Warning to Australian directors & officers

“Your D&O insurance may be prevented from responding to defence costs!”

The recent Victorian case arising from the share-price collapse of Centro Properties (ASIC v Healey) has highlighted the standards of care and diligence which will be expected of company directors and officers, notwithstanding any advice or information which they may receive, either from corporate management which reports to them or from external advisors. Approving the accuracy of financial statements, for example, is a responsibility which directors cannot delegate to others, regardless of whether they are executive directors or not. Since the Centro decision, ASIC has subsequently articulated the standards it expects.

This environment elevates the importance to directors and officers of knowing that their D&O liability insurance supports them by funding the legal or defence costs which they incur in connection with regulatory or other enquiries or claims made against them.

In this briefing, we discuss a recent development in NZ which undermines the confidence with which directors of Australian companies can rely upon their D&O insurance to fund defence costs. In our conclusion, we propose a solution which should effectively provide directors and officers with the protection they need.

The current D&O model: “combined limit” policies

Directors and officers liability insurance has developed over the years to protect a number of constituent interests, primarily the directors and officers themselves and their companies, but also shareholders, investors, creditors and others. D&O insurance seeks to do this by providing a “combined limit”: a single pool of funds which is available to meet both directors’ and officers’ legal costs as they are incurred (in respect of formal enquiries and claims made against them) and also awards for compensation or damages made against them.

A recent NZ High Court decision (Steigrad v Bridgecorp) (Steigrad & Ors v BFSL 2007 Limited & Ors, High Court of New Zealand CIV-2011-404-611), if upheld, suggests that the current “combined limit” D&O policy model may not make funds available for defence costs in certain circumstances where the value of claims against the directors exceeds the policy limits. Because the relevant NZ statute is mirrored in NSW, ACT and NT, the NZ High Court’s decision raises the spectre that current D&O policies procured for Australian corporate officers may not be “fit for purpose” either – or, at least, not from the directors’ perspective.

Until the issue is clarified, directors and officers would, in our view, be well advised to ensure that their defence costs policy proceeds are “ring fenced” from any claim that may be made against them by regulators, shareholders, creditors (including liquidators) or other competitors. This may mean that D&O underwriters will be asked to offer separate “stand alone” defence costs cover, but this may require additional underwriting capital to do so, assuming that directors still require indemnification for their liabilities to third parties.

The charge on the policy

NZ and certain Australian States & Territories (NSW, NT and ACT) have long-standing legislation designed to protect victims of parties who die or become insolvent by which the proceeds of liability policies entered into by the latter are deemed “charged” upon the happening of an event which gives rise to a claim(s) upon the insured person. The charge is deemed to descend upon the insurance policy proceeds before the claim is even made upon the insured party, before its quantification and before that person’s liability is determined. (Section 9 of the NZ Law Reform Act 1936, which is substantially mirrored in NSW by the Law Reform (Miscellaneous Provisions) Act 1946, Section 6, in ACT by the Civil Law (Wrongs) Act 2002 s.206 and in NT by section 26 of Law Reform (Miscellaneous Provisions) Act.)

The Bridgecorp case

Steigrad v Bridgecorp Ltd (in Receivership and Liquidation) arose from the collapse of the property company, Bridgecorp Ltd with net debts in excess of NZ$450 million. The circumstances of the case were as follows:

- The Bridgecorp directors had two relevant liability insurances, a Statutory Liability insurance of NZ$2 million and a D&O policy. The latter had a combined policy limit, to cover liabilities arising from Wrongful Acts (as defined) and Defence Costs, of NZ$20 million. There was no differentiation of the insurance funds to meet liability and defence costs respectively.

- Bridgecorp’s directors were subject to criminal proceedings by the NZ Financial Markets Authority, the defence costs of which were met in the first instance by the Statutory Liability policy. The limit of this policy was apportioned between five directors who faced criminal charges. For all but one director, their share of the policy limit became exhausted before trial of the criminal proceedings in October 2011.

- In 2009 Bridgecorp’s receivers had notified the D&O insurer that they intended to pursue the directors and, as their claim exceeded the D&O Policy’s limits, asserted a charge over all monies payable under the D&O policy.

- Two of the Bridgecorp Directors applied to the High Court for an order that they were entitled to an advance of defence costs under the D&O policy for purposes of defending the criminal proceedings. The NZ High Court had to consider whether the relevant NZ charging legislation (Section 9 of the NZ Law Reform Act 1936) operated so as to make the NZ$20 million policy limit subject to a statutory charge in favour of the Bridgecorp receivers, in such a way that the policy funds could not be advanced to meet the directors defence costs.

