Briefings

Cross border transactions into the EU or UK: will you be caught by the new DAC6 reporting requirements?

This briefing is a step by step guide to the new EU disclosure requirements for certain cross-border transactions and/or arrangements.

What is DAC6?

In 2011, the European Union (EU) adopted Directive 2011/16/EU on the mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements. Amendments have been made by Directive 2018/822 (EU DAC6) which introduces additional reporting requirements intended to assist the EU Member States (Member State(s)) to identify potentially aggressive tax arrangements. From a commercial perspective, EU DAC6 does not prohibit any kind of transaction but, rather, imposes an added level of transparency.

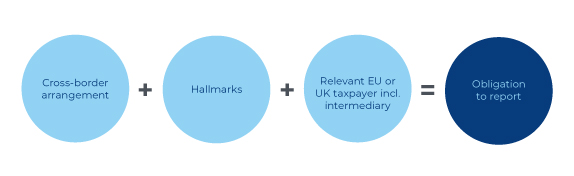

EU DAC6 requires disclosure to the relevant tax authority of all arrangements with:

- an EU cross-border element;

- where the arrangements fall within certain hallmarks; and

- in certain instances where the main or expected benefit of the arrangement is a tax advantage (Main Benefit Test).

In principal, the reporting obligation lies with the EU intermediary that designs, promotes, or implements the arrangement (e.g. tax advisors, accountants, lawyers etc.), but shifts to the taxpayer (i.e. the client) in certain cases (see Figure 1).

Mandatory disclosure will have far-reaching consequences both for us, as legal advisers, and for you, as our client. We, as the service providers in your transactions, will have to disclose any reportable arrangements to the relevant tax authority within 30 days from the date after our instruction on the transaction. In this Briefing, we go through the key features of EU DAC6 and provide guidance as to when reporting obligations arise (both for us as your lawyers, or for you directly).

The UK will adopt a UK version of EU DAC6 in early 2020 currently known as “The International Tax Enforcement (Disclosable Arrangements) Regulations 2020” (UK Regulations) regardless of whether or not it leaves the EU. The penalties for non-compliance could be quite onerous. Under the draft UK Regulations, these affect both the intermediary, if there is one, and the taxpayer and include:

- Daily penalties (£600 per day);

- Penalties from £5,000 to £10,000 per failure;

- Tribunal proceedings: penalties up to £1 million / reputational risk.

N.B. Each of the EU Member States may adopt different penalties.

Please note that this area of law is still undergoing change and there may be slight variations between each of the Member States.

Figure 1: Reporting Obligations

What is a cross-border arrangement?

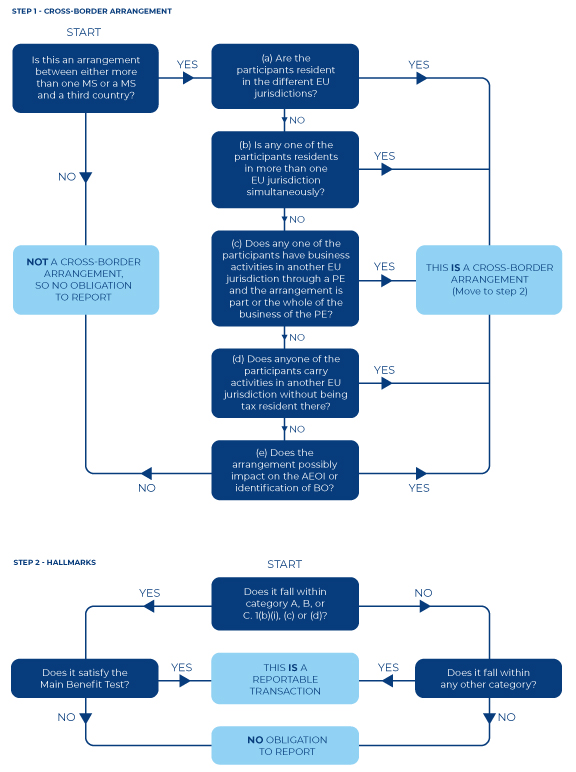

For the purposes of EU DAC6, an arrangement is a cross-border one:

- if it involves:

- participants that are tax resident either in more than one Member State (e.g. UK and France); or

- a Member State and a third country (e.g. UK and US), and

- meets any of the following conditions:

- not all of the participants are tax resident in the same jurisdiction; and/or

- at least one of the participants has dual EU tax residency; and/or

- at least one of the participants has a permanent establishment (PE) in a different EU jurisdiction and the arrangement forms part of the business of the permanent establishment; and/or

- at least one of the participants carries on activities in another EU jurisdiction without being tax resident or creating a PE situated in that jurisdiction; and/or

- such an arrangement has a possible impact on the automatic exchange of information or the identification of beneficial ownership.

