CORSIA eligible emission units and an airline’s offsetting obligations

The First Phase of CORSIA will require aircraft operators to surrender CORSIA eligible emission units. Unlike the pilot phase, the units for the First Phase will only be eligible where the host country from which the credits are generated carries out a corresponding adjustment of the emissions balance which it has reported pursuant to its obligations under the Paris Agreement. This introduces additional complexity because the eligibility of units now depends on subsequent action by the host country.

If a host country fails to make the necessary adjustment, who bears the risk of non-compliance and shall compensate the emissions? The aircraft operator that used the unit towards its CORSIA obligation or the carbon standard that issues the units? The technical advisory body for CORSIA, in the first instance, has placed that onus on the carbon standard.

Introduction

The International Civil Aviation Organization (ICAO) introduced the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) with the intention that aircraft operators monitor their greenhouse gas emissions and offset excess emissions arising from covered aviation activity. The first phase of CORSIA (2024 to 2026) (the First Phase) has started, following the pilot phase (2021 to 2023). The First Phase remains voluntary but once an ICAO State commits to participate in the First Phase, compliance becomes compulsory for the aircraft operators1 for which that State is the responsible authority. 126 States have voluntarily committed to the First Phase of CORSIA. Notable non-participating States in the First Phase include China, Russia, India, Brazil. Only flights between participating States are caught by CORSIA. Participation in CORSIA becomes mandatory for all States in the second phase (2027 to 2035).

Aircraft operators with First Phase compliance obligations are actively looking at how they achieve this. CORSIA allows aircraft operators to meet their compliance obligations using CORSIA Eligible Emissions Units(CEEUs). This client alert is one of a series on CORSIA with a focus on CEEUs , looking at clarifying the difference between CEEUs and other types of emission units.

What are CORSIA Eligible Emissions Units?

CEEUs are those units described in the ICAO document entitled “CORSIA Eligible Emissions Units”, which meet the CORSIA Emissions Unit Eligibility Criteria (EUC) contained in the ICAO document entitled “CORSIA Emissions Unit Eligibility Criteria”.2

u003ch2 class=u0022wp-block-headingu0022u003eu003cstrongu003eCriteria for a First Phase CEEUu003c/strongu003eu003c/h2u003ernu003culu003ern tu003cliu003ePart of an Eligible Programmeu003c/liu003ern tu003cliu003essued by a Programme-Designated Registryu003c/liu003ern tu003cliu003eSatisfies certainrnEligibility Criteriau003c/liu003ernu003c/ulu003ernAs per the ICAO document “CORSIA Eligible Emissions Units”, includes:rnu003cul style=u0022list-style-type: square;u0022u003ern tu003cliu003eVintage (start and endrndate of project activity)u003c/liu003ern tu003cliu003eUnit Typeu003c/liu003ern tu003cliu003eSectoral/Methodological Requirementsu003c/liu003ern tu003cliu003eAdditional co-benefit requirementsu003c/liu003ern tu003cliu003eAttestation to the avoidance of double-claiming (see belowu003c/liu003ernu003c/ulu003e

