Briefings

EU Sanctions enforcement - ever closer union?

Two years after the invasion of Ukraine and a notable variance in the enforcement of EU sanctions by EU Member States in the intervening period, the EU is moving closer to setting minimum levels of maximum criminal penalties across the EU and some EU states are leading the charge.

Variation across the EU

|

Maximum penalties that can be imposed1

|

||

| Lowest | Highest | |

| Fines for legal entities | EUR 133,000 | EUR 37,500,000 |

| Fines for individuals | EUR 1,200 | EUR 500,000 |

| Length of custodial sentence | 2 years (not including Member States where no custodial sentences can be imposed) | 12 years |

Historically, the implementation and enforcement of European Union (EU) sanctions, including the setting of penalties, has been the sole competence of individual Member States. This has resulted in a high degree of variability between the level of fines and custodial sentences that can be, and have been, imposed (Figure 1). There is currently no consistency as to whether sanctions breaches constitute civil (2 Member States) or criminal (12 Member States) offences, or either (13 Member States).

Harmonisation proposals

The EU is looking to change that, however. On 12 March 2024, the European Parliament adopted a directive to criminalise the violation and circumvention of EU sanctions, and to set minimum penalties for violations. 2 This follows the initial proposal of the Council in May 2022, the subsequent Council Decision in November 2022 to designate violations of EU sanctions as an ‘EU Crime’ under Article 83(1) of the Treaty on the Functioning of the European Union,3and a political agreement reached between the Council and the European Parliament on 12 December 2023.4

Under the adopted Directive, Member States will be required to adopt domestic legislation to provide for minimum levels of maximum penalties that can be imposed. All Member States will be required to criminalise sanctions breaches (and the inciting, aiding, abetting or attempting of such breaches). The maximum penalties that Member States must be able to impose vary depending upon the specific offence committed. All offences with a total value of at least EUR 100,000 must attract a custodial sentence for individuals. Technical offences (such as designated persons failing to report the location of funds within the EU) will attract minimum maximum sentences of 1 year. More substantive offences must attract a sentence of up to 5 years.

In respect of legal entities, Member States will be required to be able to take administrative steps to withdraw access to public benefits, funding and grants, as well as to impose restrictions on an offending entity’s ongoing business. In addition, technical offences will attract penalties of up to 1% of the legal entity’s total worldwide turnover in the preceding financial year. For more substantive offences, this rises to 5%.

A step change in enforcement?

These changes will represent a significant step change in EU sanctions enforcement, reflecting a sense of frustration as to existing enforcement levels, notwithstanding the significant and unparalleled expansion of sanctions as a foreign and security policy tool over the past two years.

While a lack of available penalties may have been a factor in the perceived reticence to enforce, it is also likely reflective of the resourcing pressure that competent authorities have been under, and the time required to mount thorough investigations. This tide appears to be turning, however, as shown in particular in the Netherlands where in just the past month three individuals have been arrested for violating Russia sanctions 5 and fines of EUR 718,841.25 and EUR 451,250 have been upheld by the Rotterdam District Court in relation to a bank’s sanctions due diligence failings.6

Likewise, EU Member States appear to be grappling with the increasing demands being placed on their competent authorities for sanctions. Latvia 7 and Germany8 are both restructuring and consolidating their sanctions implementation authorities, and Cyprus is setting up a specialised unit emulating the Office of Financial Sanctions Implementation in the UK.9