- The charge under section 9 did descend upon all proceeds of the D&O policy in respect of the directors’ potential liability to pay damages to Bridgecorp for breaches of duty.

- The charge, which arises “on the happening of an event giving rise to the claim for damages or compensation”, arose when Bridgecorp Ltd collapsed, as distinct from the time of those alleged breaches of duties by the directors which gave rise to Bridgecorp becoming insolvent.

- Although the charge is conditional upon the directors (1) being liable for a quantified sum, and (2) being entitled to cover under the policy in respect of their liability, the D&O insurer was obliged to keep the entire insurance fund intact for the benefit of Bridgecorp whose claim exceeded the policy limit.

The overall effect of the charge, therefore, was to prevent the directors from having access to the D&O policy to meet their defence costs, even though, as the judge (Lang J.) acknowledged, the specific purpose for which the D&O policy was purchased, at least in part, was precisely to meet the defence costs that might be incurred by directors. Once the insurer had been notified of the charge, its obligation to keep the insurance funds ‘intact’ applied, regardless of the merits of the claim(s) brought against the directors.

In the context of insolvent companies whose directors may receive multiple claims, each of which may generate a charge on the insurance proceeds, the case also raises interesting issues as to the priority of those charges.

What this means for directors?

The Bridgecorp case is understood to be subject to appeal. If it is upheld, there may still be some doubt whether it would be applied in Australia. For example, there is NSW authority that the statutory charge will only descend upon “claims made” insurance policy proceeds if the relevant event giving rise to the claim also occurs during the policy period. It might also be argued, based on Zurich Australia Insurance v MMI pte Ltd, ([2009] HCA 50) that there is a distinction between insurance policies “entered into” by insureds and those policies which are taken out by another party (such as the company) but which also indemnify the insured directors and officers. On this basis, it may be argued that the Australian charging legislation (Law Reform (Miscellaneous Provisions) Act, 1946, Section 6) should be interpreted narrowly and should not apply to the proceeds of insurance policies which were procured for, but not actually entered into by, the insured directors and officers. (The Zurich v MMI case involved a close and thorough analysis of a very different piece of legislation and its drafting, namely S 45 of Insurance Contracts Act 1984 which deals with double insurance. Any similar argument as to the interpretation of the LR (MP) Act 1946, s.6 would have to be treated with the utmost caution.)

However, to give comfort to directors and in the interests of good corporate governance, until the position is clarified, the prudent approach is to assume that the NZ court’s approach in Bridgecorp will be upheld and would be applied in NSW, ACT and NT.

We anticipate that investors, lenders and shareholders will continue to require companies and directors to maintain liability insurance which should be available, if necessary, to compensate them for losses they may incur as a result of the directors’ conduct. To address this, directors and officers, insurance buyers, brokers and underwriters need to explore how to ring-fence defence costs from third party claims that would otherwise freeze the D&O policy proceeds.

Solutions

A number of options have been canvassed recently. One such option, insurance for directors’ liabilities with defence costs being “in addition” to policy limits, is unlikely to appeal to insurers and, in any event, may not be appropriate for multi-layer insurance programmes. Another, for excess layer insurance to “drop down” to cover defence costs, may not always work smoothly either – it assumes the existence of (an) excess layer (which may not exist) and there are likely to be technical issues which give rise to disputes.

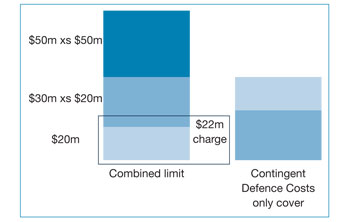

A more user friendly alternative, we believe, is for directors to couple their existing combined limit D&O liability insurance with “contingent defence costs cover” which would be triggered only in the event of the notification of a charge on the combined limit policy to the extent of its policy limit. It may be illustrated as follows:

The “contingent defence costs only” cover (CDC) could be written by the same “combined limit” insurers or by different insurers or by a combination of the two. It could also be structured in such a way so as to allow the CDC insurers to recover defence costs they may have advanced from the traditional “combined limit” policy in the event that the charge over the latter were released and to the extent that its policy limit has not been exhausted. There are further provisions which might be included to make it more affordable. In this way, directors and officers would be able to sleep more easily with the comfort of knowing that their protection for defence costs is not squeezed out by operation of a statutory charge in favour of third party claims, the merits of which are uncertain.

Download a PDF version of ‘Warning to Australian directors u0026 officers’