Feeding the dragon

This article first appeared in Petroleum Review in July 2012 and is reproduced with their kind permission. www.energyinst.org.uk.

China has an almost insatiable demand for raw materials to feed its ambitious growth, but can supply keep up?

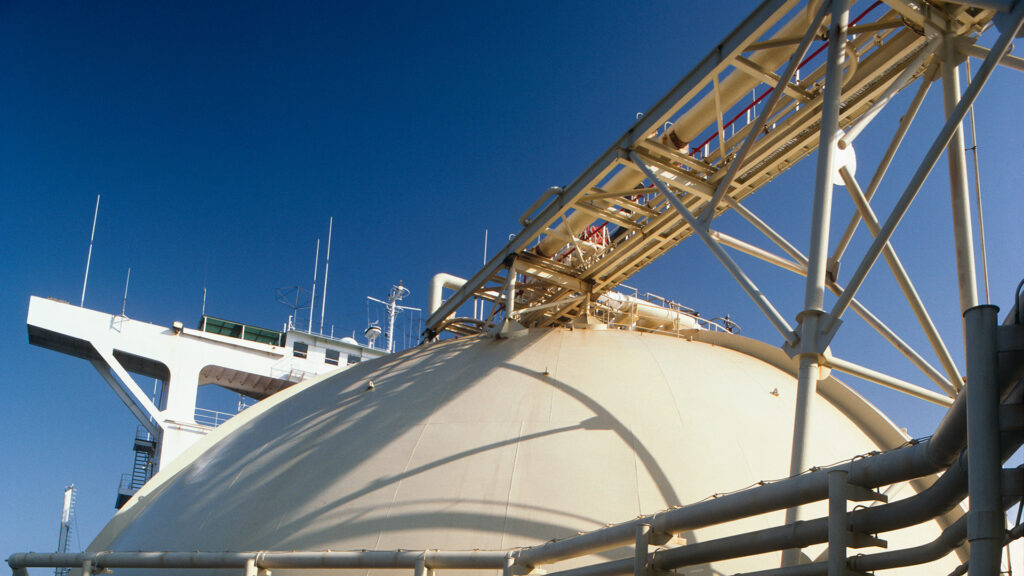

China’s first floating LNG (FLNG) platform has dominated the headlines of China’s ports and terminals development in recent months. But this latest venture is just part of a bigger story – the development of China’s import infrastructure for the energy and natural resources it so desperately needs to feed its continuing rapacious appetite for growth.

As the world’s top energy consumer, China’s demand for energy and natural resources is phenomenal. Under its 12th Five-Year Plan (2011–2015), China aims to reduce its dependence on coal and oil, and increase usage of clean energy to ensure sustainable growth for the nation. (1) In 2011, China’s natural gas consumption had increased by 20.6% to 129bn cm. This figure will reach 260bn cm by 2015, of which 90bn cm will be imported, accounting for 35% of the country’s total gas consumption. (2)

Rapidly increasing demands for natural gas and centralised planning for development of natural gas has led to vast investments in LNG infrastructure along China’s coastline. The addition of these onshore receiving terminals along the coast has been a fiercely competitive business and sites for further development are now limited. Consequently, owner-operators are now turning their attention to offshore floating facilities.

Development to date

China’s LNG market is dominated by CNOOC, PetroChina and Sinopec. While CNOOC currently leads the way, controlling half of the existing terminals and those under construction, PetroChina and Sinopec are set to compete in this market vigorously. PetroChina expects to see another three terminals commissioned in 2013/2014. (3) Sinopec currently does not have any terminals in operation, but has three receiving terminals in the pipeline, in Qingdao, Guangxi and Tianjin, with the Qingdao project close to completion in 2014.

Additionally, with limited sites available, market players are becoming more aggressive in securing their position in China’s emerging LNG business. Some preferred sites, such as Tianjin and Wenzhou, are seeing more than one proposal being made to build LNG terminals close to each other.

The majority of China’s LNG terminals, including existing, under construction and those at the advanced planning stage, are located on the south and east coastline of China, due to a more prosperous economy, easy accessibility, established port operation and low shipping costs in these areas. (4) These terminals are scattered from Guangdong, Guangxi, Fujian and Hainan to Shanghai, Jiangsu and Zhejiang. LNG terminals in the north are clustered in the Bohai Bay in Liaoning, Hebei, Shandong and Tianjin. The current capacity of these existing LNG terminals is 18mn t/y and it is expected to increase to 30mn t/y by 2015.(5)

China’s current LNG imports are facilitated by five LNG terminals – Guangdong Dapeng, Fujian, Shanghai, Jiangsu Rudong and Dalian. Guangdong Dapeng was China’s first LNG terminal, commissioned in 2006. The $3.6bn terminal is operated by BP and China’s third-largest oil company CNOOC. Its current operating capacity is about 6.7mn t/y and it will have a total receiving capacity of 13.5mn t/y by early 2015. The terminal’s main LNG supply is from Australia’s largest oil and gas development, the North West Shelf project. (6)

Fujian LNG terminal and Shanghai LNG terminal are operated by CNOOC. Fujian started operation in early 2009 and has a current capacity of 2.6mn t/y. LNG is sourced mainly from the Indonesian Tangguh LNG project. Shanghai LNG terminal is located in the Yangshan Deepwater Port, Shanghai International Shipping Centre. It began operation in October 2009, with a capacity of 3mn t/y initially, and 6mn t/y upon completion of Phase II. The project includes three 165,000-tonne concrete tanks, a special LNG jetty that can anchor ships from 80,000 cm to 200,000 cm and associated regasification and subsea gas pipelines. (7)

Coming onstream in May 2011, Jiangsu Rudong was PetroChina’s first LNG terminal and the fourth in China. (8) The terminal has a design capacity of 3mn t/y and the ability to handle the world’s largest 267,000-cm Q-Max LNG vessels.

