Briefings

New Brazilian Carbon Market Takes Shape

Like other countries that are grappling with delivering on their Paris Agreement nationally determined contributions and are passing laws to secure government oversight of greenhouse gas emissions, Brazil is in the process of passing a bill to achieve these objectives.

If passed, this bill will:

- establish a sector-agnostic emissions trading system (including the use of domestic emissions offsets, up to a limit); and

- regulate the voluntary carbon markets and the Article 6 markets in Brazil.

The HFW/CAR teams have been closely following the legislative process and have prepared the following overview of the bill and the new regime that it proposes.

Status of the bill

On 21 December 2023, the Chamber of Deputies approved the amended text of Bill 2,148/15 (the Bill).1

It was then forwarded to the Federal Senate for the approval of amendments made by the deputies, including in respect of the exclusion of primary agricultural production and associated infrastructure. The legislation is on a fast track and the final version of the Bill is expected to be voted and submitted for presidential sanction before the end of 2024 (although implementation will be gradual and will be subject to further subsequent subsidiary regulations).

Structure of the Bill

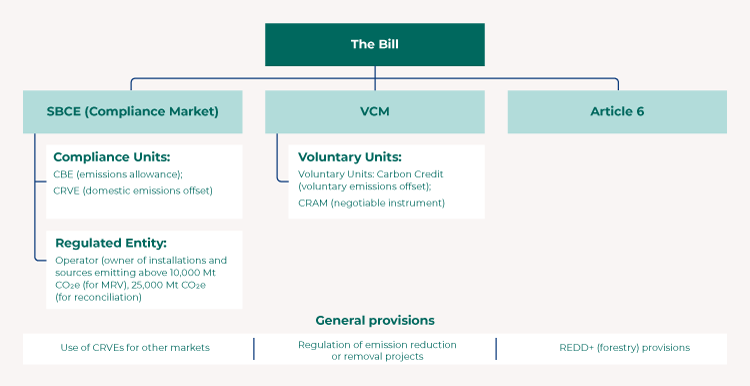

Provisions in the Bill can be broadly subdivided into several categories depending on the relevant market:

- Provisions regulating the Brazilian Greenhouse Gas Emissions Trading System (Sistema Brasileiro de Comércio de Emissões de Gases de Efeito Estufa - SBCE), which is a compliance market modelled on an emissions cap-and-trade system that allows the use of both emissions allowances and offset units for compliance purposes;

- Provisions which relate to units intended for the voluntary carbon market (VCM) (i.e. not for compliance use within the SBCE); and

- Provisions relating to units intended for use under Article 6 of the Paris Agreement.

There are general provisions which straddle these market categories, namely:

- Provisions that contemplate the use of compliance units for the VCM and Article 6; and

- Provisions that regulate emissions reduction or removal projects generally, regardless of whether they are intended for the SBCE, the VCM or the Article 6 markets.

The structure of the Bill is represented by the diagram below.

Compliance market: objective of the SBCE

The SBCE aims to support the fulfilment of the National Policy on Climate Change ( Política Nacional de Mudança Climática - PNMC)2 and the commitments undertaken by Brazil under the Paris Agreement. Brazil has committed to reducing its greenhouse gas (GHG) emissions by 48.4% below 2005 levels by 2025 and by 53.1% below 2005 levels by 2030.3

In this context, the SBCE established by the Bill is a cap-and-trade regime for capping GHG emissions of Regulated Operators and allowing them to trade emissions allowances in Brazil. This model has features that are similar to the emissions trading systems of the European Union, China, California and Quebec emissions markets.

Entities, sectors and activities covered by the SBCE

In respect of an installation or greenhouse gas ( GHG) emissions source (described in more detail below) that falls within the scope of the SCBE, the entity responsible for compliance is the Operator, who is either a Brazilian individual or legal entity that is established under Brazilian law, holding direct or indirect ownership of the covered installation or GHG source. It is presently unclear how this will be determined in practice, particularly since the sectoral scope of the SBCE is quite wide and there may be different ownership or control structures in different economic sectors. We expect that detailed rules for attributing compliance liability based on direct or indirect ownership will be eventually clarified through subsidiary regulations.

