomous Ship conference on 20-21 November 2024 ahead of the IMO meeting.37

Feature piece: Obtaining certification for USVs less than 24m under The Workbook Code 3rd edition38

Overview – To which vessels does Annex II apply?

The MCA’s third edition of The Workbook Code (the Code) came into force on 13 December 2023. The Code now includes for the first time a comprehensive regime governing certain Maritime Autonomous Surface Ships (MASSs) less than 24m in length.

The Code defines MASSs as “every description of vessel or craft used in navigation that can for any part of its voyage, fully or in part, navigate or operate autonomously or through remote operations.” However, the Code at Annex 2 specifically governs Remotely Operated Unmanned Vessels (ROUVs), which are described as vessels with no persons on board and which are operated from a remote location. In order for a vessel to operate as an ROUV under the Code, it must comply with the requirements listed in Annex II of the Code, as well as with the relevant sections of the same.

Below is a flowchart to determine whether a vessel meets the Annex 2 criteria:

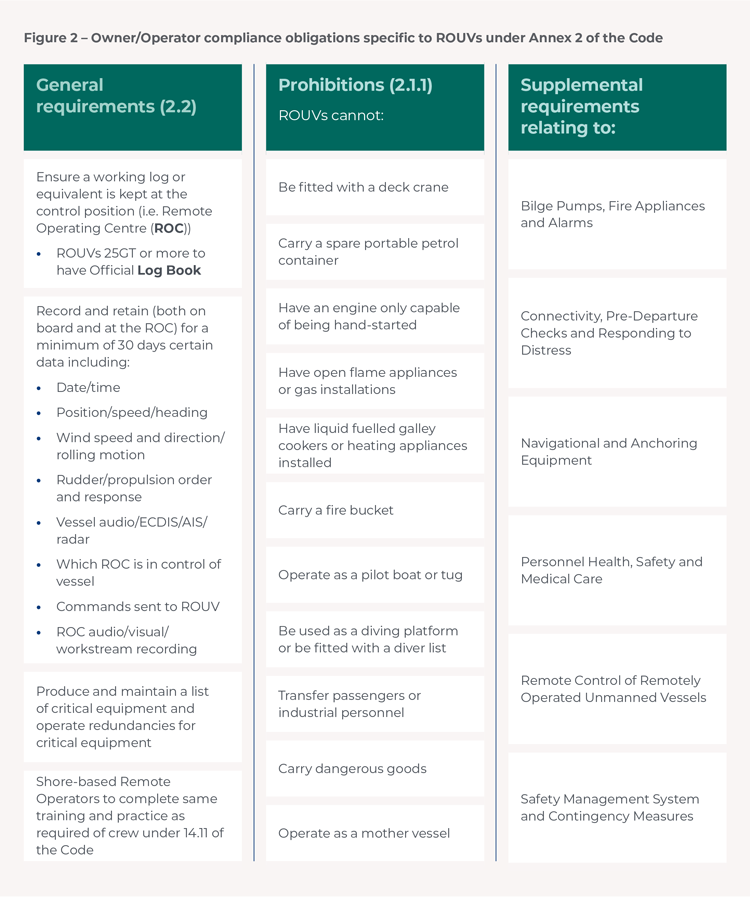

Obligations under Annex 2

If Annex II does apply, subject to exemptions or compliance with a parallel regime (see below), ROUVs must comply with certain requirements and prohibitions, which are summarised below.

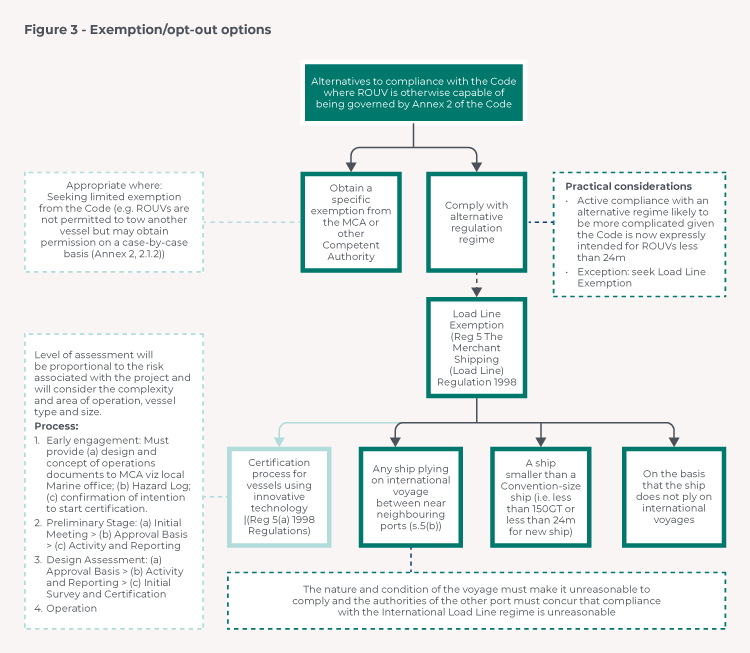

Exemptions and opting out of compliance with the Code

All MASSs less than 24m intending to operate as a workboat, including ROUVs, after 13 December 2023 will either need to:

- comply with the Code (and with Annex II where it applies i.e. for vessels meeting the definition of an ROUV); or

- obtain an exemption under the Code; or

- comply with an alternative regime such as the Merchant Shipping (Load Line) Regulations 1998, including by obtaining a Load Line Exemption Certificate.