N.B. Even if a transaction is not a cross-border one initially, if there are changes to the structure, it may then become EU DAC6 reportable.

Who needs to report?

Any person that designs, markets, organises or makes available for implementation or manages the implementation of a reportable cross-border arrangement is an intermediary. An intermediary is, also, any person that knows or could be reasonably expected to know that they have provided such a function.

An intermediary can be an individual or a company, e.g. lawyers, accountants, consultants, banks, etc. Intermediaries must report information regarding the arrangement to the relevant tax authority in their Member State.

However, in the following situations, the reporting obligation shifts to the relevant taxpayer, i.e. the client as the person to whom the arrangement is made available:

- When the intermediary is a non-EU intermediary, i.e. when it is neither:

- tax resident in a Member State; nor

- has a PE in a Member State through which the services in respect of the arrangement are provided; nor

- incorporated in, or governed by the laws of, a Member State; nor

- a member of a professional (legal, taxation or consultancy) association in a Member State.

- When there is no intermediary, i.e. an in-house arrangement;

- When an intermediary can claim legal professional privilege.

What is a reportable cross-border arrangement?

A cross-border arrangement will be reportable if it falls within any of the Hallmarks. If an arrangement falls within categories A, B and certain subcategories under category C, it will only be reportable if it is also satisfies the Main Benefit Test. The Main Benefit Test is met if an expected tax advantage is the main benefit or one of the main benefits of an arrangement.

There are five Hallmark categories:

| Category A - Generic hallmarks linked to the Main Benefit Test |

|

| Category B – Specific hallmarks linked to the Main Benefit Test |

|

| Category C – Specific hallmarks related to cross-border transactions |

|

| Category D – Specific hallmarks concerning the automatic exchange of information and beneficial ownership |

|

| Category E – Specific hallmarks concerning transfer pricing |

|

Footnotes

|

What needs to be reported?

Under the EU framework, intermediaries and taxpayers will have to report the following information regarding the reportable cross-border arrangement:

- identification of the intermediaries and relevant taxpayers, including tax residence, Tax Identification Number, etc.;

- details of the triggered Hallmark;

- a summary of the arrangement and its effect;

- the date of the first step towards the arrangement;

- details of the national provisions imposing the reporting obligation;

- the value of the arrangement;

- identification of the Member States involved in the arrangement;

- identification of any other person likely to be affected and to which Member State such person in linked.

What are the time limits?

EU DAC6 will be effective as of 1 July 2020. However, taxpayers and intermediaries need to review cross-border arrangements from 25 June 2018, as they will have to report these by 31 August 2020. The first exchange of information between EU Member States will happen on 31 October 2020.

Please note that, from 1 July 2020 onwards, we as the lawyers, and therefore as the service providers in your transactions, have to disclose any reportable arrangements to the relevant tax authority within 30 days from the date after our instruction on the transaction. (Please see Figure 2: Timeline)

Figure 2: Timeline

Conclusion

EU DAC6 introduces new reporting requirements for transactions with a cross-border element. In the commercial world, this does not prevent businesses from carrying on their activities or entering into contractual relationships, which are, also, beneficial for tax purposes. Rather, the EU is setting up an automatic exchange of information platform between its Member States.

The new rules require a historical review of arrangements entered into from 25 June 2018 onwards. As of 1 July 2020, service providers, such as lawyers, will have to disclose any reportable arrangements to the relevant tax authority within 30 days from the date after their instruction on the transaction.The flowchart (see Figure 3) at the end of this document intends to help you determine whether your transactions are reportable by answering some simple questions.

Figure 3: Flowchart

As noted above, this area of law is very complex. HFW is happy to assist you with the analysis of your transactions; please contact our Risk & Compliance team or your usual HFW contact.

For further information, please contact the authors of this briefing:

Nick Hutton

Partner, London

T +44 (0)20 7264 8254

E nick.hutton@hfw.com

Sakina Chenot

Head of Legal Risk, London

T +44 (0)20 7264 8169

E sakina.chenot@hfw.com