The multifaceted approach towards regulating carbon emissions in international shipping: Global, regional and national measures

A multi-layered and evolving regulatory landscape is emerging at the global, regional and national levels. These all share a common goal: to regulate carbon emissions in international shipping and, ultimately, reduce GHG emissions.

However, the measures set to be adopted seek to achieve this in different ways. The pressing questions right now, therefore, are how this patchwork of measures will interact and what this will mean for the stakeholders in the shipping industry; in particular, the way they will contract over the years to come.

The past few months have seen an ever-increasing focus on reducing greenhouse gas (GHG) emissions in the shipping industry.

Whilst shipping is by far the most energy-efficient mode of large-scale transport, the industry is nevertheless responsible for around 3% of global GHG emissions. This is already equivalent to the sixth largest GHG emitting country worldwide yet, given the increased demand for global trade, without adequate policy intervention GHG emissions from shipping are expected to rise further.

Consequently, international shipping is now the subject of increased scrutiny and regulatory intervention. As international, regional and national interests seek to meet their specific carbon reduction targets, we are beginning to see a multi-layered regulatory landscape take shape, consisting of a variety of measures with the same goal in mind: to reduce GHG emissions from shipping, albeit they go about it in different ways.

In this article, we consider how the proposed global, regional and national measures to decarbonise shipping could interact, and the implications for stakeholders across the shipping industry.

International proposals – IMO carbon intensity measures

The IMO’s current goals are to reduce the carbon intensity of shipping by 40% by 2030, and to reduce the total GHG emissions from shipping by at least 50% by 2050 (both compared to 2008 levels).