The SBCE, unlike other emissions trading systems, is not sector-specific. It has a tiered compliance structure whereby different degrees of compliance obligations apply to an Operator whose GHG emissions exceed certain thresholds. The main exception to this sector-agnostic approach is that primary agricultural production and associated infrastructure are excluded from the scope of the SBCE. 4

The tiered thresholds and respective obligations are as follows:

- Operators (Regulated Operators) of installations and sources emitting over 10,000 Mt CO2e per year must submit a monitoring plan to the government body established to execute the SBCE (the Managing Body) and provide a report on GHG emissions and removals as per the approved monitoring plan (i.e. such Operators have monitoring, reporting and verification (MRV) obligations).

- Operators (Large Regulated Operators) of installations and sources emitting above 25,000 Mt CO2e per year are required to fulfil the MRV obligations and must also submit a periodic reconciliation report of their obligations. This means that the Operator must have compliance units (i.e. assets, described further below) equal to its emissions by the compliance deadline.

The above thresholds may be increased by the Managing Body, taking into account: (i) the cost-effectiveness of the regulation; (ii) compliance with the PNMC and the international commitments made by Brazil; and (iii) other criteria defined by the Managing Body.

These obligations apply only to activities for which there are consolidated methodologies for MRV, as approved by the Managing Body pursuant to subsidiary regulations. 5

Compliance market: compliance units

The SBCE acknowledges two types of units that may be used for compliance purposes ( Compliance Assets), namely:6

- Brazilian Emission Quota (Cota Brasileira de Emissões - CBE): A fungible, tradable asset that represents the right to emit one tonne of carbon dioxide equivalent. CBEs are emissions allowances (as opposed to offset units). A CBE will be allocated by the Managing Body of the SBCE, either free or for a fee, to Large Regulated Operators.

- Verified Emission Reduction or Removal Certificate (Certificado de Redução ou Remoção Verificada de Emissões - CRVE): This is a fungible, tradable asset that represents the reduction or removal of GHG equivalent to one tonne of carbon dioxide. A CRVE is a domestic emission reduction or removal unit that is issued by the SBCE (or potentially by a carbon credit certifier) pursuant to a methodology approved under the SBCE and registered on the SBCE.

Compliance Assets, and transactions in such units, will be recorded in a digital registry known as the SBCE Central Registry.

Compliance market: phase-in of the SBCE

The SBCE will be phased in gradually, in five phases, with the obligation to submit a periodic reconciliation report only arising when the first National Allocation Plan (explained below) has come into force (expected to be at least two years after the entry into force of the Bill). 7

Further, there will initially be free allocation of CBEs. 8 Therefore, we would expect compliance demand for CBEs and CRVEs in the short to medium term to be rather limited. Whether there will eventually be demand for CRVEs to be used in substitution for CBEs is likely to depend on the price of CBEs as free distribution is phased down or if emitters emit more than the number of CBEs allocated to them free of charge.

Compliance market: allocation of CBES

The technical details for the allocation of CBEs will be set out in a National Allocation Plan, which will establish, for each commitment period:

- the maximum emission limit (i.e. the total cap for the SBCE);

- the quantity of CBEs to be allocated among the Large Regulated Operators;

- the methods of allocating the CBEs, either free or for a fee, to Large Regulated Operators;

- the maximum number of CRVEs (as a percentage of a Large Regulated Operator’s GHG emissions) that can be used for compliance purposes;

- the management and operation of the price stabilization mechanism for Compliance Assets;

- the criteria for transactions of Net Greenhouse Gas Emission Removals;9 and

- other relevant provisions for the implementation of the SBCE.

The National Allocation Plan will adopt a gradual approach between consecutive commitment periods, 10 ensuring predictability for Operators, and will be approved at least twelve months before its period of validity.

