Sanctions enforcement in the commodities sector: trends during 2024 and predictions for 2025

2024 was an inconsistent year for global sanctions enforcement, with significant variance in the volume and severity of enforcement actions between jurisdictions. It saw the privatisation of sanctions enforcement and increasing adoption of designations as an enforcement tool, both with significant impacts for the commodities sector.

Enforcement

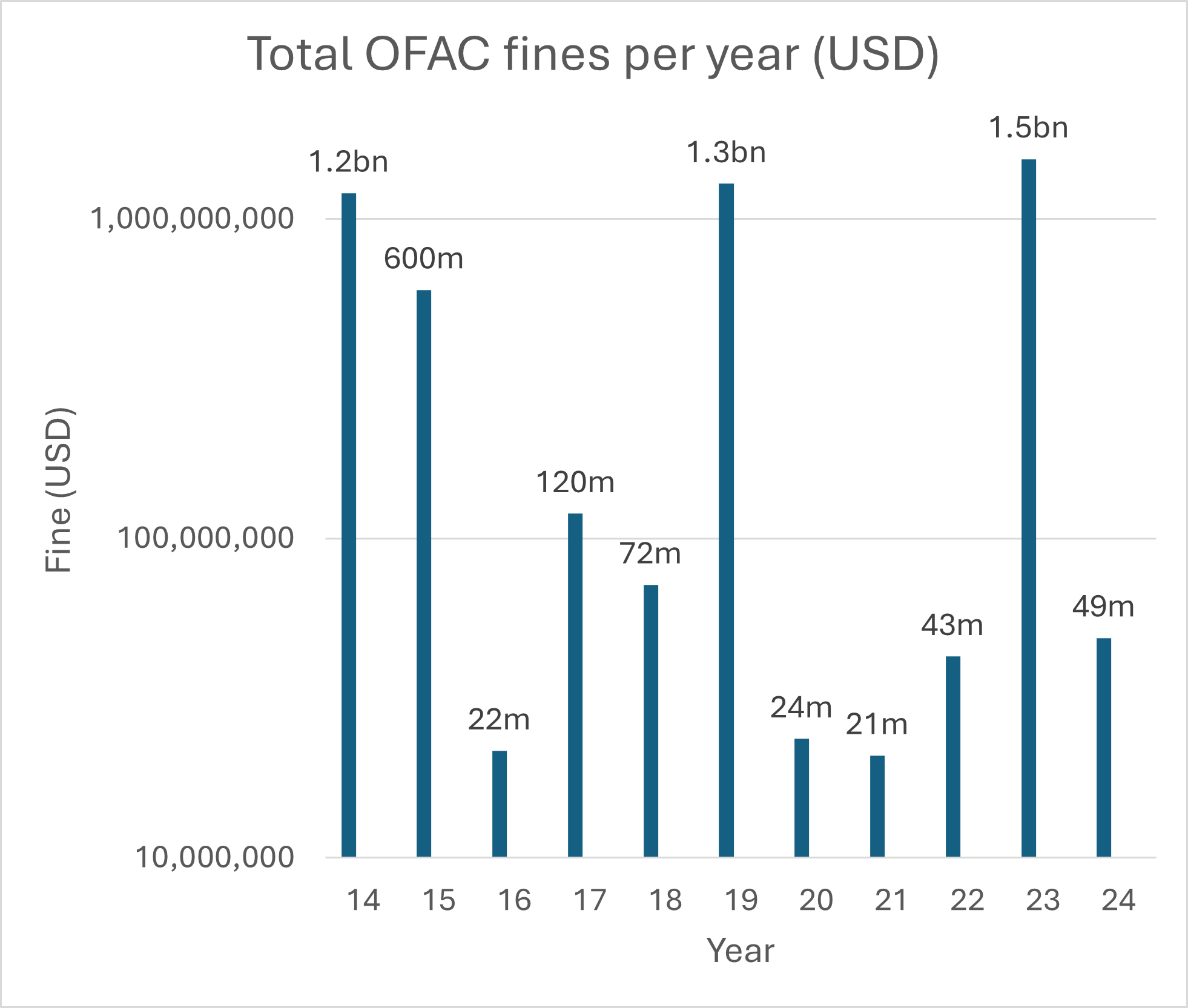

Penalties for breaching US sanctions were at a relatively low level in 2024, with 12 fines imposed by the Office of Foreign Assets Control (OFAC) totalling approximately USD 49m. Notably, only three penalties related to violations of sanctions programmes targeting Russia, with the remainder primarily comprised of violations under programmes targeting Iran and North Korea. This is likely to be as a result of the significant lead time between the point when sanctions are imposed and an investigation into a breach is concluded, rather than a lack of appetite for enforcement. The Trump administration’s approach to enforcement of Russia sanctions remains to be seen, but sanctions were a favoured foreign policy of his first term (albeit in a different policy landscape).

By contrast, 2024 saw significant enforcement actions being taken in EU member states. For example, large fines were imposed in Estonia and Lithuania and significant custodial sentences were imposed in the Netherlands and Germany. Reports of criminal investigations and police raids on businesses were also common. The deadline for EU Member States to adopt national legislation allowing them to impose minimum penalties for breaches of EU sanctions is 20 May 2025, and so we expect even harsher penalties and more aggressive enforcement of EU sanctions in 2025.

The picture is quite different in the UK. The Office of Financial Sanctions Implementation (OFSI) only imposed one fine of GBP 15,000 in 2024, which was the first financial penalty imposed by OFSI for breaches of Russian sanctions. Other UK regulators have picked up some of the slack, with the Financial Conduct Authority fining Starling Bank GBP 29m for systems and control failings in respect of sanctions and HM Revenue & Customs having reached six compound settlements totalling GBP 1.4m in relation to breaches of Russian trade sanctions since February 2022. It was reported in October 2024 that OFSI has 37 live investigations into breaches of the Russian oil price cap, so we expect further penalties in 2025 as the ‘enforcement-lag’ closes.

Designations as an enforcement tool

