Business rates Relief for ports

On 14 June 2011, the UK Government published draft guidance on its plans to cancel backdated business rates, with a view to finding a solution to the backdated rates liabilities incurred by businesses as a result of alterations to rating lists proposed in 2008. This resulted in many companies incurring liabilities for significant sums which could not reasonably have been expected or planned for.

In April 2011 we wrote on the issue of who should be liable to pay business rates on ports and harbours. In that article, we reported that in December 2010 the Localism Bill was put before the UK Parliament with the intention of clarifying the position on the liabilities of businesses for backdated business rates.

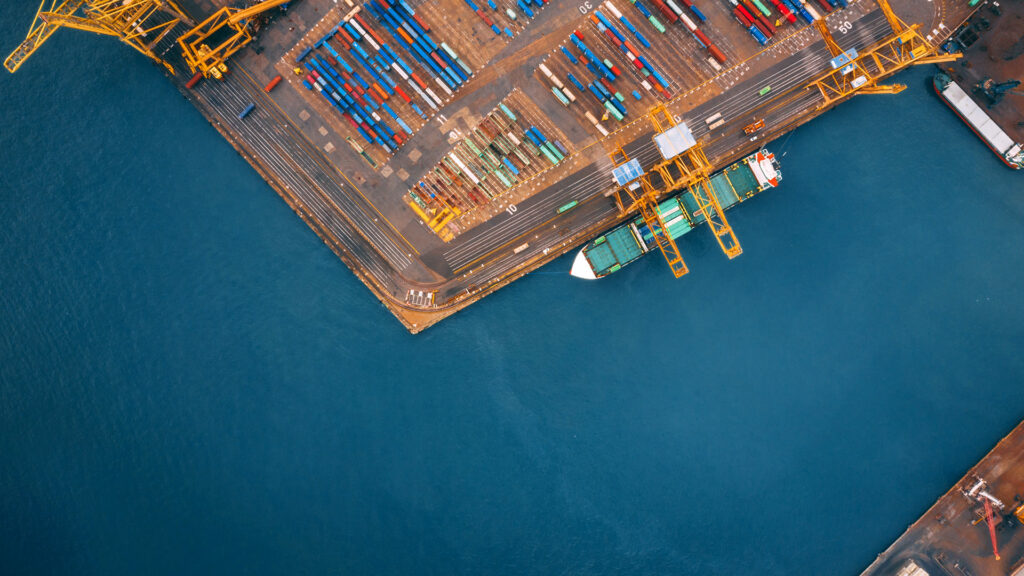

Whilst the proposals will apply to any eligible business in England, this news will come as a particular relief to many port-based businesses, which were the hardest hit by the backdated liabilities.

The purpose of the draft guidance is to give local authorities and interested parties the opportunity to make comments on or ask questions about the process and the draft regulations, to ensure that local authorities will be able to fully implement the cancellation of the backdated rates.

The draft regulations provide for cancellation of backdated business rates in the following circumstances:

- The rateable unit of property (“hereditament”) is a qualifying hereditament, where:

- It has been entered onto the 2005 rating list for the first time as a result of being split from a larger rateable hereditament.

- The newly split hereditament has a backdated liability of 33 months or more. Therefore, for example, the occupier of a property which generates a liability backdated to 1 April 2005 could benefit from the cancellation where the rating list was altered (i.e. the split occurred) on or after 1 January 2008 (and before 31 March 2010).

- The newly split hereditament was split from the existing hereditament before 31 March 2010.

The cancellation does not extend to occupiers who occupied the newly split property prior to the split, as liability for business rates on the newly split property cannot be said to be unexpected or unfair in those circumstances. Therefore, the cancellation will only apply to occupiers who were not liable for business rates prior to the split.

- The hereditament is a qualifying predecessor hereditament, where:

- It is no longer shown on the rating list.

- It was previously shown on the rating list.

- When the hereditament appeared on the list, it formed part of the existing hereditament.

- It satisfies the conditions for a qualifying hereditament (set out above).

If a business benefits from the cancellation, the retrospective rates will either be refunded or offset against future rates liabilities.

The Localism Bill is still before Parliament and it is not yet known when this will receive Royal Assent and enter into force. Nevertheless, the government’s draft guidance and regulations will be welcome news for many ports businesses, some of whom faced insolvency as a result of the excessive and unfair retrospective rates bills. However, there are a number of strict criteria that need to be met in order for a business to benefit from the cancellation so these must be considered carefully in relation to each hereditament.

For more information, please contact Andrew Williams, Associate, on +44 (0)20 7264 8364 or andrew.williams@hfw.com, or Adam Richardson, Associate, on +44 (0)20 7264 8015 or adam.richardson@hfw.com, or your usual contact at HFW.,/p>