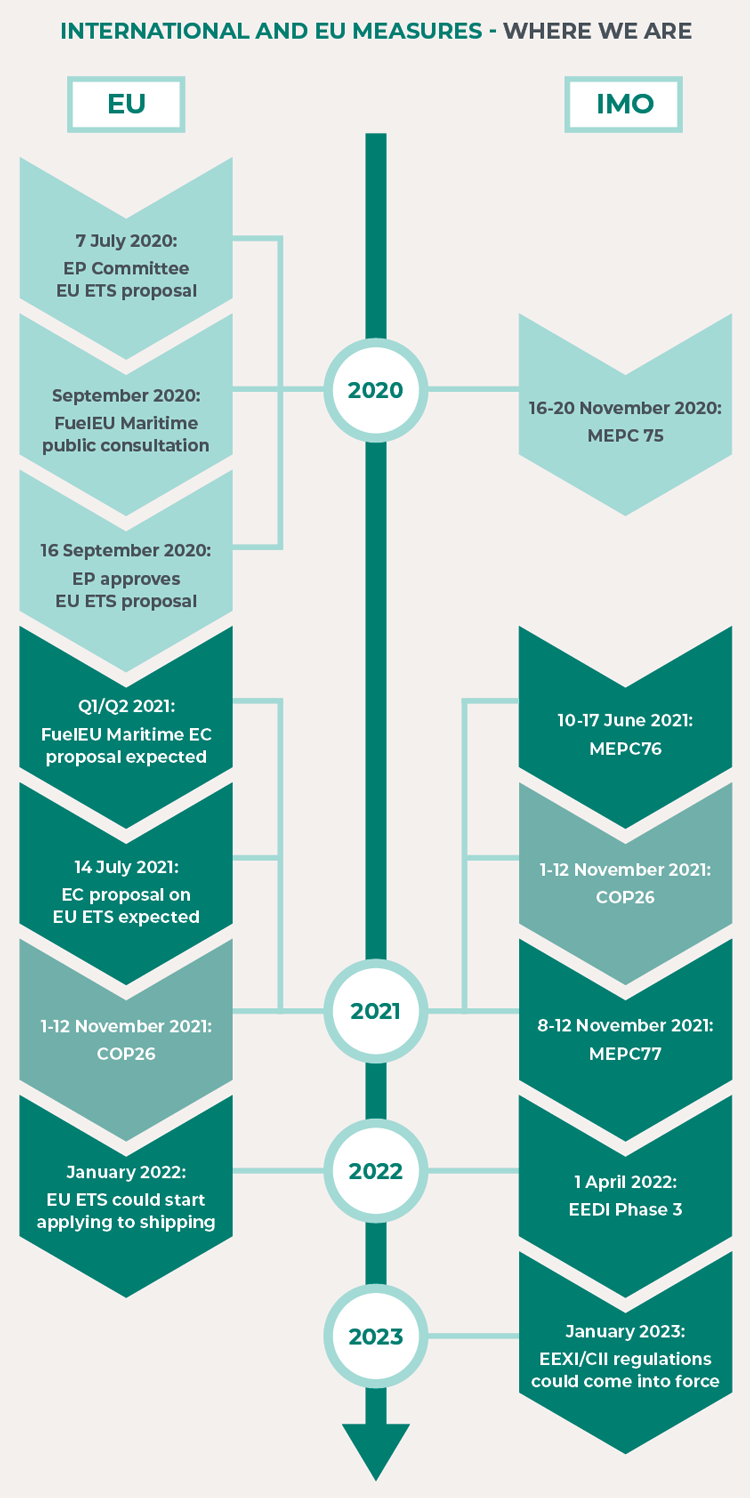

To this end, the IMO’s proposed Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) regulations are expected to be adopted at the next meeting of the Marine Environment Protection Committee, MEPC 76, which is taking place between 10 – 17 June 2021. These regulations are planned to come into force on 1 January 2023.

The EEXI regime, which will apply to all vessels above 400 GT, is a technical measure aimed at improving the energy efficiency of vessel design. In order to achieve the required energy efficiency under the regime, technical modifications to vessels may be required.

The CII regime, which will apply to all vessels above 5,000 GT, seeks to improve operational energy efficiency by attempting to calculate a vessel’s annual carbon intensity. On the basis of the relevant vessel’s performance, a carbon intensity rating of A – E will be ascribed to it, and this will determine whether any corrective actions to improve the vessel’s carbon intensity are required.

There remain several issues regarding both the EEXI and CII regimes which need to be clarified. Hopefully these will be addressed at the upcoming MEPC 76. For example, both the metric used to calculate a vessel’s annual carbon intensity under the CII regime (AER or EEOI) and the determination of the CII reduction rate (i.e. the yardstick for continuous improvement of the CII year on year), are still to be confirmed. It also remains to be seen what enforcement and sanctions measures might be put in place to ensure compliance with the EEXI and CII regulations.

The IMO regulations are also likely to significantly impact commercial contracts and, in the absence of tailored contractual solutions, could very well lead to disputes.

For example, whilst on the face of it responsibility for any technical modifications required under the EEXI regime appears to rest with shipowners, in a long term charter the parties may disagree over the type of modification that is to be carried out (there are no stipulations under the regime), and practical considerations (e.g. drydocking for installation of energy efficiency technology, time out of service and so on) may also need to be catered for in the contract.

The CII regime looks set to have an even more fundamental impact on commercial contracts in shipping. For example, the nature of adjustments to a vessel’s operational activity that could be necessary to improve its annual carbon intensity (which might include operating at a reduced speed, deviating from the shortest or quickest route on a voyage, or reducing cargo volume intake) may directly impact the traditional rights and obligations of the parties under a time charter.

For a detailed analysis of the challenges likely to be thrown up by these IMO regulations please refer to our previous article.1

Regional measures – EU Emissions Trading System

The landscape is further complicated by measures proposed at the regional and national level, the most prominent of which is the potential inclusion of shipping in the EU’s Emissions Trading System (ETS). Following a consultation which concluded earlier this year, a formal announcement is expected from the European Council around 14 July 2021, and if shipping is included in the ETS, the new regime could apply by as early as 1 January 2022 provided the necessary legislative framework is in place.

The EU’s ETS currently works by setting a steadily reducing cap on the permitted GHG emissions in the power sector and the manufacturing and airline industries, also known as emissions quotas. In combination with reporting requirements from the relevant industry entities, GHG emission allowances are sold and/or distributed in the market. The incentive for a given entity is to reduce its annual GHG emissions below the permitted cap so that excess allowances can be sold on the market.

