An Introduction to Insetting

Insetting refers to activities carried out by or on behalf of an organisation that has the effect of reducing greenhouse gas emissions within that organisation’s supply or value chain.

As demand from organisations seeking to reduce their value chain emissions grows, suppliers and service providers who are developing insetting solutions should recognise the challenges associated with developing robust and credible solutions. Managing greenwashing risk requires a solid understanding of this nascent but developing area of law.

What is Insetting?

There is no universally accepted definition of insetting, otherwise known as value chain/Scope 3 interventions. One of the earliest proponents of insetting has been the International Platform for Insetting (IPI), which is a non-profit organisation that has a number of corporate members, including H&M Group, Accor, Chanel, Nestle, South Pole, Kering, and Nespresso. The IPI has defined insetting as “the actions taken by an organisation to fight climate change within its own value chain in a manner which generates multiple positive sustainable impacts.”1

While there are a number of other insetting standards and guidance which have been developed,2 for this introductory paper, we will focus on the IPI’s Insetting Program Standard (IPI Standard). This is because (a) the IPI Standard is sector-agnostic rather than tailored to any particular sector, (b) the IPI Standard is designed to be aligned with insetting guidance provided by other organisations such as the Gold Standard and SBTi, and (c) stakeholders in insetting and/or offsetting markets often refer to the IPI Standard or the positions of IPI members.3

Insetting compared with offsetting

Within value chains

The key difference between insetting and offsetting is that insetting refers to activities (Mitigation Activities) to mitigate greenhouse gas (GHG) emissions within an organisation’s value chain, as compared with offsetting, which refers to Mitigation Activities that are not within the organisation’s value chain.4

The IPI describes the “value chain” as: “The value chain of a company is composed of all stakeholders, from suppliers and sub-suppliers (tier 0 to X) upstream, to distributors, retailers, consumers and society downstream.”5 The GHG Protocol, the Gold Standard and the Value Change Initiative have defined it as “All upstream and downstream activities associated with the operations of the reporting company, including the use of sold products by consumers and the end-of-life treatment of sold products after consumer use”.6

An example illustrates the distinction between inside and outside supply chain. If a coffee brand (referred to in this paper as Coffee Inc.) pays the farmers from which it buys coffee beans for Mitigation Activities, such as by switching to agroforestry or improved agricultural land management practices, this would be considered insetting within the IPI definition. By contrast, if Coffee Inc. were to pay indigenous people to restore or conserve a mangrove forest, this could not be considered insetting since the mangrove forest is not in Coffee Inc.’s value chain i.e. is not involved in the delivery of coffee beverages to the market.

In the opinion of the IPI, there is a further limitation on what Mitigation Activities, within the value chain, can be considered as insetting. According to the IPI,7 the Mitigation Activities must be directed at the organisation’s Scope 3 emissions (and not that organisation’s Scope 1 or 2 emissions), as these are defined by the GHG Protocol Corporate Standard,8 to qualify as insetting. The different scopes of GHG emissions in the GHG Protocol Corporate Standard are summarised in the table below.

| Scope 1: Direct GHG emissions | GHG emissions from sources that are owned or controlled by the organisation e.g. emissions from vehicles owned by the organisation. |

| Scope 2: Electricity indirect GHG emissions | GHG emissions from the generation of purchased electricity or heating consumed by the organisation. |

| Scope 3: Other indirect GHG emissions | GHG emissions that are a consequence of the activities of the organisation, but occur from sources not owned or controlled by the organisation e.g. emissions generated by raw material suppliers in producing such raw materials for the organisation. |

Therefore, Mitigation Activities within an organisation’s value chain and directed at sources under its control or ownership (Scope 1) or purchased electricity or heating (Scope 2) are not regarded as insetting by the IPI. This is just a reduction in the organisation’s own GHG emissions. Only Mitigation Activities directed at sources outside the organisation’s control or ownership (other than purchased electricity or heating), but nonetheless within its value chain, are considered insetting by the IPI.

