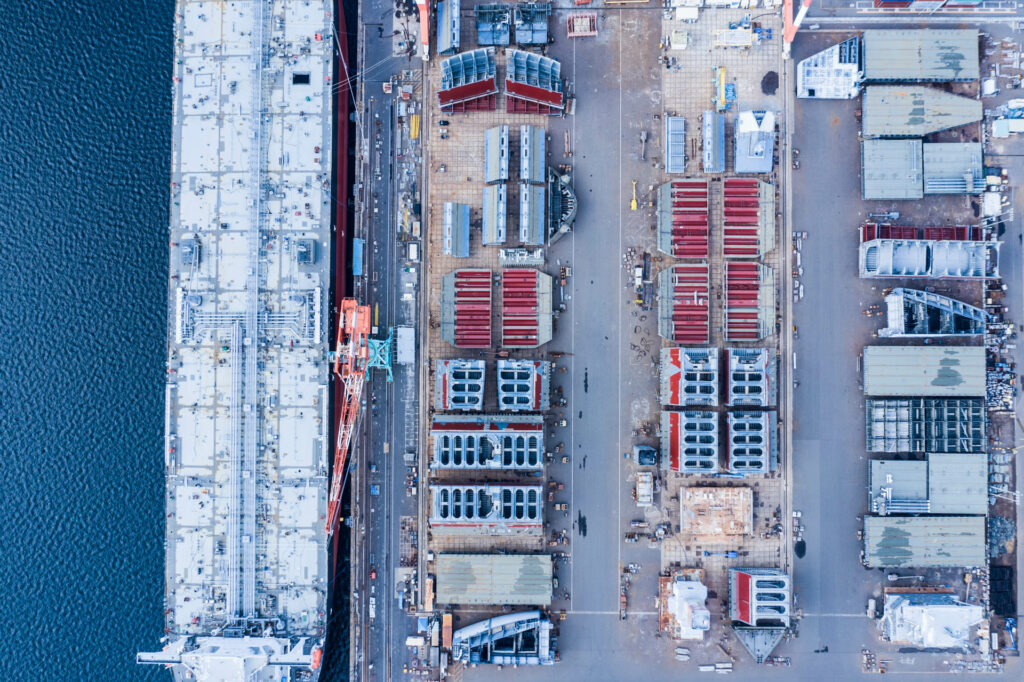

Our experience in shipping

Our experience extends across the full spectrum of maritime law, covering dry shipping, admiralty and crisis management and ship finance.

Acting for the salvors of the BP production drilling quarters platform vessel which nearly capsized in the Gulf of Mexico. This is the most valuable property ever subject to the Lloyd’s Open Form Contract (the standard form of salvage contract) being approximately USD $1.2 billion.

Acting for a large European shipping company on the establishment of a USD $450 million joint venture with a listed Dubai entity.

Acting for a Bermudian holding company in a capital raising exercise to fund a $50 million investment in a subsidiary which will write residue value insurance on ships.

Key Contact

24-hour Maritime Response

Our casualty response lawyers, and master mariners are available remotely via our dedicated crisis response room or can travel on demand, 24 hours a day, seven days a week, practically anywhere in the world.

HFW | Yachts

We routinely represent leading shipyards and prominent owners, providing legal advice on some of the world’s largest and most complex projects in the yacht industry.

HFW | CyberOwl

HFW and CyberOwl have joined forces to help our clients assess, monitor and actively manage their cyber risks, and gain assurance of cyber compliance.