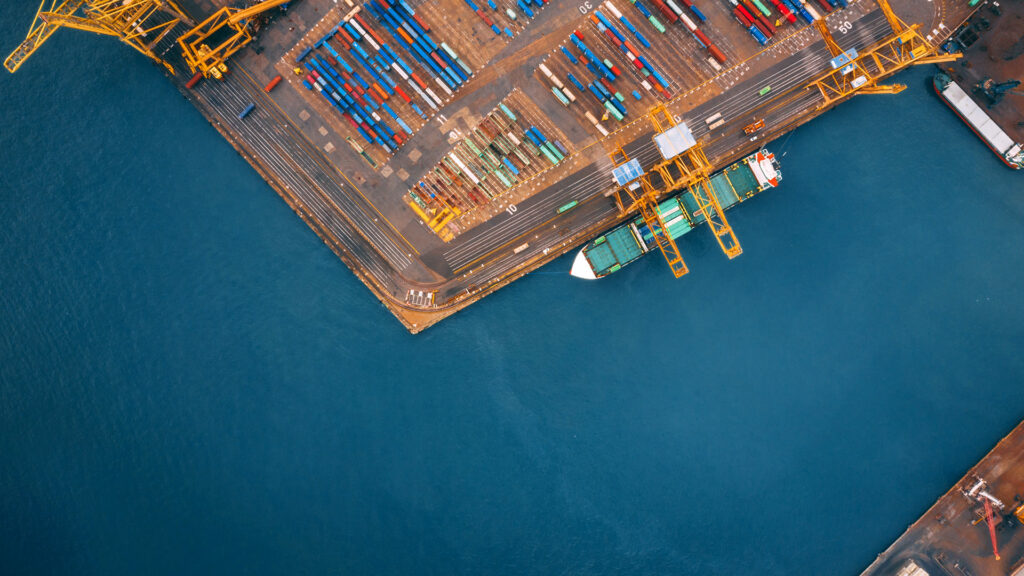

Qingdao: judgment in Mercuria v Citigroup in London’s Commercial Court, May 2015 (Chinese)

This afternoon (Friday, May 5), the London Commercial Court handed down its long-awaited first phase judgment in the Mercuria v Citigroup lawsuit.

background

The dispute involved Mercuria’s purchase of $2 million worth of metals from Techeng Resources. The metal was stored in a warehouse in Qingdao and sold to Citigroup on a “buy-back” basis (i.e., the intention was to allow Citigroup to sell the same or equivalent metal back to Mercuria at a later time). At the end of May 7, it was discovered that some of the above-mentioned metals may no longer exist or have been pledged several times. For the purposes of this trial, the parties agree that Citigroup owns and assumes the risks associated with the metal at the time of discovery. Citigroup also acknowledges that, pursuant to the contract documents, Citigroup warrants good title and possession of the metals to be sold to Mercuria on the date of each resale.

On June 2014, 6, Citigroup issued advance notice to exercise its contractual right to advance the sale date of all metals to the next banking day. On July 9, 2014, Mercuria announced the termination of the contract by giving notice in its sole discretion, which, once effective, would require Citigroup to deliver the equivalent metal to Mercuria before Mercuria is obligated to pay the price. On July 7, 11, Citigroup provided a blank endorsed warehouse receipt issued to Citigroup with the apparent intention of delivering the metal to Mercuria, but Citigroup did not issue a release order to the warehouse operator, who did not issue its own release confirmation or a new warehouse receipt with Mercuria as the consignee to identify the new owner.

The legal proceedings brought by Mercuria are designed to determine: whether Citigroup’s notice is valid; whether Mercuria’s notice of the termination event is valid; And ultimately, whether Mercuria is contractually obligated to pay Citigroup $2 million, although no one knows whether the metal is stored in warehouses in Qingdao, which remain closed.

Sixth transaction

One of the issues at issue was the status of the “sixth transaction” – i.e. the resale transaction due to be performed on 2014 June 6 – at which point the parties had become aware of the alleged fraud but had not yet given advance notice or notice of the termination event. Citigroup invoiced Mercuria for the transaction, and Mercuria paid but retained its rights. The day after the payment, Citigroup delivered a warehouse receipt for the metal to Mercuria, endorsed by Mercuria. Mercuria requested delivery of the metal, but the warehouse operator claimed that it had no access to the warehouse and therefore could not obtain the goods. To date, Mercuria has not been able to obtain confirmation from the warehouse operator as the owner of the metal. For the remaining 3 transactions, neither Mercuria nor Citigroup attempted to get warehouse operators to identify new owners of the metals.

Delivery under English law

At the time of the case, Citigroup acknowledged that, even if its advance notice was effective and Citigroup was entitled to full payment prior to delivery to Mercuria, if Citigroup was subsequently unable to properly deliver the metal, Mercuria would be entitled to repayment of the purchase price. Therefore, Mercuria has the defense of “circular action”. This means that Citigroup is under no obligation to pay Citigroup unless Citigroup can demonstrate that it can deliver properly, notwithstanding the terms of the contract.