Tracing and allocation

A practical issue with insetting is tracing – determining whether a particular supplier (or customer) is within the value chain. Using Coffee Inc. again as an example, if Coffee Inc. purchases coffee beans from a distributor that sources the beans from a number of farmers in a particular country, how does Coffee Inc. ensure that it can trace the beans it purchases to a particular farmer with whom it has partnered to implement an insetting project?

It is important to distinguish between tracing, which is the process of determining whether a particular supplier (or customer) is within the value chain at all, and allocation, which is the process of dividing emission reductions from a shared facility or other system (that is within an organisation’s value chain) amongst the various outputs. The GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (GHG Protocol Scope 3 Standard) provides guidance on allocation but not tracing.

To mitigate tracing difficulties, the Gold Standard and the Value Change Initiative advocate the concept of a “supply shed”, which is a group of suppliers providing similar goods or services, from which an organisation can demonstrate it purchases goods or services either directly or indirectly, although it cannot trace those goods or services to any particular supplier within the group.9 Under the Gold Standard approach, an organisation can reduce its Scope 3 emissions by partnering with suppliers in the supply shed. In certain cases, where data is particularly lacking, as an interim solution, the entire country or larger geographical region which the organisation buys from may be defined as the supply shed, such that any GHG reduction or removal activity done in partnership with providers of that good or service from that country may be regarded as insetting. The supply shed approach has not yet been endorsed by the GHG Protocol, although it is being considered.10

Physical accounting

In certain sectors such as aviation and shipping, the main practical problem is not tracing but rather the fact that opportunities for Mitigation Activities may not be available along the transportation routes used by an organisation seeking to do insetting. For instance, an organisation whose executives regularly fly between Country A and Country B aboard a passenger airline may seek to reduce its carbon footprint by paying that airline a premium to use sustainable aviation fuel for those flights. However, sustainable aviation fuel may not be available at the airports in or around Country A or Country B, which limits opportunities for insetting if GHG emissions are strictly tied to the physical supply of aviation fuel.

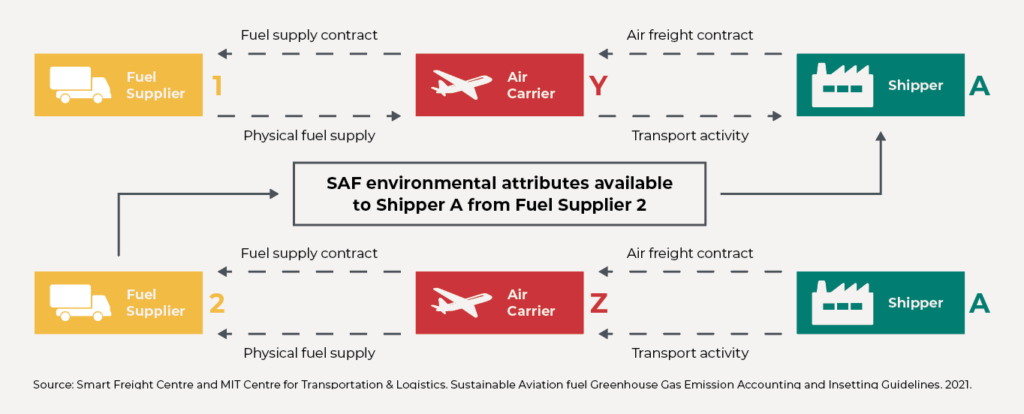

In response to such constraints, the Smart Freight Centre and the MIT Center for Transportation and Logistics have proposed an approach (the SFC-MIT Approach) for separating the sustainability attributes (which can be used for insetting purposes) of sustainable aviation fuel (SAF) from the physical supply of the fuel.11 The SFC-MIT Approach recommends a “Book and Claim” system which allows the emissions reductions of SAF to be traced and sold for the purposes of insetting its Scope 3 air transportation activities even if the insetting organisation did not physically use any SAF in its Scope 3 air transportation activities. This is illustrated by the diagram above reproduced from the SFC-MIT Guidelines.

The SFC-MIT Approach assumes that, as long as the emissions reductions of SAF are used to inset an organisation’s Scope 3 air transportation activities and not any other kind of activity, this Mitigation Activity would be considered to have occurred within its value chain. Following this logic, the Mitigation Activity should be considered an inset rather than an offset.