Compliance market: requirements for offset projects to be eligible to issue CRVEs

As stated above, CRVEs are a type of Compliance Asset which can be used in substitution for emissions allowances for SBCE compliance purposes (subject to a limit). 11

However, there are certain additional requirements that apply to projects seeking accreditation to issue CRVEs for use in the SBCE. The project must follow a methodology approved for use in relation to the SBCE, 12 which means that the potential for arbitrage is dependent on consistency between methodologies in these different markets. It is not clear what methodologies will eventually be accredited.

Further, project developers and certifiers (i.e. carbon standards approved for the domestic market) seeking to develop or certify such eligible projects must establish a Brazilian legal entity that has a minimum share capital equivalent to that required for a mortgage company under Brazilian banking regulations. 13

Compliance market: financial regulatory implications

The Bill expressly states that, when traded on the financial and capital market, Compliance Assets as well as CRAMs (which are financial instruments relating to the VCM, as explained below) are considered securities subject to the regime of Law No. 6.385/1976, which governs the capital markets in Brazil. 14 This approach has some similarities with the financial regulatory treatment of compliance units in the emissions trading systems of some other jurisdictions, such as the European Union, where emissions allowances are treated as financial instruments for regulatory purposes.15 This means that carbon market activities and participants (whether in the compliance market or the purely voluntary market) may be subject to financial regulatory requirements unless an appropriate exemption applies.

Compliance market: penalties

Non-compliance with SBCE-related rules will result in various penalties, including partial or total suspension of activities, installations, and sources, as well as restrictions of rights such as suspension of licences, loss of fiscal benefits, and prohibition on contracting with the public sector administration for up to three years.

Financial penalties include fines proportional to the severity of the non-compliance, with legal entities potentially facing fines based on a percentage of their annual gross revenue, and individuals or entities without any turnover facing fines ranging from R$ 50,000 (approximately USD 10,200) to R$ 20,000,000 (approximately USD 4,075,500).

These infractions and penalties are determined through an administrative process which allows the defendant a 30-day period to present their defence after the notice of non-compliance (known as an infraction notice) is issued.

VCM: units not recognized as compliance units

Although the SBCE compliance market is the centrepiece of the Bill, the Bill also contains provisions which relate to units intended for the VCM.

In general, the Bill references two types of units which are of relevance to the VCM ( Voluntary Assets) but are not recognized as compliance units for the purposes of the SBCE:

- Carbon Credit (Crédito de carbono): A tradable unit representing the effective reduction or removal of one tonne of carbon dioxide equivalent, achieved through emission reduction or GHG removal projects or programs. Carbon Credits are a catch-all category of emissions reductions or removals units that are not CRVEs (i.e. not issued pursuant to a methodology approved under the SBCE or registered on the SBCE).

- Environmental Credit Receivables Certificate (Certificado de Recebíveis de Créditos Ambientais - CRAM): A negotiable instrument that represents a promise of payment in cash or delivery of Carbon Credits. It is a financial instrument that may be sold or used as collateral, and is intended to encourage participation in carbon reduction initiatives.

Article 6 market: subsidiary regulations to follow

The provisions relating to the Article 6 markets 16 are fairly sparse, apart from stating that authorization from the federal government is required for transfers of internationally transferred mitigation outcomes (ITMOs) and that subsidiary regulations will be published in relation to the conditions for such authorization, including the prices for ITMOs.

General provisions: use of compliance assets in other markets

Although Compliance Assets are intended primarily for compliance use in the SBCE, the Bill also allows Compliance Assets to be used in other markets. In particular, the Bill contemplates the following:

- the use of Compliance Assets for voluntary offsetting purposes;17 and

- the authorization of CRVEs and CBEs as ITMOs under the Paris Agreement.18 The rules for such authorization will be set out in subsidiary regulation.

The overlaps discussed above may create arbitrage opportunities for the same emissions reduction or removal unit that can be used for multiple different markets, namely the SBCE, the VCM and under Article 6 of the Paris Agreement.

