Briefings

The sustainable loan market and the commodities sector: what is it, what's new and what's to come

In the second part of our series on responsible business, sustainable finance and ESG, we focus on the sustainable loan market: we look at the key loan structuring issues, the latest guidance on green and sustainability linked loans, ask what is new for the commodities sector and consider what is to come.

Responsible business, sustainable finance and ESG briefing series.

What are the key sustainable lending products?

The two major sustainability products in the loan market space are green loans and sustainability linked loans.

Green loans are generally structured the same as other syndicated loans but with the key difference that the purpose of the loan is to fund an eligible 'green project'.

Sustainability linked loans, on the other hand, are structured so that the loan incentivises a borrower to achieve sustainability goals. This is generally in the form of a margin reduction which can be triggered when sustainability targets are met. Crucially, the proceeds of a sustainability linked loan don't need to be used for a specific purpose, making them more flexible products than green loans.

In the loan market, green and sustainability linked loans are now mainstream products. In 2019, more than USD 160 billion of green and sustainability linked loans were issued. There was a slight decrease in volume in the first half of 2020 compared to 2019 but we expect an increase in issuances in the second half of this year.

Are there any guidelines on using these products?

The LMA, LSTA and APLMA1 published new guidelines on green loans and sustainability linked loans in May 2020. These followed the publication of the first major industry principles on these products in 2018 and 2019. The new guidelines may have slipped under the radar for those in the market who were busy dealing with the impact of COVID-19. Their purpose is to promote development of the sustainable loan market by giving clear guidance on how the principles should be applied and to reduce the risk of so-called 'green-washing' - where green or sustainability labels are misused.

The new guidance is timely as sustainability issues are moving back up the agenda, particularly in the commodities sector. It makes clear that green loans are not just for 'green' companies; any borrower is able to access the green loan market provided the loan is structured in the right way. For the commodities sector, this means that even so-called 'brown' industries can be eligible provided there is a suitable commitment to decarbonisation. These loans tend to be labelled as 'transition' or 'light-green' loans.

The guidelines on sustainability linked loans make clear that these loans can be structured with two-way pricing. This means that, as well as an incentive for meeting sustainability targets, there can also be a margin premium if the company fails to meet the targets. We are already seeing this kind of pricing being adopted in the market.

What kind of sustainability targets are relevant?

The sustainability linked loan principles published in 2019 provided a list of 10 common categories of sustainability targets, including a range of green and social issues such as greenhouse gas emissions, sustainable farming and renewable energy. As the market has developed, we have begun to see more bespoke and carefully structured targets that are unique to the particular industry and sustainability profile of the borrower.

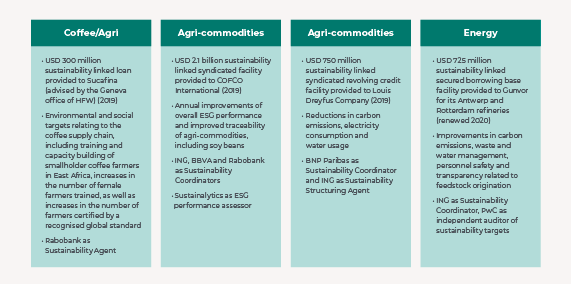

Figure 1 above shows some of the sustainability targets in the Geneva-based commodity trading market. In the agri-sector, for example in the soy bean and coffee sectors, targets might relate to the traceability of supply chains. As an example, we advised Sucafina - a multinational coffee merchant - on a sustainability linked loan with targets linked to training and capacity building for smallholder farms in East Africa. In the energy sector, we have seen targets on environmental issues like carbon emissions and water management, but also social issues like safety of workers.

Why is sustainable lending important for commodities?

Sustainable finance is increasingly important in the commodities sector. This is partly as other sources of commodity finance have been tightening, even before the impact of COVID-19. A number of banks have pulled back from trade finance altogether in recent months and there is pressure on funding for the extractive industries in particular as the views of the public and bank stakeholders are shifting.

If companies in the commodities sector can align their businesses to meet the key sustainability targets in their industry sector, they may be able to access a broader range of funding. Smaller traders and producers may be able to tap into a deeper pool of capital and potentially improve pricing as well as position their businesses for long term sustainability.

What's new?

In our briefing2 in February we, along with many in the industry, predicted a continued rise in the issuance of green bonds and sustainable loans in 2020. Then, in early March, COVID-19 dramatically impacted European markets and global trade and we saw a steep drop in the number of sustainability linked issuances, along with predictions of a decline in the importance of sustainability issues.

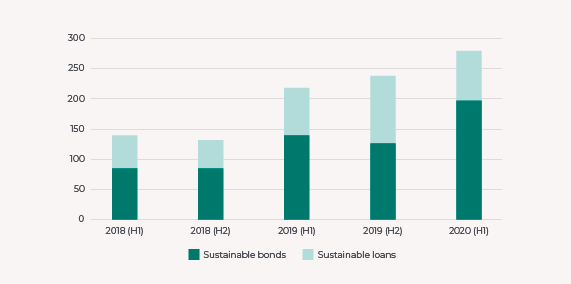

This now looks more like a temporary interruption than a roadblock. In the sustainable bond market - the most mature sustainable finance product - there has been a higher total volume of issuances in Q2 of this year than ever before. In the first half of 2020, total volumes were up 47% on the same period during 2019 to almost USD 200 billion (see Figure 2).

What's coming next?

Despite a slight pause in new loans when the market was dealing with the immediate impact of COVID-19, there now seems to be a renewed focus on sustainability and ESG issues, including in the commodities sector.

Some of the research on the impact of the pandemic is suggesting the disruption to markets and economies has caused a shift in how corporates are viewing green and sustainability issues which are now higher up the agenda; this includes climate change and green issues but also social issues - for example around transparency in supply chains and employee safety and human rights - all of which are highly relevant in a commodities context.

The global regulatory environment is also shifting; new EU regulations will make disclosure on ESG issues mandatory for certain businesses. A new EU-wide system for classifying green and sustainability issues is also likely to have an impact on how the loan market develops.

Although there were initially some predictions that COVID-19 would divert the focus away from sustainability issues, there are now signs that lenders and borrowers are in fact increasingly taking them into account. The market in sustainable lending is now clearly mainstream.

Footnotes:

- Loan Market Association, Loan Syndications and Trading Association, and Asia Pacific Loan Market Association.

- https://www.hfw.com/Getting-the-Green-Light-for-Sustainable-Finance-in-the-Commodities-Sector-Feb-2020

- https://thesource.refinitiv.com/thesource/getfile/index/a9687f16-6ee6-498a-a26b-0d5a3552b062