While traditional enforcement of US and UK sanctions targeting Russia has been lacking, both jurisdictions are increasingly using designation powers to target activity deemed contrary to their sanctions policy. The UK has been particularly aggressive in this space, with a number of persons and entities having been designated for purported dealings with Russia outside of UK jurisdiction. The threat of designation for activities conducted out of jurisdiction makes sanctions compliance significantly more challenging and sanctions risk management must now take account of all-encompassing designation criteria, where any level of trade with Russia in certain sectors is sufficient to be added to a sanctions list, even if the trade is lawful and out of jurisdiction.

Privatisation of sanctions enforcement

The EU has not yet followed the path of designation as an enforcement tool but is instead spearheading the privatisation of sanctions enforcement. This manifests in two ways: firstly, due diligence obligations are increasingly onerous; and secondly, legislation and guidance is mandating contractual terms, thereby restricting freedom of contract. An example of this would be mandating that contracts include termination rights in the event that oil price cap-related documents are not provided, or requiring that goods are not on-sold to Russia.

Impact on the commodities sector

The combined effect of these trends is likely to be an increasing globalisation of sanctions and increased enforcement in 2025.

Competent authorities expect market operators carefully to scrutinise suppliers, end users and trade documentation. Failure to comply with these responsibilities may result in harsher penalties being imposed. The level of compliance required is becoming increasingly intricate as the measures taken to circumvent or evade sanctions becomes more sophisticated. Falsified certificates of origin, spoofed AIS data and intermediaries being interposed to obfuscate sanctioned parties’ interests are increasingly common occurrences.

It is paramount, therefore, that market participants take stock of their potential sanctions risk exposure; make an informed decision as to their risk appetite; and consider how to manage their exposure while continuing to operate in their chosen markets.

Sanctions policies and procedures should be refreshed to address the current guidance issued by sanctions authorities, because adherence can both reduce the risk of breaching sanctions and serve as a defence or argument in mitigation in the event that something goes wrong. Similarly, contractual terms should be reviewed to ensure compliance with mandatory requirements and provision of sufficient rights and protections to address the sanctions landscape, as it develops in 2025.