The SFC-MIT Approach, as well as book and claim systems more generally, have yet to receive endorsement by the GHG Protocol but are being considered.12 Indeed, in relation to the land sector, the draft version of the GHG Protocol Land Sector and Removals Guidance: Part 213 states that “For scope 3 accounting, companies that source land-based products (e.g., crops, forest products or animal products) need physical traceability of their purchased goods to properly account for upstream scope 3 emissions or removals on the lands associated with that material” and “As book and claim systems are not necessarily specific to the reporting company’s supply chain, companies can separately report certification claims but cannot use such information from certification programs with book and claim models to support scope 3 GHG accounting.” This guidance suggests that the GHG Protocol is not presently inclined to support book and claim systems for evidencing GHG reductions achieved in respect of Scope 3 GHG emissions.

Co-Benefits

A subtle difference between insetting and offsetting relates to their treatment of co-benefits. The IPI’s definition of insetting incorporates co-benefits, such as benefits for water, soil, biodiversity and communities, other than just GHG reductions or removals.

By contrast, voluntary carbon credits do not automatically or necessarily come with co-benefits.14

Similarities

Aside from the differences highlighted above, insetting shares many similarities with offsetting, particularly in respect of the process of project development and quantification of GHG removals or reductions. Indeed, the IPI requires Mitigation Activities to follow methodologies established by standards bodies such as Verra, the Gold Standard or the UNFCCC.15 The IPI further recommends that the GHG reductions or removals achieved via Mitigation Activities within insetting be certified by standards bodies including the Gold Standard and Verra.16 The criteria identified by the IPI as “critical” in a Mitigation Activity, namely additionality, permanence, quantification, verification / validation, and avoidance of double counting, are familiar concepts in the voluntary market for carbon offset units.

Verra is currently developing a Scope 3 Program designed to bring increased integrity and assurance to the insetting process.17 It is a program specifically designed to, amongst other things, adapt VCS methodologies for insetting processes. The targeted launch date of this new program is 2025.

Double-counting

Double-counting and its derivative, double claiming, can be a contentious issue when organisations are engaged in insetting programs. This issue can arise in several different ways.

Firstly, within a particular value chain, overlaps between the inventory boundaries of different organisations may result in the same GHG emissions being recorded more than once. For instance, under the GHG Protocol Corporate Standard, an organisation’s Scope 3 emissions are, by definition, the Scope 1 emissions of its suppliers and customers. This, in itself, does not cause a problem because the purpose of this accounting approach is to determine how best to attribute responsibility for GHG emissions across a particular corporate entity’s various sources of GHG emissions.

However, to determine whether a particular activity (whether or not it is insetting or offsetting) has led to a GHG reduction or removal, it is expressly stated that an entirely different GHG accounting approach from the GHG Protocol Corporate Standard should be used. Without careful consideration therefore of whether or not the correct GHG Protocol accounting approach is being used, there is a risk that the same GHG reduction or removal18 achieved may thus be accounted for in the GHG inventories of two or more organisations along the same value chain – once by the organisation carrying out the insetting program as a Scope 3 reduction or removal and again by its supplier as a Scope 1 reduction or removal.19 It is also possible for the same GHG reduction or removal to be recorded in the Scope 3 inventory of more than one organisation along the value chain.

Such double-counting for GHG inventory accounting purposes is an inherent part of the GHG Protocol Corporate Standard’s inclusion of Scope 3 GHG emissions within the inventory boundary. The GHG Protocol Scope 3 Standard provides the following recommendations for dealing with such double-counting due to overlaps between inventory boundaries:20

- Scope 3 emissions should not be aggregated across companies to determine total emissions in a given region.

- to ensure transparency and avoid misinterpretation of data, organisations should acknowledge any potential double-counting of reductions or credits when making claims about Scope 3 reductions. For example, an organisation may claim that it is working jointly with partners to reduce emissions, rather than taking exclusive credit for Scope 3 reductions. Therefore, the bigger concern follows not from reporting of GHG emissions across inventories but with the claim that is then associated with that reporting (i.e. double claiming).