General provisions: title acquisition and consent requirements applicable to emissions reduction or removal projects

There are certain requirements relating to title acquisition and free, prior and informed consent ( FPIC) which apply regardless of whether an emissions reduction or removal project is intended to generate CRVEs (which are a Compliance Asset) or merely Carbon Credits (which are a Voluntary Asset) generated from GHG reduction or removal projects.

The Bill distinguishes between: 19

- a Carbon Credit Generator, which has the right to property that is used in the implementation of a project (i.e. a landowner, where real estate will be used to implement the project); and

- a Carbon Credit Developer, which implements a project in association with a carbon credit generator.

The ownership of the Carbon Credits or CRVEs belongs to the relevant Carbon Credit Generator, and such ownership may be validly exercised through a contract for sharing or transferring these credits in projects carried out in partnership with a Carbon Credit Developer. Such a contract must be registered in the Land Registry of the relevant district where the land used for the project is located.

The Bill recognises ownership: 20

- By the Federal Government of the Carbon Credits or CRVEs generated on vacant lands, federal conservation units, and other federal real estates that are cumulatively owned and enjoyed by the Federal Government, provided there is no overlap with third-party owned areas;

- By the States of the Carbon Credits or CRVEs generated in state conservation units and other state real estates that are cumulatively owned and enjoyed by the Federated States, provided there is no overlap with third-party owned areas;

- By the Municipalities of the Carbon Credits or CRVEs generated in municipal conservation units and other municipal real estates that are cumulatively owned and enjoyed by the Municipalities, provided there is no overlap with third-party owned areas;

- By private owners, or persons entitled to use and/or derive income from land, of the Carbon Credits or CRVEs generated on privately owned real estates;

- By indigenous communities of the Carbon Credits or CRVEs generated on lands described in Article 231 of the Federal Constitution (this article pertains to the rights of indigenous peoples, particularly concerning their traditional lands);

- By extractive communities of the Carbon Credits or CRVEs generated in Extractive Reserves as provided in the law;

- By Quilombola communities (a Quilombola community refers to a group of people in Brazil who are descendants of African enslaved people) of the Carbon Credits or CRVEs generated on remaining lands of Quilombola communities, as provided in a specific article of the Brazilian constitution;

- By agrarian reform settlement beneficiaries living in settlement projects, of the Carbon Credits or CRVEs generated on the lots of such settlement projects, regardless of whether they already possess a title deed or not.

State Carbon Credit or CRVE projects (i.e. projects developed by or on behalf of State entities) will be developed with strict respect to private property and can only be carried out on areas of the Federal Government, States, and Municipalities where a public entity has, cumulatively, ownership and rights to use and/or derive income from land of such areas, provided there is no overlap with third-party owned area.

The public entity, meeting these conditions, can directly develop state Carbon Credit projects in such areas or, alternatively, implement private Carbon Credit projects in these areas in partnership with a Carbon Credit Developer, in which case, a tender for a forest concession will be required.

The Bill also proposes strict requirements with regard to obtaining FPIC from indigenous peoples, peoples and communities, where relevant to either CRVE projects or Carbon Credit projects that involve land in respect of which indigenous peoples have rights. These include the following: 21

- Compliance with the International Labour Organization’s Indigenous and Tribal Peoples Convention, 1989 (No. 169);

- Oversight by federal authorities responsible for protecting the rights of indigenous peoples;

- Compliance with various national policies relating to indigenous peoples;

- A minimum percentage of benefit sharing in favour of indigenous peoples (at least 50% of Carbon Credits from removal projects and 70% from REDD+ projects); and

- An indemnity or contractual rights to compensation for damage suffered by indigenous peoples.

The FPIC and benefit-sharing requirements applicable to land areas where indigenous peoples have, or claim to have, rights could significantly increase the compliance burden on forestry or other land management projects in Brazil. It is not entirely clear how these requirements will apply to existing projects.