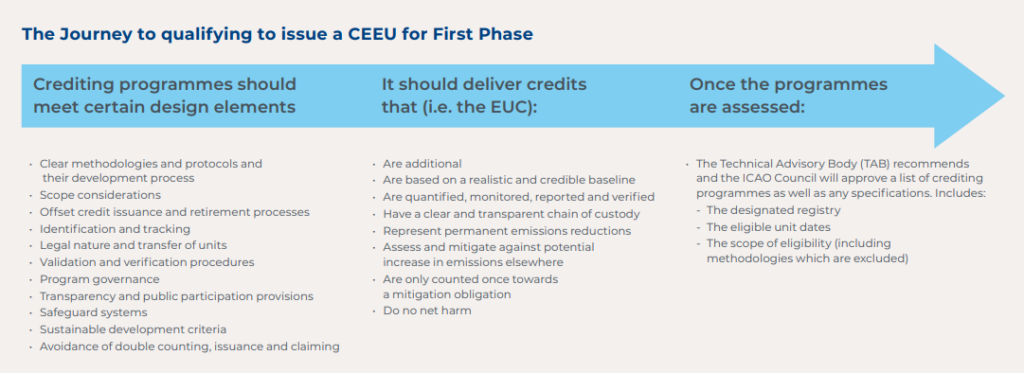

Process to supply CEEUs and be an Eligible Emissions Unit Programme

To be approved by the ICAO Council, a crediting programme needs to apply to and be assessed by the Technical Advisory Body (TAB). The assessment is based on the EUC and is undertaken at the programme level and at the emission unit level. The eligible offset credit programme shall meet programme design elements and shall deliver units complying with the ‘carbon offset credit integrity assessment criteria’.

TAB has also provided guidance on how they interpret each criterion of this process and clarifications of the criteria interpretation contained in the various TAB reports.

For the First Phase, as of 15 June 2024, the ICAO Council has only approved two voluntary crediting programmes, with the following specifications (please see fig. 2).3

This means that, for now, only these units are CEEUs for the purposes of the First Phase.

Unit Dates |

Scope of Eligibility |

|

| > American Carbon Registry (ACR) |

Activities that started their first crediting period from 1 January 2016 and in respect of emissions reductions that occurred from 1 January 2021 through 31 December 2026 |

ACR Emission Reduction Tonnes (ERTs), including any additional certifications, and with the exclusion of the following activity and/or unit types, methodologies, programme elements, and/or procedural classes: |

| Architecture for REDD+ Transactions (ART) |

Activities that started their first crediting period from 1 January 2016 and in respect of emissions reductions that occurred from 1 January 2021 through 31 December 2026 |

ART credits, including any additional certifications, and with the exclusion of the following activity and/or unit types, methodologies, programme elements, and/or procedural classes: ART credits issued in respect of emissions reductions that occurred from 1 January 2021 onward and that have not been authorized by the host country for use in CORSIA by way of an attestation to the avoidance of double-claiming. |

Other crediting programmes are in the process of applying for full approval

A number of other standards were given conditional approval4 namely the Verified Carbon Standard, Gold Standard and Climate Action Reserve. These standards were part of the eleven programmes approved for the pilot phase of CORSIA. One of the main reasons why these standards were only given conditional approval was that additional actions needed to be taken by each of these crediting programmes in relation to the “Only counted once towards a mitigation obligation” criterion under the EUC.

As a general principle, TAB made it clear in their January 2024 report that as part of the “Only counted once towards a mitigation obligation” criterion, they will exclude any units issued in respect of emissions reductions or removals that occurred from 1 January 2021 onward and that have not been authorised by the host country for use in CORSIA by way of an attestation to the avoidance of double-claiming.5

Corresponding adjustments as a tool adopted by TAB to avoid double-claiming

It is worth recognising that the Convention on International Civil Aviation6 (which established ICAO and, in turn, led to the assembly resolution establishing CORSIA) and the Paris Agreement7 are separate international legal treaties. The scope of CORSIA is to deal with GHG emissions8 that occur from aviation activity in the international airspace. Unlike the Paris Agreement, where countries have to account for their domestic GHG emissions (including domestic aviation activities), CORSIA holds aircraft operators to account for those GHG emissions that fall outside of the Paris Agreement.

The scope of CORSIA is to deal with GHG emissions8 that occur from aviation activity in the international airspace. Unlike the Paris Agreement, where countries have to account

for their domestic GHG emissions (including domestic aviation activities), CORSIA holds aircraft operators to account for those GHG emissions that fall outside of the Paris Agreement.

However, CORSIA CEEUs are sourced from GHG abatement activity occurring within countries that are part of the Paris Agreement.

So the activity representing the GHG abatement in the host country for that activity is reflected in the GHG inventory reported for that country under the Paris Agreement. CEEUs are essentially, an export of a GHG mitigation outcome that is subject to GHG inventory accounting with the Paris Agreement, to the CORSIA framework.

