The International Civil Aviation Organization (ICAO) introduced the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) with the intention that aircraft operators monitor their emissions and offset excess emissions arising from covered aviation activity. The first phase of CORSIA (2024 to 2026) (the First Phase) has started. The First Phase remains voluntary but once an ICAO State commits to participate in the First Phase, compliance becomes compulsory for the aircraft operators1 for which that State is the responsible authority. 126 States have voluntarily committed to the First Phase of CORSIA. Notable non-participating States in the First Phase include China, Russia, India and Brazil. Only flights between participating States are caught by CORSIA. Participation in CORSIA becomes mandatory for all States in the second phase (2027 to 2035).

Airline operators with First Phase compliance obligations are actively looking at how they achieve this. CORSIA allows aircraft operators to meet their compliance obligations using either or both CORSIA eligible fuels (CEFs) and CORSIA Eligible Emissions Units (CEEUs). This client alert is one of a series on CORSIA (with a focus on the First Phase), and provides an introduction to CEFs and how CEFs may be used to satisfy their offsetting obligations.

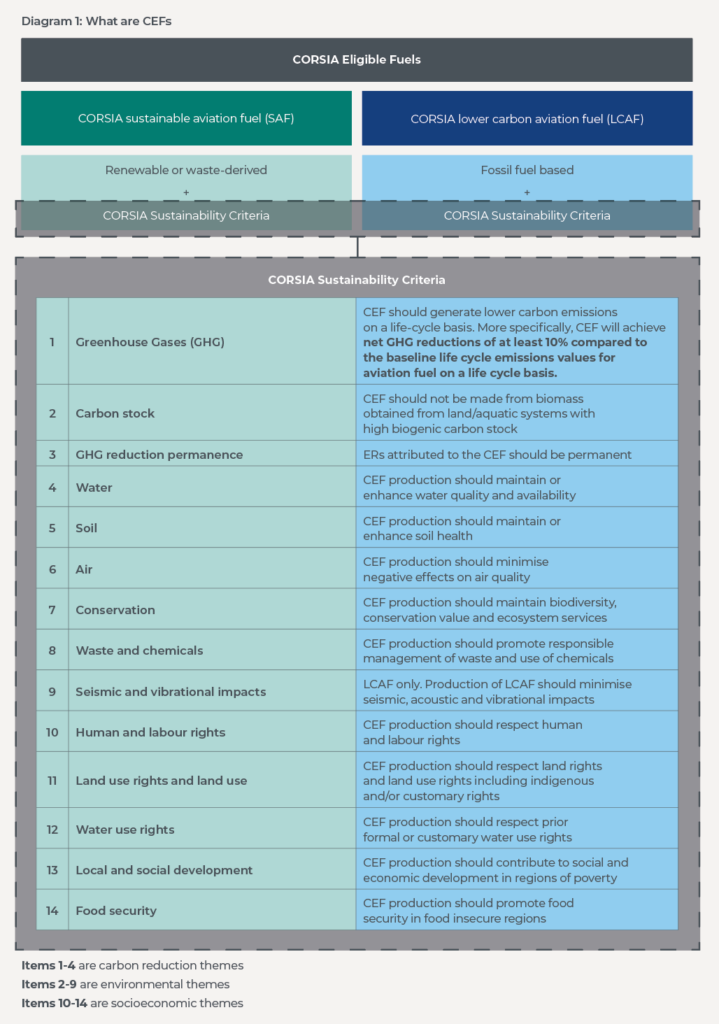

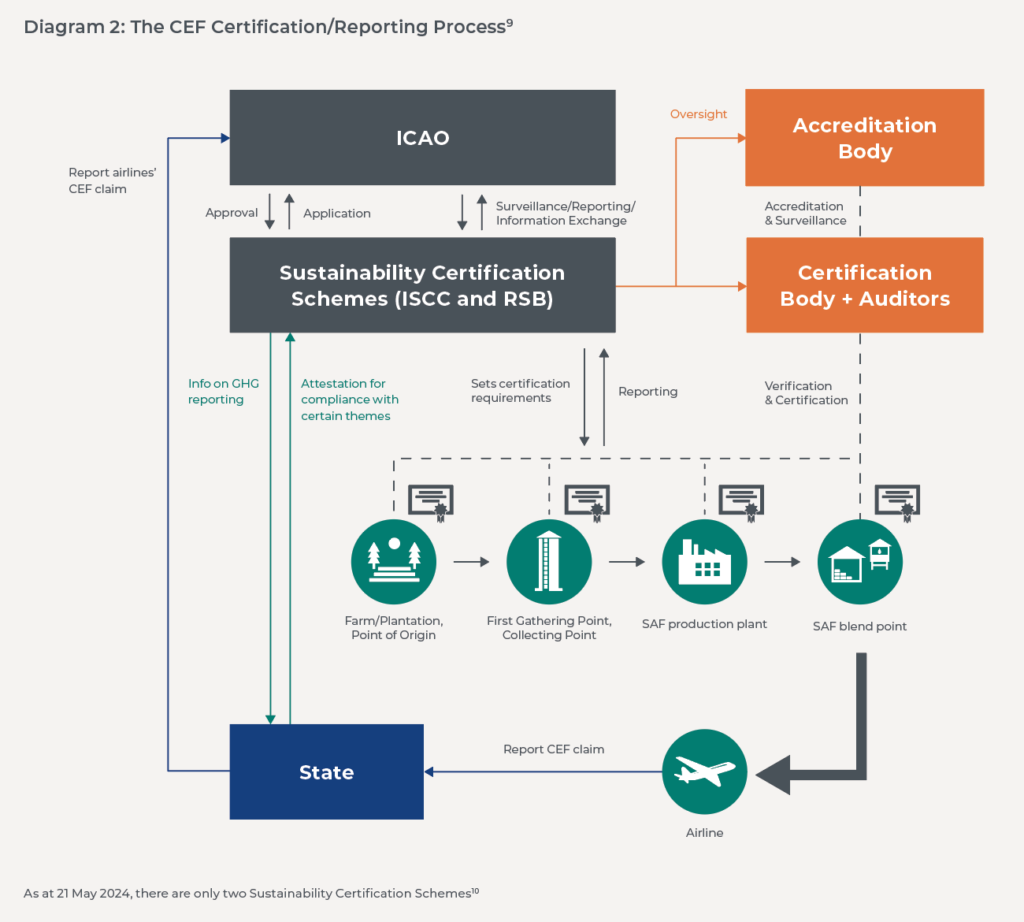

CEFs are either (i) a CORSIA sustainable aviation fuel or (ii) a CORSIA lower carbon aviation fuel, which an airline operator may use to reduce their offsetting requirements. CEFs will have to satisfy the CORSIA Sustainability Criteria which will be assessed by a Sustainability Certification Scheme (SCS). The SCS reviews the entire production and blending cycle – from feedstock production/collection to blending.