Under English law, a receipt or warehouse receipt is not a document of entitlement (and therefore completely different from a bill of lading). It has long been customary for a seller to obtain a “new owner approval” or confirmation letter from that third party if the goods are in the possession of a third party. Citigroup argued that although it did not actually deliver to Mercuria, the delivery was “deemed to have occurred” under the terms of its contract with Mercuria. This argument is based on the provision in the confirmation of resale that delivery (by definition) may occur “without any acknowledgment from the owner/operator of the storage facility”. This provision differs from the provision of the confirmation of sale (in the case of a delivery from Mercuria to Citigroup), which does not contain the above wording.

After a comprehensive examination of the confirmation and, in some cases, contradictory, the provisions of the master agreement, the judge ruled that it could not be interpreted as requiring only the delivery of documents and not the delivery of metal. The judge ruled that, although Citigroup assumed the risk and ownership of the metal, it could not perform the delivery, despite the presumptive existence of the metal and Citigroup’s good title to it. The wording in the confirmation relied upon by Citigroup was rejected because it was inconsistent with the overall business intent of the transaction.

transfer

Citigroup’s alternation reason is that, according to the contract documents, Citigroup has the right to transfer its rights to Mercuria to meet the transaction requirements if it “is unable to deliver the metal sold to it by the counterparty”. The judge ruled that Citigroup was not entitled to do so because any failure to deliver the metal would be due to problems on the part of Qingdao and would be a termination event (whereas Citigroup does not allow the transfer of its rights after a termination event).

outcome

The judge’s ruling against Citigroup resulted in Citigroup’s failure to effectively deliver the metal pursuant to a resale agreement known as the “sixth transaction.” If Mercuria had terminated the transaction, it would have claimed a return of the price paid, but because Mercuria had attempted to obtain delivery from the warehouse operator that issued the receipt, it was limited to making a claim for non-delivery (not claiming the price paid).

Mercuria’s argument for advance notice of events is that Citigroup has no reason to believe that the storage facility is no longer safe or satisfactory for storing metals and therefore requires notification. Relying on the views expressed in some internal emails of Citigroup at the time, Mercuria believed that the notice was a means of forcing Mercuria to comply. Finally, the judge distinguished Citigroup’s motive for giving notice from Citigroup’s determination, finding that Citigroup did believe so. The judge also ruled that this understanding was rational and “objectively reasonable”. Based on the foregoing facts, Citigroup’s notice is valid and effective.

Citigroup’s effective advance notice of the event under the terms of the agreement means that Citigroup has a claim to the total price of US$2 million in the metal. However, as Citigroup was unable to deliver the goods properly, it was not entitled to claim the price claimed.

Although Citigroup may not be entitled to payment for the metal at this time, Mocres is repentant of breach of the Master Agreement to which Citigroup has the right (but not yet) to terminate due to the effective notice, and this right has not been forfeited despite events (including litigation) after June 2014.

Real sales?

The judgment mentions in various places that Citigroup claims that it is actually only providing “financing” for Mercuria’s metal inventory. For example, the difference in the repurchase price represents Mercuria’s financing costs (in the form of interest), and the underlying metals are referred to as collateral for such financing. Although the judgment did not rule on the genuine sale (as Citigroup accepted that Citigroup assumed the risk and ownership of the metal in the event of discovery of the alleged fraud), such representations had clear implications for the wider repo market: would such representations still be made if the event giving rise to the lawsuit was not the alleged fraud, but the insolvency of the counterparty? Under English law, contracts must be understood substantively, not just formally, and repurchase transactions with these characteristics are clearly dangerous.

Further Claims

The judgment itself acknowledges that once the timing, nature and scope of any fraud becomes clearer, further litigation is likely to be required to determine whether Mercuria or Citigroup has breached the warranty of good title to the metal. The judgment also states that Citigroup may have a claim under the service agreement entered into on May 2013, 5. Under the agreement, Mercuria is required to meet its metal-related warehousing obligations. There may also be insurance and/or third-party claims. Nothing in the judgment prohibits such claims, whether in the UK or elsewhere, in current or new proceedings.

At that time, if the date on which any fraud occurred can be ascertained, Citigroup may decide whether to accuse Mercuria of failing to give good title to the metal delivered to Citigroup. However, the success or failure of this argument depends on the confirmation of currently unknown facts. Given the lex situ law, the ownership dispute and related conflicts of interest (should such conflicts arise) in this case are governed by Chinese mainland law, and it is clear that although this judgment provides the parties to this case with a certain degree of clarity, it does not give any conclusion to the other parties involved in Qingdao. This suggests that seemingly ordinary arrangements can create difficulties in their actual implementation.

Download a PDF version of ‘Qingdao: judgment in Mercuria v Citigroup in London’s Commercial Court, May 2015 (Chinese)’

-1024x576.jpg)