It does not necessarily mean that the mitigation outcome represented by the CEEU is being counted by the host country towards its Paris Agreement commitments via its nationally determined contributions (NDC). This will depend on whether the abatement activity is occurring inside the host country’s NDC or outside its NDC. Logically, where the activity is not inside the host country’s NDC, there is no question of double counting or double claiming of that CEEU. However, where the activity is inside the host country’s NDC, there is a possibility that the host country will count that abatement towards in NDC. Therefore, the CEEU could be double claimed, once by the host country towards its NDC and also by the aircraft operator towards its CORSIA compliance obligations for the First Phase. Because CORSIA and the Paris Agreement are separate treaties and accounting ledgers, there is technically no double counting but arguably, there may be double claiming.

Paragraph |

Extract |

|

| Host country attestation to prevent double claiming towards its NDCs under the Paris Agreement (the Host Country Attestation) | 3.7.8 |

Only emissions units originating in countries that have attested to their intention to properly account for the use of the units toward offsetting obligations under the CORSIA… should be eligible for use in the CORSIA. The programme should obtain, or require activity proponents to obtain and provide to the programme, written attestation from the host country’s national focal point or focal point’s designee. The attestation should specify, and describe any steps taken, to prevent mitigation associated with units used by operators under CORSIA from also being claimed toward a host country’s national mitigation target(s) / pledge(s). Host country attestations should be obtained and made publicly available prior to the use of units from the host country in the CORSIA. |

| Reconciliation Mechanism where double-claiming occurs | 3.7.13 |

The programme should have procedures in place for the programme, or proponents of the activities it supports, to compensate for, replace, or otherwise reconcile double-claimed mitigation associated with units used under the CORSIA which the host country’s national accounting focal point or designee otherwise attested to its intention to not double-claim. |

This concern about double claiming has been reflected by TAB through its requirement that the CEEU should “Only be counted once towards a mitigation obligation”. In order to address this, TAB’s guidelines state as follows in the table above (fig. 3)9

In determining how to deal with the double claiming concern, TAB considered three possible approaches. The approach that it landed on was to ensure that CEEUs were appropriately accounted for by the host country when claiming achievement of its target(s) / pledges(s) / mitigation contributions / mitigation commitments, in line with the relevant and applicable international provisions.

In the absence of any other available tools to ensure conformity with international provisions to avoid double claiming, TAB adopted the use of corresponding adjustments. This is the tool used under Article 6 of the Paris Agreement for avoiding double counting. In other words, TAB sought to ensure that CEEUs would be issued together with a commitment by the host country to carry out an adjustment to its emissions balance at the time of reporting for the purposes of its NDC (i.e. with a corresponding adjustment).

TAB sought to ensure that CEEUs would be issued together with a commitment by the host country to carry out an adjustment to its emissions balance at the time of reporting for the purposes of its NDC (i.e. with a corresponding adjustment).

The adoption by TAB of the Paris Agreement concept of corresponding adjustment, designed initially to apply to Article 6 units only (i.e. internationally transferred mitigation outcomes (ITMOs) or Article 6.4 Emission reductions (Art 6.4ERs), but transposed to CEEUs, has led to confusion in the market. This is particularly the case since CEEUs need not be issued pursuant to such Article 6 mechanisms. For example, as a result of the guidelines adopted at COP26 for Article 6, a corresponding adjustment has to be carried out by an exporting host country of an ITMO or Art 6.4ER irrespective of whether that unit is from an activity inside its NDC or outside its NDC. As applied by the Article 6 guidelines, a corresponding adjustment is a penalty on the host country even when there is no double claiming (e.g. because the activity is not part of the host country’s NDC). By therefore adopting an Article 6 tool, TAB perpetuates that penalty on the host country even when there is no double claiming between the Paris Agreement and CORSIA.

The other inadvertent confusion created by requiring corresponding adjustments of CEEUs is the assumption that a CEEU generated under a purely voluntary crediting programme (i.e. not under an Article 6 market mechanism) but which benefits from a corresponding adjustment must therefore be an ITMO. It is clear from TAB’s prior treatment of Kyoto Protocol and Article 6 units that their status under the EUC is different from that of a purely voluntary program. For example, the Article 6.4 Mechanism does not have to apply to TAB for consideration in the same way that a purely voluntary crediting programme has to apply.10 However, TAB left open the possibility that other accounting approaches could be accommodated in the future to avoid double-claiming against NDCs.11

To be clear, not all CEEUs are ITMOs – a CEEU need not be an ITMO because ITMOs must satisfy the de-minimis requirements under Article 6 of the Paris Agreement. Similarly, not all ITMOs are CEEUs – each qualifying ITMO must be assessed by TAB separately.