Schemes must satisfy a stringent set of criteria before being recognised as a SCS.2 Once certified, a SCS will be eligible to certify CORSIA eligible fuel economic operators for compliance with the CORSIA sustainability criteria and to ensure that the lifecycle calculation methodology has been applied correctly.3 The sustainability certification under the SCS regime is intended to ensure (i) sustainability in feedstock production, (ii) traceability of sustainable materials through the supply chain, and (iii) verified reduction of lifecycle emissions. In other words, even if certain sustainability attributes are satisfied, fuels are only categorised as CEFs if they reach a threshold of at least 10% emissions reductions savings after taking into account the fuels’ core lifecycle emissions and indirect land use change emissions (if any). The lifecycle emissions can utilise certain default values accepted by CORSIA4 or the actual life cycle emissions as verified by an approved SCS using the methodology approved by CORSIA.5

For the avoidance of doubt, this is only the position under CORSIA SARP, and not how it may have been implemented under national law. For instance, CORSIA offsetting obligations are built into Articles 12(6) to 12(9) of the EU ETS Directive.6 ‘CORSIA eligible fuel’ is linked to the fuels eligible for support under Article 3c(6) of the EU ETS Directive, which is in turn linked to the requirements for ‘sustainable aviation fuels’ under RED II7. This may be more stringent than the position under CORSIA. For instance, under RED II, the greenhouse gas emission savings from the use of biofuels, bioliquids and biomass fuels needs to be “at least 65 % for biofuels, biogas consumed in the transport sector, and bioliquids produced in installations starting operation from 1 January 2021”.8 However, under Criteria 1 (see Diagram 1) CEF needs to only achieve a net GHG reductions of at least 10% compared to the baseline life cycle emissions values for aviation fuel on a life cycle basis. Airline operators should therefore check on the position applicable to them under national law.