Similarly to the IMO’s proposed measures, a number of questions currently remain unanswered, including (i) which vessel and / or voyages will be covered by the ETS; (ii) who will be responsible for the carbon footprint of a given vessel under the ETS; and (iii) how will the ETS operate in practice, for example in terms of reporting emissions for non-EU participants.

For a detailed analysis of these uncertainties, please see our dedicated article.2

Potential national measures

Answers to these questions on the EU’s ETS are especially relevant because any decision to include shipping in the EU’s ETS may lead to similar measures being taken elsewhere. In particular, application of the EU’s ETS beyond intra-EU voyages could well be the catalyst.

For example, China, which seeks to achieve carbon neutrality by 2060, has its own internal ETS that launched on 1 February 2021. Whilst this ETS does not currently include shipping, this could change depending on the precise application of the EU’s ETS.

The UK is also considering including shipping in its national ETS, which was set up after Brexit. This would align with the inclusion of shipping emissions in the UK government’s next Carbon Budget, whereby the UK has committed to reduce overall GHG emissions by 78% by 2035 (compared to 1990 levels).

Lastly, it is conceivable that the US, which has set a national target of net zero carbon emissions by 2050, could take similar steps in due course. Indeed, a bill was recently introduced in the US House of Representatives called the “Ocean Climate Based Solutions Act”, which includes a proposal for the US to replicate a similar system to the EU’s MRV Regulation (which requires shipowners and operators to monitor, report and verify CO2 emissions on a continuing basis and which will most likely form the bedrock for the EU’s ETS).

Regulatory compatibility

The EU’s push to include shipping in the ETS, and the potential for further national ETS schemes, raises the question of compatibility and serves to illustrate the risks that ship owners and operators could be exposed to if such regimes conflict with each other or with measures introduced by the IMO.

Multiple regimes applying to regulate and catch GHG emissions may result in increased administrative costs if shipowners or operators are required to monitor and report emissions to different authorities, as well as uncertainty over which international, regional or national regime might apply to a vessel at any one time, especially when conducting voyages between locations where different regimes apply.

The question of which party will be responsible for emissions quotas under the EU’s ETS is particularly relevant in this context. A recent theme emerging from proposals made by the European Parliament is the concept of the “polluter-pays” principle,3 which recognises that the party responsible for the commercial operation of a ship and responsible for arranging and paying for fuel (for example, the charterers in a time charter context) should be responsible. If replicated in the ETS Directive (the precise detail of which is still awaited), this could see the time charterer required to pay for emission quotas. In those circumstances, a situation could arise where ship owners bear primary responsibility under the IMO’s regulations, but the time charterers are the responsible party under the EU’s ETS. Cooperation will be required here to ensure the cost, risk and responsibility under the differing regimes is adequately managed. In particular, charterers’ lack of access to relevant emissions information, which may be required to assist compliance, may also need to be catered for. This is something that industry initiatives such as the Sea Cargo Charter4 aim to address.

Market-Based Measures

A raft of Market-Based Measures (MBMs) have also been proposed, which might also potentially sit alongside the measures discussed above.

MBMs are economic instruments which, on the face of it, are designed to incentivise the reduction of GHGs from international shipping. The EU’s ETS is one form of an MBM, as it monetises and thereby creates a financial incentive to minimise GHG emissions. However, MBMs also include taxes or levies on GHG emissions or high-carbon fuels, which serve to both increase the absolute cost of higher emissions, and generate revenues for other initiatives (such as research and development for new energy efficient technologies or alternative fuels).

MBMs that have been proposed thus far, all of which have been made at the international level via the IMO, include the following:

- A levy of US$ 100 per tonne of CO2 equivalent emitted from vessels proposed by the Marshall Islands and the Solomon Islands, with the proceeds partly used for research and development into sustainable shipping and partly to help developing countries combat climate change.

- A levy of US$ 2 per tonne of fuel, with the proceeds being managed by a new IMO body called the International Maritime Research and Development Board, as proposed by industry bodies such as BIMCO and the International Chamber of Shipping.

- A levy of US$ 250 to US$ 400 per tonne of carbon (or US$ 700 to US$ 1,200 per tonne of marine fuel), put forward by Denmark, France, Germany and Sweden.