Verified Carbon Standard |

Gold Standard |

Climate Action Reserve |

|

|

|

Measures to be taken by crediting programmes for full eligibility

Against the background of the previous section, in relation to the Verified Carbon Standard, Gold Standard and Climate Action Reserve, TAB required them to take, amongst others, the following actions relating to the “Only counted once towards a mitigation obligation” criterion (fig. 4).12

These crediting programmes and others have submitted material updates to their previously-assessed programmes by the deadline for TAB to consider them and make a recommendation for the 233rd ICAO Council Session (starting in mid-September 2024).13 TAB will consider the crediting programmes’ submissions to ascertain if all requirements have been adequately addressed so as to make them fully eligible under the First Phase. However, even once these crediting programmes meet the TAB’s threshold, the challenge of obtaining the host country’s commitment to carry out a corresponding adjustment will remain. Many host countries (i.e. the hosts of these projects that are generating CEEUs) do not yet have a framework for issuing letters of authorisation binding them to the obligation to apply a corresponding adjustment. The importance of these frameworks cannot be understated because (i) there is a cost on the host country associated with granting a corresponding adjustment,14 and (ii) there is liability on the crediting programmes to the ICAO Council that follows if the host country fails to carry out a corresponding adjustment.

Are there other potential programmes?

Lastly, and for completeness, it should also be noted that the CORSIA SARP recognises the potential for other mechanisms to be included. More specifically, it provides that “[t]he emission units generated from mechanisms established under the UNFCCC and the Paris Agreement are eligible for use in CORSIA, provided that they align with decisions by the Council with the technical contribution of CAEP, including on avoiding double counting and on eligible vintage and timeframe.”15 This statement highlights the elevated status given to the Article 6 mechanisms over the voluntary crediting programmes.

The delay in the approval of the voluntary crediting programmes with the highest historical supply and the challenges of obtaining host country letters of authorisation are likely to lead to bottlenecks for supply of CEEUs for the First Phase. We discuss this in more detail in a separate client alert but ultimately, this has a knock-on effect on price of CEEUs and other decision points for an aircraft operator.

How to Comply with CORSIA Offsetting Obligations

How does an aircraft operator comply with its offsetting obligations for the First Phase of CORSIA?

- First, an aircraft operator will need to comply with its monitoring, reporting and verification obligations, including submitting its CO2 emissions monitoring plan and its annual CO2 emissions report by the requisite deadlines.16