There also does not appear to be any criminal or administrative penalty for non-compliance with these requirements, although non-compliance may potentially render the contract entered between the Carbon Credit Generator and the Carbon Credit Developer invalid. 22

General provisions: REDD+

The Bill also places particular emphasis on REDD+ projects and programs, which are defined widely in the Bill to include “projects to reduce greenhouse gas emissions from deforestation and forest degradation, conservation of forest carbon stocks, sustainable forest management and increasing forest carbon stocks” (i.e. any forestry project that conserves or increases forest carbon stocks). This definition appears to be broader than the usual understanding of REDD+ in the VCM and would, on its face, include most types of forestry projects.

The Bill expressly contemplates that REDD+ projects would be eligible to issue Carbon Credits or CRVEs (in the latter case, only if approved methodologies are implemented 23). This may send a demand signal to the market for such projects, although the precise methodologies that will be eligible for the issuance of CRVEs have yet to be determined.

The Bill contemplates different categories of REDD+ financing structures as well as projects and programs.

- REDD+ non-market refers generally to results-based payment schemes.

- REDD+ market approach refers generally to carbon markets involving the sale and purchase of Carbon Credits.

The REDD+ market approach comprises three alternatives:

- State Carbon Credit projects “REDD+ market approach”, which refers to Carbon Credit projects developed by a public entity directly;

- Jurisdictional Carbon Credit programs “REDD+ market approach”, which refers to Carbon Credit programs developed by a public entity directly, in respect of emissions reductions or removals that have already been achieved;

- Private Carbon Credit projects “REDD+ market approach”, which refers to Carbon Credit projects developed by a private entity.

In relation to the approval of methodologies for REDD+ projects to issue CRVEs (as opposed to Carbon Credits), the National REDD+ Committee (CONAREDD+) will need to be consulted in the approval process. The CONAREDD+ will also be responsible for maintaining a national register of Jurisdictional Carbon Credit programs.

Footnotes

- https://www.congressonacional.leg.br/materias/materias-bicamerais/-/ver/pl-2148-2015

- The PNMC, established in 2009, is made up of five sectoral plans aimed at reducing deforestation by 80% in the Amazon and by 40% in the Cerrado, among other goals. It encompasses sectors like energy, agriculture, livestock and industry.

- https://unfccc.int/sites/default/files/NDC/2023-11/Brazil%20First%20NDC%202023%20adjustment.pdf

- If the Bill is passed, we would expect a more detailed description of excluded agricultural activities and infrastructure to be eventually published in subsidiary regulations.

- The lack of an MRV methodology for a specific sector does not automatically exclude it from the obligations under the SBCE. The Managing Body will be responsible for developing and/or approving MRV methodologies.

- See Art 10 of the Bill. These terms are defined in Art 2 of the Bill.

- See Art 50 of the Bill.

- Ibid.

- It is unclear what is the intended meaning of ‘Net Greenhouse Gas Emission Removals’ / ‘Remoções Líquidas de Emissões de Gases de Efeito Estufa’. This term is only mentioned in the Bill under Article 21, item VI, without a clear definition.

- The length of a commitment period is not fixed and will be set out in the National Allocation Plan. See Art 2(XXII) of the Bill.

- See Art 21(IV) of the Bill.

- See Art 42 of the Bill.

- See Art 26 of the Bill. The minimum share capital required is R$ 3,000,000 (approximately USD 600,000).

- See Art 14 of the Bill.

- See e.g. Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU, which designates EU allowances as financial instruments.

- See Art 51 of the Bill.

- See Art 45 of the Bill.

- See the definition of international transfer of mitigation results in Art 1 of the Bill, as well as Art 51 of the Bill.

- See Art 2(IX) and (XV)) of the Bill.

- See Art 43 of the Bill.

- See Art 47 of the Bill.

- See Art 43 of the Bill.

- See Art 12 of the Bill.

Article co-written by HFW with Julio Costa and Eduardo Penna of Costa, Albino & Rocha Sociedade de Advogados (CAR)