It remains to be seen whether any of these proposals will be adopted following MEPC 76 in mid-June, although even if a proposal was adopted, it would probably take years to come into force, albeit pressure is mounting to expedite any timeframe.

However, a risk remains that MBMs could be introduced at regional and / or national levels in a shorter timeframe. Indeed, the European Community Shipowners Association has asked the EU to create a fund via an MBM which would be used for research and development into decarbonisation.

Proposals have also already been made for measures that could come into force later than 2023 – for example, Denmark, France, Germany and Sweden have asked the IMO to consider the creation of its own ETS which would operate internationally, yet how this would interact with the EU’s proposed ETS for shipping remains unclear.

Ultimately, for commercial contracts, carbon levies would constitute an additional cost linked to a vessel’s use of fossil fuels. This may encourage the use of alternative fuels and/or investment in technologies targeting fuel efficiency, but it also raises the question of which party will bear the additional cost.

The role of carbon offsetting

Another consideration is what role carbon offsetting will play as a method for complying with the patchwork of proposed measures, with an increasing number of entities in sectors other than shipping seeking to ‘offset’ their GHG emissions by financing emissions-reducing projects, thus leading to a net overall reduction in emissions.

Besides difficulties with accurately measuring the actual emissions reduction benefits of individual offsetting projects, it is notable that, as currently drafted, none of the proposed measures outlined above would allow for carbon offsetting as a means of compliance. Consequently, it remains to be seen whether it will grow in significance as international shipping seeks to decarbonise.

Conclusion

A multi-layered regulatory landscape is evolving at the global, regional and national levels, which all ultimately strive to achieve the same common goal – the reduction of GHG emissions in shipping – but by different means. Currently, the legal framework and proposed operation of these different regulations is not clear, and stakeholders are faced with commercial uncertainty when preparing to comply and entering into long term commercial contracts.

Whilst some clarity might be gleaned from the outcome of both MEPC 76 (which is due to take place between 10 – 17 June 2021) and the European Council announcement on the legislative framework for the inclusion of shipping in the EU’s ETS (expected around 14 July 2021), ultimately stakeholders may need to prepare for a patchwork of different measures to co-exist, and set a course to navigate through the evolving regulatory landscape by negotiating appropriate contractual arrangements.

Given the nature of the rights and obligations involved in charterparties and other relevant commercial contracts, straightforward solutions for neatly allocating risk, costs and rewards under the emerging multi-layered regulatory landscape are unlikely to exist. Therefore contractual solutions will need to be explored to cater for the various compliance regimes, to facilitate the sharing of information on emissions and to determine the limits of the vessel’s operational and technical activities under efficiency measures as well as the added costs of using fossil fuels due to levies/taxes. In the absence of contractual solutions and close cooperation between the stakeholders, disputes are likely to materialise.

Should you have any questions on sustainable shipping, emissions regulations or decarbonisation of shipping, please contact the authors of this briefing;

Alessio Sbraga

Partner

D +44 (0)20 7264 8768

E alessio.sbraga@hfw.com

Alessio is part of BIMCO’s Carbon Intensity Impact Study working group responsible for assessing the impact of emissions regulations and drafting charterparty clauses.

Joseph Malpas

Associate

D +44 (0)20 7264 8497

E joseph.malpas@hfw.com

Assistance provided by Johanna Ohlman, Trainee Solicitor.

For more information on HFW’s sector-focused work on sustainability, visit the HFW Sustainability Hub.

Footnotes

- https://www.hfw.com/insights/Reducing-international-shippings-carbon-intensity-through-the-IMOs-EEXI-and-CII-charterparty-implications-and-challenges/

- https://www.hfw.com/insights/Inclusion-of-shipping-in-the-EU-Emissions-Trading-System-current-landscape-perspective-and-potential-impact/

- See https://www.europarl.europa.eu/doceo/document/TA-9-2020-0219_EN.html (Amendment 38); and https://www.europarl.europa.eu/doceo/document/TA-9-2021-0131_EN.html (paragraph 22)

- https://www.seacargocharter.org/

Download a PDF version of ‘The multifaceted approach towards regulating carbon emissions in international shipping: Global, regional and national measures’