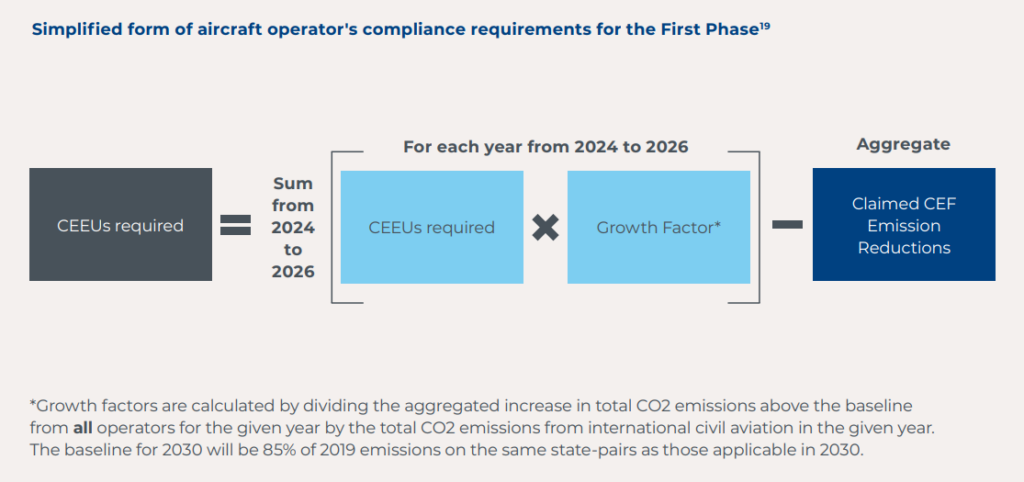

- Second, aircraft operators will be notified by their State of their offsetting requirements for each emissions year by 30 November of the following year (e.g., the State is required to inform the aircraft operator of the offsetting requirements for 2024 by 30 November 2025). The State will calculate annual offsetting requirements for each operator by multiplying the operator’s CO2 emissions covered by CORSIA offsetting obligations with a growth factor.

- Third, the State is required to calculate the total final offsetting requirements for the First Phase and inform aircraft operators of this as part of the State’s notification of offsetting requirements for 2026, i.e. by 30 November 2027.17

- Then, where the total final offsetting requirement is higher than 3,000 tonnes of CO2,18 aircraft operators are required to purchase and cancel an equivalent number of CEEUs by 31 January 2028 or 60 days after the State informs the aircraft operators of their total final offsetting requirements for the First Phase (whichever is later) (the Offsetting Deadline).

- However, an aircraft operator is not prohibited from cancelling CEEUs earlier, including on an annual basis, e.g., based on the offsetting requirements notified to them for each emissions year.

TAB has provided in the TAB Jan 2024 Report that programme-designated registry labels or categories used to identify CEEUs should:20

“(a) Be applied at the emissions unit level (i.e., not, or not only, at the activity level);

(b) Clearly distinguish CORSIA-eligible units from those that are not CORSIA-eligible, as well as the applicable Eligibility Timeframe(s), i.e., the CORSIA compliance period(s) for which each unit is eligible; and,

(c) Be consistent with the programme-specific section of the ICAO Document CORSIA Eligible Emissions Units for the relevant CORSIA compliance period.”

Therefore, an aircraft operator should be able to procure CEEUs which are expressly identified and labelled as being eligible for the First Phase by the crediting programme’s registry. The registry’s representative21 is required to ensure that these CEEUs can be identified and to enable the public identification of cancelled units that are used towards CORSIA requirements. As discussed above, the ICAO Council has required the crediting programme (not the aircraft operator) to have certain measures in place in relation to the eligibility of both the crediting programme and the emission units before they are considered CEEUs. In particular, the ICAO Council has required a crediting programme to “have procedures in place for the programme, or the proponents of the activities it supports, to compensate for, replace, or otherwise reconcile double-claimed mitigation associated with units used under the CORSIA which the host country’s national accounting focal point or designee otherwise attested to its intention to not double-claim“.22 It is also telling that TAB had expressly stated in the TAB Jan 2024 Report that requiring an aircraft operator to fully compensate in such a scenario would “leave the affected [Aircraft] Operator liable for replacing units that it had purchased and cancelled in good faith.”23 In other words, based on the ICAO forms and guidance, the ICAO Council’s view appears to be that the onus in relation to the aircraft operator is to surrender CEEUs while the onus of identifying the eligibility of an emission unit as a CEEU is placed with the crediting programme.

Once the requisite number of First Phase-eligible CEEUs are procured, an aircraft operator will have to cancel such CEEUs with the crediting programme registry or registries by the Offsetting Deadline.

What happens if an aircraft operator fails to comply with its offsetting obligations under CORSIA?

Under CORSIA, the sanctions and penalties for any failure to cancel CEEUs by the Offsetting Deadline is left to each individual State.24

For instance, in the UK, The Air Navigation (Carbon Offsetting and Reduction Scheme for International Aviation) Order 202125 provides for reporting and verification obligations in line with CORSIA and offsetting obligations for 2021 emissions. However, a further air navigation order will set out the rest of the offsetting obligations (including for First Phase) and its interaction with the UK’s Emissions Trading Scheme.26 This was intended to be in place by the start of 2024.27 Unless specific penalties are stated pursuant to this further air navigation order, then the UK Environment Agency’s general enforcement and sanctions policy will apply.28