Secondly, double-counting may arise when an organisation in a value chain reports an emission reduction or removal in its GHG emissions inventory and another organisation outside the value chain seeks to use the same emission reduction or removal to make claims. For example, is an organisation permitted to report Scope 3 emissions reductions or removals in its inventory when those emissions reductions or removals also form the basis for issuances of carbon credits under a carbon crediting program, such as the Verified Carbon Standard or the Gold Standard, and a third party may purchase those carbon credits?

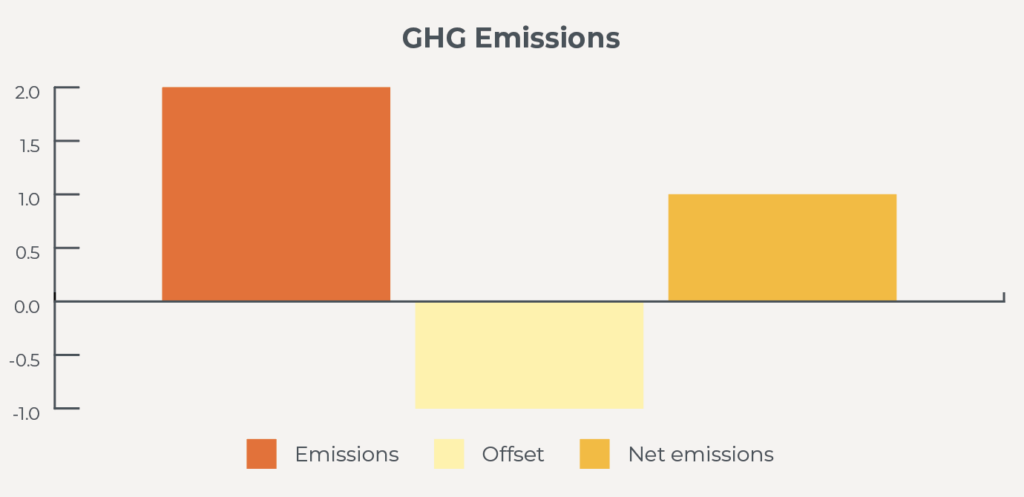

Carbon crediting programs that issue carbon credits generally contain prohibitions against double counting, to maintain environmental integrity.21 Organisations that purchase carbon credits have historically been using them to make offsetting claims. Double counting may lead to misleading claims being made if the same reduction or removal is being used to offset more than one unit of emissions. This is because carbon compensation (zero net emissions) is claimed by two organisations when, in actual fact, there is a net quantity of emissions since the quantity of emissions from two organisations

(+1 x 2 = +2) exceeds the quantity of reductions or removals represented by the one carbon credit (-1) that is being used by both of them. This is represented by the diagram above.

The GHG Protocol Scope 3 Standard provides some guidance on how to deal with such double counting.22 The Gold Standard and the Value Change Initiative have also issued guidance,23 which has been endorsed by IPI,24 to address these issues. The following broad principles emerge from guidance provided / endorsed by these three bodies:

- if the GHG reductions or removals are to be used to offset other GHG emissions (i.e. to cancel out other GHG emissions for the purpose of making a carbon compensation claim), then only one party can use them for such purposes; and

- GHG reductions or removals reported in an organisation’s Scope 3 inventory should not be sold or monetised as carbon offset units. This guidance appears unnecessarily strict in light of the fact that the different organisations may be making different types of claims/ reports, and it is not particularly clear how this guidance can be implemented without distorting GHG inventory reporting.