Dalian LNG terminal is the first operating LNG terminal in the north region of China, coming onstream in November 2011 with a total capacity of 6mn t/y.

In addition to the five existing terminals, a further five are currently under construction along the south, east and north coast of China. An additional terminal has been approved in Shenzhen. Upon completion of these terminals by the end of 2015, China will have more than doubled the amount of LNG that it can import. (9)

The five LNG terminal projects under construction are Zhejiang, Zhuhai, Hainan, Tangshan and Qingdao, the latter two located in the north of the country. Sinopec is developing the Qingdao LNG terminal, its first, located at the Dongjiakou Port in Shandong Province. Phase I of the project has a design capacity of 3mn t/y and construction is expected to finish by 2014. The main source of LNG supplies for the Qingdao LNG terminal is from PNG LNG and APLNG under Sinopec’s long-term sale and purchase agreements.

The Tangshan LNG terminal, under construction at the Caofeidian Port in Tangshan City, Hebei Province, is operated by PetroChina, which owns a 51% interest. Phase I of the project has a designed receiving capacity of 3.5mn t/y and is expected to start operation in early 2014.

The Zhejiang LNG terminal is a greenfield project being developed on the east coast, located in Ningbo Zhejiang Province. Zhejiang LNG is a joint venture between CNOOC and local energy companies. The project received approval from the National Development and Reform Commission (NDRC) in December 2004 and is expected to start operation in 2013. Phase I has a designed regasification capacity of 3mn t/y and berthing facilities capable of receiving the world’s largest Q-Max LNG vessels.

Two projects are under construction on the south coast. The Zhuhai LNG terminal is located in Zhuhai City in Guangdong Province. This is CNOOC’s fourth LNG terminal. Phase I of the project is designed with a receiving capacity of 3.5mn t/y and is expected to become operational by the end of 2013. The first phase of the project includes construction of three LNG storage tanks, a wharf and 291 km of pipeline, with a total investment of $1.7bn.

The Hainan LNG terminal is located at the Yangpu Economic Development Zone in Hainan Province and is jointly owned by CNOOC and the Hainan Development Holding Company. The project received NDRC approval in July 2011. Once completed, the terminal will have a regasification capacity of 2mn t/y and berth facilities capable of receiving Q-Max LNG vessels. The project is expected to start operation by 2015, with further expansion of 1mn t/y of regasification capacity in Phase II.

Planned projects

Several LNG terminal projects are in various stages of planning in China (10):

- Yancheng LNG – 2.6mn t/y FLNG terminal at Binhai Port, Yancheng City in Jiangsu Province, proposed by CNOOC and the municipal government of Yancheng. As of July 2011, the project had completed a feasibility study and was targeted to launch production by 2013.

- Jieyang LNG – 2mn t/y, wholly owned by CNOOC, located in Huilai, Jieyang City in Guangdong Province. The terminal is planned to be brought online by 2015.

- Guangxi LNG – 3mn t/y, owned by Sinopec, is located in the Beihai city of Guangxi Autonomous Region. The terminal aims to start production by the end of 2015. The main source of LNG supply will be Sinopec’s SPAs with Papua New Guinea LNG (PNG LNG) and Australian Pacific LNG (APLNG), both of which could be diverted from Sinopec’s Qingdao LNG terminal.

The challenge

Is the future bright? Behind the projects listed above is a long line of planned LNG terminal projects which have stalled. The demand is there, clearly – the issue is a lack of global supply. China has been investing heavily in LNG projects, with CNOOC, PetroChina and Sinopec all having taken stakes in global established gas projects. For example, Sinopec has secured a total of 6.3mn t/y of long-term supplies through agreements with APLNG and PNG LNG. (11) However, these projects are just not delivering at the level China requires. In a recent report, consulting firm Research and Markets predicts that the ‘LNG glut’ will dissipate from 2012, with Asia-led demand exceeding supply by 75mn tonnes by 2020. (12) Due to this lack of progress in securing upstream supplies from overseas, most of the LNG terminal projects still in the early planning stages have been shelved.

However, in a sense the problem is not so much lack of supply, but too much demand. And in this global economic climate that’s surely a nice problem to have.

References

1. China’s 12th Five-Year Plan: Energy. KPMG. April 2011.

2.‘PetroChina to develop Canadian LNG’. China Daily, 17 May 2012. www.china.org.cn.

3. ‘LNG Terminals in China and related developments’. Hydrocarbon Asia, January – March 2012. www.safan.com.

4. Ibid.

5. Event brief – 4th Annual China LNG Technology and development Summit, 13-14 October 2011, Shanghai, China. www.noppen.com.cn.

6. ‘Thirsty China opens huge LNG terminal’. The Guardian, 28 June 2006. www.guardian.co.uk.

7. ‘Shanghai LNG Project, China’.www.hydrocarbons-technology.com.

8. LNG Processing and Storage. Kunlun Energy Company.

9. ‘The future of natural gas, Coming soon to a terminal near you. Shale gas should make the world a cleaner, safer place’. 6 August 2011. www.economist.com.

10. Ibid ref 3.

11. Ibid ref 3.

12. ‘A tale of two gas markets’. 23 May 2012. www.global.com http://tinyurl.com/bodc3wf.

For more information, please contact Connie Chen, Special Counsel, on +61 (0)2 9320 4616 or connie.chen@hfw.com, or your usual HFW contact.