Fuel batches and economic operators that have been certified under CORSIA can be found on the CORSIA website.11

Why are CEFs relevant in respect of CORSIA, and in particular for an airline operator? Broadly, where an airline operator uses CEFs, CORSIA allows that airline operator to reduce its final total offsetting requirements at the end of the relevant compliance period (e.g., at the end of the First Phase).12 Since CEFs are, to some extent, a substitute for CEEUs, their price should logically bear some relation to the price of CEEUs.

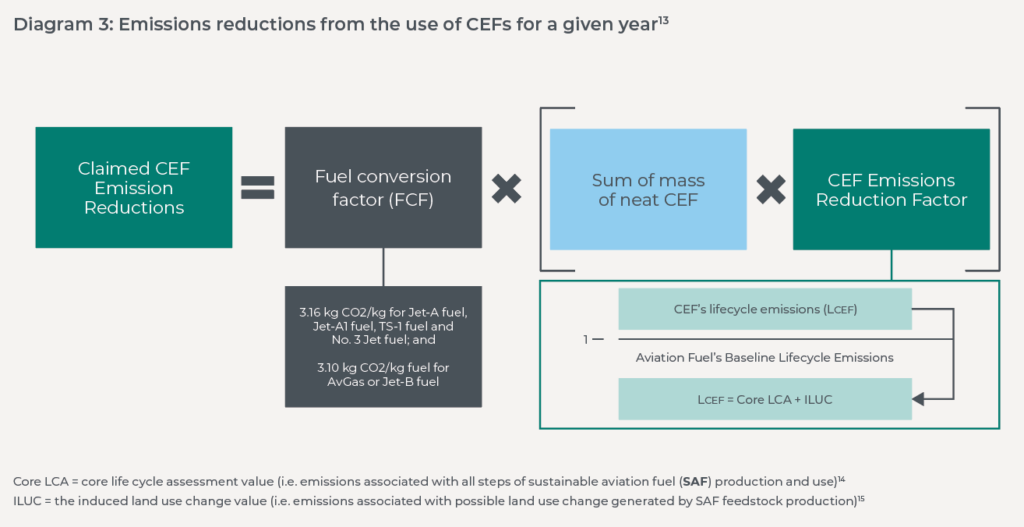

Claims of emissions reductions from the use of CEFs by an airline operator are based on mass of CEFs according to purchasing and blending records. The quantity of CEF reductions allowed is, in essence, calculated by considering the fuel conversion factor of a fuel-type against mass of CEFs and against the CEF’s emissions reduction factor (being a ratio of the lifecycle emissions value for the CEF against the baseline lifecycle of the first-mentioned fuel-type, i.e. proportional to the life cycle emissions benefits of the fuels used, compared to a baseline life cycle emissions value).

ICAO has recommended that airline operators make CEF reduction claims on an annual basis in their emissions reports.16 However, airline operators can still decide to make a CEF reduction claim within the relevant compliance period during which the CEF was blended.17 Put another way, if the CEF is blended in 2024, the CEF reduction claim can be reported in 2024, 2025 or 2026 as part of the First Phase but not for the next compliance period beginning in 2027.

Apart from CORSIA, airline operators may also participate in other GHG schemes that apply domestically in different jurisdictions, such as the UK ETS (which works hand in hand with the UK SAF mandate) or the EU Renewable Energy Directive (i.e. RED II).

Each GHG scheme has its own rules and requirements and incentives. As an example, each GHG scheme applies different GHG emissions reductions threshold for a particular SAF to be compliant with the scheme. The UK SAF mandate, for instance, requires a minimum of 40% GHG emissions savings in order for SAF to qualify as compliant (albeit the requirement is placed on SAF suppliers as opposed to airline operators)18 and the EU RED II which requires GHG emissions savings of at least 65%.19

There are also differences in the application of the GHG savings thresholds under different schemes. For instance, under EU RED II, the GHG savings threshold applies only to direct emissions, whereas under CORSIA the GHG savings threshold applies to direct and indirect emissions. However, notwithstanding these differences, there is an obvious tension between different minimum GHG emissions reductions applying under different schemes.

Further reducing the GHG emissions will lead to increased production costs for SAF suppliers. SAF mandates may award certificates based on the carbon intensity of SAF, which may mean that the value of the physical commodity is higher for SAF with a lower carbon intensity. However, it is by no means clear whether any increase in the value of the physical commodity will be proportionate to or exceed the increased production costs.