By contrast, Verra takes a different approach to double counting/double claiming between carbon credits and Scope 3 emissions, by focusing more on public disclosure of the fact of VCU issuance from activities within a supply chain. Broadly speaking, where a VCS project creates GHG reductions or removals in a supply chain, the project proponent or authorised representative must make a statement on their website stating: “Carbon credits may be issued through Verified Carbon Standard project [project ID] forthe greenhouse gas emission reductions or removals associated with [project proponent or authorised representative organisation name(s)] [name of product(s) whose emissions footprint is changed by the project activities]”.25

Verra’s more flexible approach may be more appropriate when no more than one organisation is using the same emission reduction or removal for offsetting purposes. This is because of the difference between GHG inventory reporting and the making of offsetting claims. When an organisation (Organisation 1) reports a reduction or removal in accordance with the GHG Protocol, it is simply reporting the fact that the reduction or removal occurred within its corporate inventory. If another organisation (Organisation 2) purchases that reduction as a carbon credit for offsetting purposes, there should be no double counting as the emission reduction or removal is being used by Organisation 1 and Organisation 2 separately to make different reports and claims.

Interaction with other voluntary decarbonisation guidance/initiatives

The concept of insetting overlaps with other voluntary guidance / initiatives which exhort organisations to prioritise reducing GHG emissions within their own value chain over funding GHG emissions reductions or removals elsewhere. Examples of such voluntary guidance / initiatives include:

- the Science Based Targets initiative (SBTi), which is a voluntary initiative that requires organisations which sign up to its principles to adopt science-based targets for reducing emissions in their value chains and prohibits the use of carbon credits towards meeting those targets (although it allows the use of carbon credits representing GHG removals to neutralise residual emissions once long-term targets have been met).26

- the endorsement by the International Emissions Trading Association (IETA) of the mitigation hierarchy, which requires organisations to take steps to avoid or reduce the environmental impacts of their own actions or projects before seeking to offset any residual environmental impacts.27

- the Claims Code of Practice, v.2, issued by the Voluntary Carbon Markets Integrity Initiative (VCMI), which requires organisations to set, and demonstrate progress towards meeting, emissions reduction targets for their value chains as a foundational criterion for making VCMI-approved claims.28

These voluntary guidance/initiatives generally prioritise insetting over offsetting, encouraging organisations to reduce their own carbon footprint and work with their partners in the value chain to reduce theirs. Several consequences flow from this:

- firstly, organisations which adhere to these voluntary guidance/ initiatives are likely to direct corporate decarbonisation budgets towards emissions reductions within their value chain instead of channelling finance to carbon credits in the voluntary carbon market; this creates demand for insetting solutions from such organisations.

- secondly, insetting will generally require organisations to adopt a more hands-on approach, by working with suppliers or customers to reduce or remove GHG emissions and quantify such reductions or removals, as compared with offsetting, where the organisation simply purchases a carbon credit directly or indirectly from a project developer. It may be worthwhile for upstream suppliers and service providers facing significant demand for low GHG emission product solutions to consider developing standardised low-carbon solutions for their downstream customers, (e.g. via insetting initiatives) so as to differentiate themselves from their competitors and potentially charge a green premium for their products and/or services.

For completeness, there are differences, between various decarbonisation initiatives, about the residual role of carbon credits once insetting has been prioritised. At one end of the spectrum, the SBTi characterises the role of carbon credits merely as “Beyond Value Chain Mitigation”29 (i.e. a contribution to climate action) and recommends that companies go beyond their science-based targets by channelling additional climate finance towards mitigation activities outside of their value chains. At the other end of the spectrum, IETA promotes the offsetting of residual emissions that cannot be fully avoided or reduced. In the middle is the VCMI, which encourages the making of claims about the use of carbon credits equivalent to a stated percentage (or range of percentages) of residual emissions but discourages the making of offsetting claims.30 The VCMI is also trialling a beta version of a “Scope 3 Flexibility Claim”, which would allow organisations to use carbon credits to meet their Scope 3 emissions reduction targets, subject to a quantitative limit (the carbon credits used for this purpose cannot exceed 50% of Scope 3 emissions) and a temporal limit (the use of carbon credits for this purpose must be phased out no later than 10 years after the first claim is made, or by 2035, whichever is earlier).31

In its current review of its Corporate Net-Zero Standard, the SBTi is also considering whether and how “carbon credits from mitigation activities within the value chain” may be “used to substantiate value chain emission reduction claims” (i.e. using carbon credits representing emissions reductions32 within the organization’s value chain as evidence to meet science-based targets).33 Such carbon credits, as conceptualized by SBTi, are essentially insetting units (as opposed to offsetting units) contemplated by the other guidance discussed. The distinction between an inset unit and an offset unit seems to be simply limited to whether the reduction is generated inside or outside the user’s value chain.