Nonetheless, many First Phase participating states have not yet fully implemented the offsetting elements of the CORSIA SARP into their domestic laws and consequently have not specified the penalties for an aircraft operator’s failure to comply. This is leading to uncertainty for many aircraft operators as to what their actual liability for non-compliance with CORSIA is.29 This, in turn, makes assessment of their costs of complying with their obligations hard to compare as against the cost of non-compliance.30 States may seek to align CORSIA with their domestic legal landscape and policy goals to reduce emissions – this may entail them taking a more prescriptive approach and tying the failure to surrender CEEUs to the price of a cap-and-trade unit or allowance in their jurisdiction or the per ton price under their carbon tax.

Conclusion

CEEUs are a key part of CORSIA, and as we have highlighted above, there remain uncertainties relating to (i) supply of CEEUs for the First Phase, and (ii) what an aircraft operator’s actual liability for non-compliance with CORSIA is. In the next in this series of briefings we will discuss how an aircraft operator’s decisions could be affected by issues relating to CEEUs and CORSIA Eligible Fuels, and how they may interact with each other. Aircraft operators do need to be aware of these uncertainties but should take comfort in the fact that future developments could address or mitigate some of these issues.

Download a PDF version of ‘CORSIA eligible emission units and an airline’s offsetting obligations’.

Footnotes

1. Defined as ‘aeroplane operator’ in Annex 16, Environmental Protection, Volume IV, Appendix [CORSIA SARP]

2. See CORSIA SARP, Part II, para 4.2.1.

3. See “ICAO document: CORSIA Eligible Emissions Units” (March 2024): https://www.icao.int/environmental-protection/CORSIA/Documents/CORSIA%20Eligible%20

Emissions%20Units/CORSIA%20Eligible%20Emissions%20Units_March%202024.pdf

4. As recommended by TAB in its January 2024 report, subject to certain matters being addressed to the ICAO Council’s satisfaction, See the TAB’s report dated 29 January 2024: https://www.icao.int/environmental-protection/CORSIA/Documents/TAB/TAB2023/TAB%20recommendations_2023_2/TAB%20report_Jan2024_en.pdf [TAB Jan 2024 Report].

5. TAB Jan 2024 Report at para 4.1.4.

6. Chicago Convention on International Civil Aviation (1994) 15 U.N.T.S. 295.

7. Paris Agreement to the United Nations Framework Convention on Climate Change, Dec. 12, 2015, T.I.A.S. No. 16-1104.

8. For CORSIA, this is limited to CO2.

9. See Application Form Appendix A – Supplementary Information at para 3.7.8 and para 3.7.13 [emphasis added]. Do note that there are other elements but we have extracted on the two below for the purposes of this client alert.

10. This is discussed in more detail below.

11. See para 6.4.6 (relating to Approach 3) and para 6.4.11 of TAB Report – September 2022 in Approach 3 in the TAB March 2024 Clarifications.

12. For the avoidance of doubt, there are others, but we have extracted those which are relevant to the points that we have flagged in the preceding paragraphs of this client alert. Emphasis included in original.

13. For the programmes that have submitted updates, see https://www.icao.int/environmental-protection/CORSIA/Pages/TAB.aspx. For the TAB’s 2024 Work Programme, see https://www.icao.int/environmental-protection/CORSIA/Documents/TAB/TAB2024/2024workprogramme.pdf.

14. See e.g., the global change analysis model which considers the marginal cost and the associated opportunity cost associated with granting a corresponding adjustment in The World Bank, “Corresponding Adjustment and Pricing of Mitigation Outcomes” (2023) World Bank Working Paper, Washington DC (Corresponding Adjustment and Pricing of Mitigation Outcomes | Public Private Partnership (worldbank.org):

“When the host country transfers authorized emission reduction credits1 or internationally transferred mitigation outcomes (ITMOs), Corresponding Adjustment creates an

obligation and the associated liability for the host country – i.e., the host country has to increase its NDC burden by the volume transferred. Without informed decisions,

countries may oversell and end up having to implement more expensive mitigation activities to meet their NDCs. This potential liability to the host country is linked to the

marginal cost and the associated opportunity cost of meeting the NDC.”