This may have an impact on suppliers’ production and development strategy. SAF mandates (such as the UK SAF mandate and the ReFuelEU Aviation Regulation20) tend to place an obligation on jet fuel suppliers to ensure that the fuel made available within the relevant jurisdiction consists of a blend containing increasing minimum shares of SAF. What is eligible SAF under the relevant mandate may depend on the type of feedstock used and the minimum GHG and lifecycle emissions savings. Differences in the GHG emissions savings that apply under different schemes may therefore have an impact on suppliers’ ability to meet their supply obligations under the relevant mandates.

For example, under ReFuelEU, jet fuel suppliers will need to ensure that the fuel they supply contains a minimum share of 2% SAF by 2025, rising to 6% by 2030, 20% by 2035, 34% by 2040, 42% by 2045 and 70% by 2050. Eligible SAF must have a minimum of 65% GHG emissions reductions. If the cost of producing SAF with GHG savings of 65% far exceeds the cost of producing CEFs with GHG savings of 10%, but the increase in value of the product is not proportionate to the increase in production costs, suppliers may be tempted to produce the minimum quantity of eligible SAF under ReFuelEU required to satisfy the SAF mandate and focus their remaining production on CEFs that have lower GHG emissions reductions but may allow for higher profit margins taking into account the value of the product relative to the cost of production.

In the short term, this may not incentivise suppliers to ramp up production of the quantities of eligible SAF required to meet the increasing minimum shares of SAF that apply under the SAF mandates.

While the formula for calculating GHG emissions reduction varies across each scheme, it is still possible that CEFs may qualify as compliant with the UK SAF mandate or the EU ETS and therefore, allow airline operators to claim the benefits from emissions reductions under both CORSIA and these GHG schemes. This could therefore, lead to an airline operator “double claiming” – being the accounting of emissions reductions from one batch of fuel more than once. CORSIA has recognised this and to prevent double claiming, it requires an airline operator to “provide a declaration of all other GHG schemes it participates in where the emission reductions from the use of [CEF] may be claimed, and a declaration that it has not made claims for the same batches of [CEF] under these other schemes.”21 ICAO has defined ‘other GHG schemes’ as “GHG emission reduction programs other than CORSIA in which the aeroplane operator can reduce its quantified emissions through the use of CEF”22 In addition, extensive information is required on the CEF itself (e.g., production year, producer, type of fuel, feedstock and conversion process, life cycle emission values, batch number and mass) and CEF claims would be made publicly available.23 Similarly, other GHG schemes would have their own reporting requirements to guard against double counting.

Ultimately, whether an airline operator decides to claim benefits / allowances under CORSIA or other GHG schemes (e.g., EU ETS / UK ETS) would depend on the demand and supply of CEF (which we discuss in a separate briefing), or the costs of purchasing CEEUs as against allowances under the other GHG schemes.

As with CEEUs, CEFs are also integral to CORSIA. As CEFs (and SAFs) are still in the early stages of development, uncertainty remains around the viability of CEFs. This is further complicated by the fact that different jurisdictions have different GHG emissions reductions schemes that require different types of SAFs (which may or may not be CEF).

In turn, how different regimes use policy measures to encourage greater adoption of sustainable aviation fuels will also impact the demand side of certain types of fuels. For example, the EU has created a SAF re-investment mechanism that sets aside 20 million EU ETS aviation allowances for aircraft operators that are available from 2024 to 2030. The purpose of this is to allow aircraft operators to offset the higher cost of SAF and is aimed at helping to narrow the cost gap between second-generation advanced fuels and fossil kerosene. The mechanism rewards fuels in tiers, and the lowest- GHG aviation fuels receive the most funding. For example, 95% of the cost differential is paid for the difference between renewable fuels of non- biological origin (including liquid e-fuels and hydrogen derived from renewable electricity) and fossil kerosene, after adding on taxes on fossil fuel. By contrast, advanced biofuels under EU RED II will receive 70% of the cost differential etc. Other jurisdictions may offer different incentives leading producers looking to leverage these opportunities and subsidies. As we note in a separate briefing, an aircraft operator’s decisions could be affected by issues relating to CEFs and CEEUs and the market factors that impact how they interact with each other.

Footnotes

Download a PDF version of ‘An introduction to CORSIA eligible fuels: what are they and why are they relevant for CORSIA?’