From a GHG accounting perspective, both an inset unit and an offset unit represent a tonne of CO2 equivalent reduced or removed. So the difference is mostly in the claim that is made associated with the ‘use case’ for such a unit. The logic somehow being that this difference in use case, absolves the inset unit from the concerns associated with offsets that have been tainted by greenwashing allegations. It is notable that a key feature about an inset unit is that it allows for multiple claimants (i.e. scope 1 and potential multiple scope 3 claimants), whereas offset units do not allow for multiple claimants (i.e. no double claiming or double counting). It is also worth reminding companies using the GHG Protocol Scope 3 Standard that, as per the GHG Protocol’s draft Land Sector and Removals Guidance, inset “credits cannot therefore be used adjust scope 3 emissions or removals (e.g. by subtracting credits from reported emissions), but can be used as a tool for ensuring that actions in the value chain are properly accounted for in the scope 3 inventory using an inventory accounting approach.”34 The practical question that therefore follows from the SBTi position on insetting in favour of offsetting, is whether that is sufficient incentive to support a corporation’s objectives in light of the limited GHG accounting benefit to such corporations.

Regulatory scrutiny or greenwashing

Consumer-facing businesses are likely to be subject to increased regulatory scrutiny relating to their advertising or marketing claims associated with low GHG emission products produced via offsetting approaches. As advertising regulators in certain jurisdictions introduce tighter controls over claims relating to products claiming to have lower GHG emissions, such consumer-facing businesses may be driven to seek robust insetting solutions in order to support such claims. This aspect of applying environmental attribute labelling to such products will be covered in more detail in a separate HFW publication.

Footnotes

- IPI Standard, page 3 https://www.insettingplatform.com/wp-content/uploads/2020/09/INSETTING_PROGRAM_STANDARD_IPS_V2.0_Final.pdf.

- See e.g. Smart Freight Centre and MIT Center for Transportation and Logistics, Sustainable Aviation Fuel Greenhouse Gas Emission Accounting and Insetting Guidelines (SFC-MIT Guidelines) , https://smartfreightcentre.org/en/about-sfc/news/decarbonizing-the-air-transportation-sector-new-guidelines-for-sustainable-aviation-fuel- greenhouse-gas-emission-accounting-and-insetting-launched-today/; the Value Change Initiative, https://valuechangeinitiative.com/.

- See e.g. Getting to Zero Coalition, Accelerating Maritime Decarbonisation: A Book and Claim Chain of Custody System for the early transition to Zero-emission Fuels in Shipping, https://www.globalmaritimeforum.org/content/2023/03/Insight-brief_Accelerating-Maritime-Decarbonisation-A-Book-and-Claim-Chain-of-Custody-System. pdf; Sylvera, The difference between insetting and offsetting, https://www.sylvera.com/blog/insetting; World Economic Forum, Explainer: Carbon insetting vs offsetting, Carbon insetting vs offsetting – an explainer | World Economic Forum (weforum.org).

- International Platform for Insetting, A Practical Guide to Insetting, (IPI Guide) https://www.insettingplatform.com/insetting-guide/.

- IPI Standard, page 3.

- GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain- Accounting-Reporing-Standard_041613_2.pdf; See also the Value Chain (Scope 3) Interventions – Greenhouse Gas Accounting & Reporting Guidance https://goldstandard. cdn.prismic.io/goldstandard/value_change_scope3_guidance-v.1.1.pdf.

- Ibid.

- 28 GHG Protocol Corporate Standard, https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf.

- Gold Standard, Scope 3 Value Chain Interventions Guidance, https://www.goldstandard.org/our-story/valuechange-scope3-solutions.

- https://ghgprotocol.org/sites/default/files/Market-based%20accounting%20Survey%20Memo.pdf.

- See SFC-MIT Guidelines.