15. See CORSIA SARP, Part II, para 4.2.1 Note.

16. The administrative requirements can be delegated to a third party (other than its verification body): see CORSIA SARP, para 1.1.5. We have not covered monitoring, submissions and verifications in detail for the purposes of this client alert and note that there are various tools that can be used, e.g., CORSIA ICAO CO2 Estimation and Reporting Tool (CERT) to support the monitoring and reporting of CO2 emissions. Do also note that there are competing regimes for monitoring, submission of reports etc. under CORSIA and other regulatory schemes such as the UK ETS.

17. See Appendix 1 of CORSIA SARP.

18. Note that if the aircraft operator’s total offsetting requirement is less than 3,000 tonnes of CO2, then they do not have any offsetting requirements under CORSIA for the compliance period (see CORSIA SARP, Part II, Chapter 3, para 3.4.2).

19. Some notes: (i) the split between the individual component and sectoral component applies from 2033 to 2035 and thus does not apply for First Phase, and (ii) there are various factors to covered routes, e.g., state-pairs subject to offsetting requirements.

20. See TAB Jan 2024 Report at para 4.4.5.

21. See section 7.3 of the Emissions Unit Programme Registry Attestation: “identify / label its CORSIA eligible emissions units as defined in the ICAO Document ‘CORSIA Eligible Emissions Units”.

22. See Application Form, Appendix A – Supplementary Information at para 3.7.8.

23. See TAB Jan 2024 Report at para 4.4.13.

24. See Assembly Resolution A41-22, paragraph 19 f), States are ” to take the necessary action to ensure that national policies and regulatory frameworks are established for the compliance and enforcement of the CORSIA, in accordance with the timeline set forth by Annex 16, Volume IV” (https://www.icao.int/environmental-protection/CORSIA/Documents/Resolution_A41-22_CORSIA.pdf). There is no express timeline set-out for the incorporation of CORSIA SARP into national legislation.

25. https://www.legislation.gov.uk/uksi/2021/534 (as amended) [the 2021 Order]. This was amended by The Air Navigation (Carbon Offsetting and Reduction Scheme for International Aviation) (Amendment) Order 2022 [the 2022 Amendment Order]. The 2021 Order (as amended) only deals with CORSIA’s offsetting requirements for the 2021 scheme in the UK.

26. See e.g., https://www.gov.uk/guidance/corsia-how-to-comply; see also the Explanatory Memorandum for the 2022 Amendment Order (https://www.legislation.gov.uk/uksi/2022/1050/pdfs/uksiem_20221050_en.pdf): “Further secondary legislation to amend the UK’s civil aviation emissions legislation will be required to implement CORSIA’s offsetting requirements for the full duration of the scheme and clarify any interaction between the CORSIA and the UK Emissions Trading Scheme (UK ETS). The Government aims to have this legislation in force by 2024.”

27. See the Explanatory Memorandum for the 2022 Amendment Order.

28. See Article 52(1) of the 2021 Order; https://www.gov.uk/guidance/corsia-how-to-comply; https://www.gov.uk/government/publications/environment-agency-enforcement-and-sanctions-policy. The revised draft policy that specifically refers to the 2021 Order is under consultation but presently provides that the Environment Agency will issue an enforcement notice under Article 52(1) of the 2021 Order and penalties for which are pursuant to Article 60 of the 2021 Order where there are no specific penalties. The consultation (https://www.gov.uk/government/consultations/enforcement-and-sanctions-policy-updates-to-include-uk-ets-and-corsia) was opened on 21 May 2024 and closes on 16 July 2024.

29. See e.g., United Airlines, “Annual Report on Form 10-K for Year Ended December 31, 2023” at page 15: https://www.sec.gov/ix?doc=/Archives/edgar/data/100517/000010051724000027/ual-20231231.htm.

30. See e.g., American Airlines, “2023 Annual Report on Form 10-K” at page 19: https://www.sec.gov/Archives/edgar/data/6201/000119312524114062/d636721dars.pdf.