Implications for economic operators

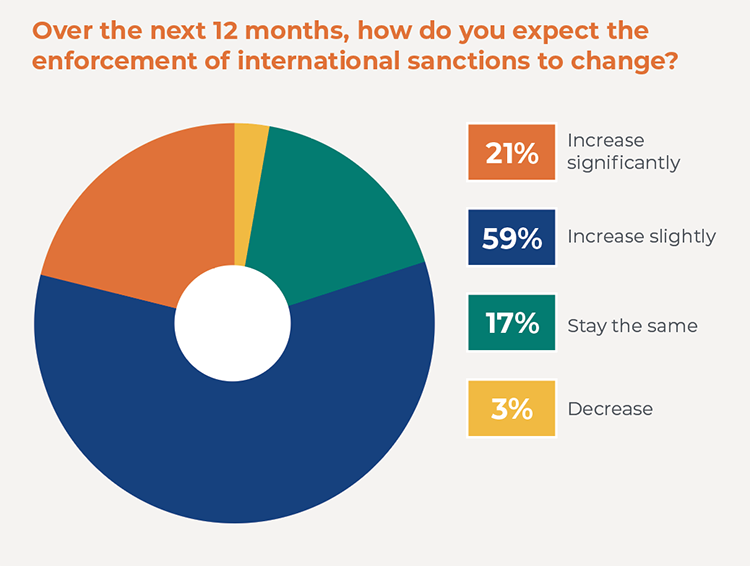

All of this points to a potentially significant increase in sanctions enforcement within the EU, with more cases being brought to the enforcement stage as well as steeper penalties being imposed. That would certainly align with the result of a recent HFW poll where 80% of responses expected an increase in the enforcement of EU sanctions over the next 12 months, with 21% of responders expecting a ‘significant’ increase over that period. 10(Figure 2).

That said, we are unlikely to see materially greater penalties imposed by those Member States that do not already have a robust legal framework for the penalisation of sanctions breaches in the immediate term. Once the Directive is formally approved by the Council (for which there is no set timeline), it will enter into force 20 days after its publication in the Official Journal. Member States will then have one year to transpose the provisions of the Directive into national law so as to implement the minimum maximum penalties set out above (Figure 3).

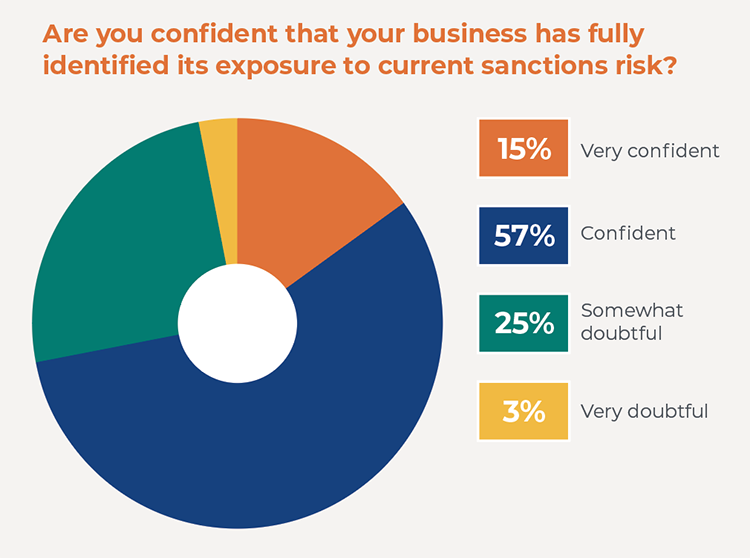

It is vital, however, for economic operators to ensure that they will not be exposed to the significant levels of available penalties and the clear appetite of regulators to impose them. HFW’s poll results indicated that 38% of respondents were ‘somewhat’ doubtful as to their business having adequate resources to manage their current sanctions risk exposure. 11

With the consequences of ‘getting it wrong’ set only to increase, steps should be taken to identify organisations’ sanctions risk exposure, and to mitigate those risks in light of current and anticipated changes to the sanctions landscape. Such steps might include:

- Assessment of the organisation’s touch points to sanctions risks;

- Determination of the organisation’s sanctions risk appetite;

- Development or review of sanctions policies and procedures, including identifying responsible persons and a sanctions governance framework;

- Building internal resource or engaging external support to assess and manage sanctions risks; and

- Providing training to compliance and trading teams.

Footnotes:

- COM(2022) 684 final

- P9_TA(2024)0125

- Council Decision (EU) 2022/2332

- Council and Parliament reach political agreement to criminalise violation of EU sanctions - Consilium (europa.eu)

- Support to Dutch action against violation of export sanctions to Russia: three arrests | Eurojust | European Union Agency for Criminal Justice Cooperation (europa.eu)

- ECLI:NL:RBROT:2022:12285, Rechtbank Rotterdam, ROT 22/2451 en ROT 22/2452 (rechtspraak.nl)

- The Financial Intelligence Unit will become the main authority for sanctions enforcement in Latvia | Iekšlietu ministrija (iem.gov.lv)

- Bundesfinanzministerium - Voller Einsatz gegen Finanzkriminalität

- Cyprus Finance Ministry: More than 1.2 billion euros in Russian assets frozen | eKathimerini.com

- 005517-HFW-Sanctions-Poll-Results.pdf

- Ibid.