- https://ghgprotocol.org/sites/default/files/Market-based%20accounting%20Survey%20Memo.pdf.

- https://ghgprotocol.org/sites/default/files/2022-12/Land-Sector-and-Removals-Guidance-Pilot-Testing-and-Review-Draft-Part-2.pdf. See Section 16.3.4.

- See definition of “Verified Carbon Unit (VCU)” in the VCS Program Definitions v4.4, https://verra.org/documents/vcs-program-definitions-v4-4/. By contrast, Gold Standard does require co-benefits for certification – see Gold Standard Principles and Requirements, paragraphs 4.1.1 – 4.1.2, https://www.goldstandard.org/project-developers/ standard-documents.

- IPI Standard, pages 6 – 7.

- IPI Guide, Lesson 4. This recommendation is subject to certain exceptions.

- Verra, Green Light for Scope 3 Program, https://verra.org/verra-launches-scope-3-standard-program-development-group/.

- The GHG Protocol’s position on accounting for removals is still in flux. The existing GHG Protocol Scope 3 Standard (see Sections 6.2 and 11.2) only permits removals to be reported as optional information, separate from Scope 1, 2 and 3 emissions. However, the draft Land Sector and Removals Guidance (https://ghgprotocol.org/sites/default/ files/2022-12/Land-Sector-and-Removals-Guidance-Pilot-Testing-and-Review-Draft-Part-1.pdf) would introduce a concept of Scope 1 and Scope 3 removals that can be included in an organisation’s inventory (see Sections 5.3. and 6). This article assumes that organisations will eventually be able to include removals in their inventories.

- The GHG Protocol, Corporate Value Chain (Scope 3) Standard, Section 9.6, states that “Scope 3 emissions are by definition the direct emissions of another entity”, Corporate Value Chain (Scope 3) Standard | Greenhouse Gas Protocol (ghgprotocol.org). See also Section 5.1.

- GHG Protocol Scope 3 Standard, Sections 5.1 and 9.6.

- See e.g. Section 3.2.3 of the VCS Standard, v4.5.

- GHG Protocol Scope 3 Standard, Section 9.6.

- Gold Standard, Scope 3 Value Chain Interventions Guidance, https://www.goldstandard.org/publications/scope-3-value-chain-interventions-guidance

- IPI Guide, Lesson 8.

- VCS Standard, v4.5, Section 3.24.7, https://verra.org/wp-content/uploads/2023/08/VCS-Standard-v4.5-updated-11-Dec-2023.pdf.

- https://sciencebasedtargets.org/resources/files/Net-Zero-Standard.pdf.

- https://ieta.b-cdn.net/wp-content/uploads/2023/09/IETA_101_MitigationHierarchy_Sept2023.pdf.

- VCMI-Claims-Code-v1.10.pdf (vcmintegrity.org).

- https://sciencebasedtargets.org/beyond-value-chain-mitigation.

- VCMI-Claims-Code-v1.10.pdf (vcmintegrity.org), at page 27.

- https://vcmintegrity.org/wp-content/uploads/2023/11/Scope-3-Flexibility-Claim-Beta.pdf.

- The SBTi distinguishes between emissions reduction/abatement credits, which reduce GHG emissions compared to the emissions in a reference or base year, and emissions avoidance credits, which refer to certificates issued from activities that prevent potential future emissions compared to a counterfactual baseline scenario. Most credits that voluntary carbon market participants consider to be an emissions reduction credit would be deemed by the SBTi to be an avoidance credit. SBTi Research: Scope 3 Discussion Paper (July 2024), https://sciencebasedtargets.org/news/sbti-releases-technical-publications-in-an-early-step-in-the-corporate-net-zero-standard- review, at page 92.

- SBTi Research: Scope 3 Discussion Paper (July 2024), https://sciencebasedtargets.org/news/sbti-releases-technical-publications-in-an-early-step-in-the-corporate-net- zero-standard-review, at pages 12 – 13.

- https://ghgprotocol.org/sites/default/files/2022-12/ Land-Sector-and-Removals-Guidance-Pilot- Testing-and-Review-Draft-Part-1.pdf at p.246