The Code is intended to provide owners/operators with a straightforward certification and compliance regime. While compliance with the Code is mandatory if any vessel including an ROUV is certified under the 2023 Workboat Regulations, owners/operators may nevertheless elect to comply with parallel merchant shipping regulations.

ROUV owners/operators may seek a specific exemption from any of the requirements specified in Annex II (or the Code more generally) if they can establish that compliance with any part of the Code including Annex II is impracticable or unreasonable (Annex II, 1.1.3).

For MASSs including ROUVs that are otherwise capable of regulation under the Code, owners/operators may instead seek a Load Line Exemption Certificate under the Merchant Shipping (Load Line) Regulations 1998.39

In particular, given the novel technology that ROUV and other MASSs employ, owners/operators may benefit from the MGN 664 M+F certification process. This exempts vessels from obtaining load line certification provided the ROUV embodies novel technological features whose incorporation would be impeded if the vessel had to comply with the international load line regime.40

Below is a flow chart summarising options for owners/operators of ROUVs seeking certification through means other than compliance under Annex II/the Code.

Footnotes

- https://finance.yahoo.com/news/autonomous-ships-market-size-growing-150500669.html

- https://assets.publishing.service.gov.uk/media/6564a8301524e6000da10138/The_Workboat_Code_Edition_3.pdf

- In this section we provide updates on projects and developments we have been following in earlier bulletins.

- New Autonomous Zero-Emission Containership Design (marinelink.com)

- Unmanned autonomous container ships to cross North Sea in 2026, navigating one of the world’s busiest waterways | TradeWinds (tradewindsnews.com)

- The Royal Institute of Naval Architects, The Naval Architect (February 2024), page 17

- https://www.hfw.com/downloads/004825-HFW-MASS-Autonomous-Vessels-The-Momentum-Is-Building.pdf

- Fugro USV Receives UK Coastguard Approval | Unmanned Systems Technology

- https://www.clearbot.org/

- Clearbot – cleaning our oceans autonomously | LR

- Clearbot – cleaning our oceans autonomously | LR

- Robot ships: Huge remote controlled vessels are setting sail - BBC NewsRobot ships: Huge remote controlled vessels are setting sail - BBC News

- The Autonomous Ships Market size growing with a CAGR of 17.83%: Growth Outlook from 2022 to 2030, projecting market trends analysis by Application, Regional Outlook, and Revenue (yahoo.com)

- Tech standard to reshape shipping one brick at a time | TradeWinds (tradewindsnews.com)

- https://www.imca-int.com/calendar/floating-wind-solutions-2024/

- https://www.oceaneering.com/rov-services/next-generation-subsea-vehicles/liberty-e-rov/

- Robotic seagrass solution targets commercial adoption | The Global Maritime Business News Portal - The Maritime Economy Publications

- Norway Orders World’s First Battery-Power Autonomous Ferries (maritime-executive.com)

- Mideast defense firms fine-tune unmanned surface vessels (defensenews.com)

- Mideast defense firms fine-tune unmanned surface vessels (yahoo.com)

- Mideast defense firms fine-tune unmanned surface vessels (yahoo.com)

- The Royal Institute of Naval Architects, The Naval Architect (February 2024), 14-15 ; Tackling the Houthi Drone Threat Effectively with AI Technology | Defense | News (oceannews.com)

- Houthis using underwater drones in Red Sea says US military: Lloyd’s List (lloydslist.com)

- The Royal Institute of Naval Architects, The Naval Architect (February 2024), 15

- Ibid.

- Oceanbotics Delivers Nine Underwater Drones to Mexico Port Authorities | The Global Maritime Business News Portal - The Maritime Economy Publications

- Home - Oceanbotics Professional Grade ROVs

- MILKOR exhibits manned/unmanned convertible vessel at WDS 2024 - Naval News

- China Unveils Next-Gen Attack USV ‘Thunderer A2000’ at WDS 2024 - Naval News

- Northrop to showcase Project Scion tech payloads for unmanned vessels (defensenews.com)

- https://insurancemarinenews.com/insurance-marine-news/south-korea-launches-container-ship-built-for-autonomous-operations/

- IMO Seminar on implications, challenges and opportunities of Maritime Autonomous Surface Ships (MASS) for ports and public authorities

- IMO and the Republic of Korea Symposium on IMO MASS Code

- Warship 2024: Future Surface Combatants (rina.org.uk)

- Autonomous Ship Expo 2024

- Home - MTEC ICMASS 2024 - NTNU

- Autonomous ships 2024 | IDA English

- https://assets.publishing.service.gov.uk/media/6564a8301524e6000da10138/The_Workboat_Code_Edition_3.pdf

- The Merchant Shipping (Load Line) Regulations 1998 (legislation.gov.uk)

- MGN 664 (M+F) Amendment 1: Certification process for vessels using innovative technology - GOV.UK (www.gov.uk)

Research undertaken by trainee Jake Rickman.