Workplace Safety: Penalties Surge Under WHS Act in Western Australia

The changes made to legislation governing work health and safety offences in Western Australia in 2020 provided for dramatically increased penalties, including for individuals and company directors

In this article we use the best currently available data to examine the practical effect of those laws since they’ve been introduced. We also provide an explanation of the penalties under the pre-October 2018 and post-October 2018 Occupational Safety and Health Act 1984 (WA) (OSH Act) and Mines Safety and Inspection Act 1994 (WA) (MSI Act) compared with the current Work Health and Safety Act 2020 (WA) (WHS Act) and the significant penalties that now apply to companies and individuals.

Insurance or indemnity against fines

One significant change between the OSH/MSI Act and the WHS Act, other than the substantial increase in penalties is that insurance against penalties was permitted under the OSH/MSI Act. However, insurance or indemnity against penalties is now unlawful.1

How have the fines changed between the acts?

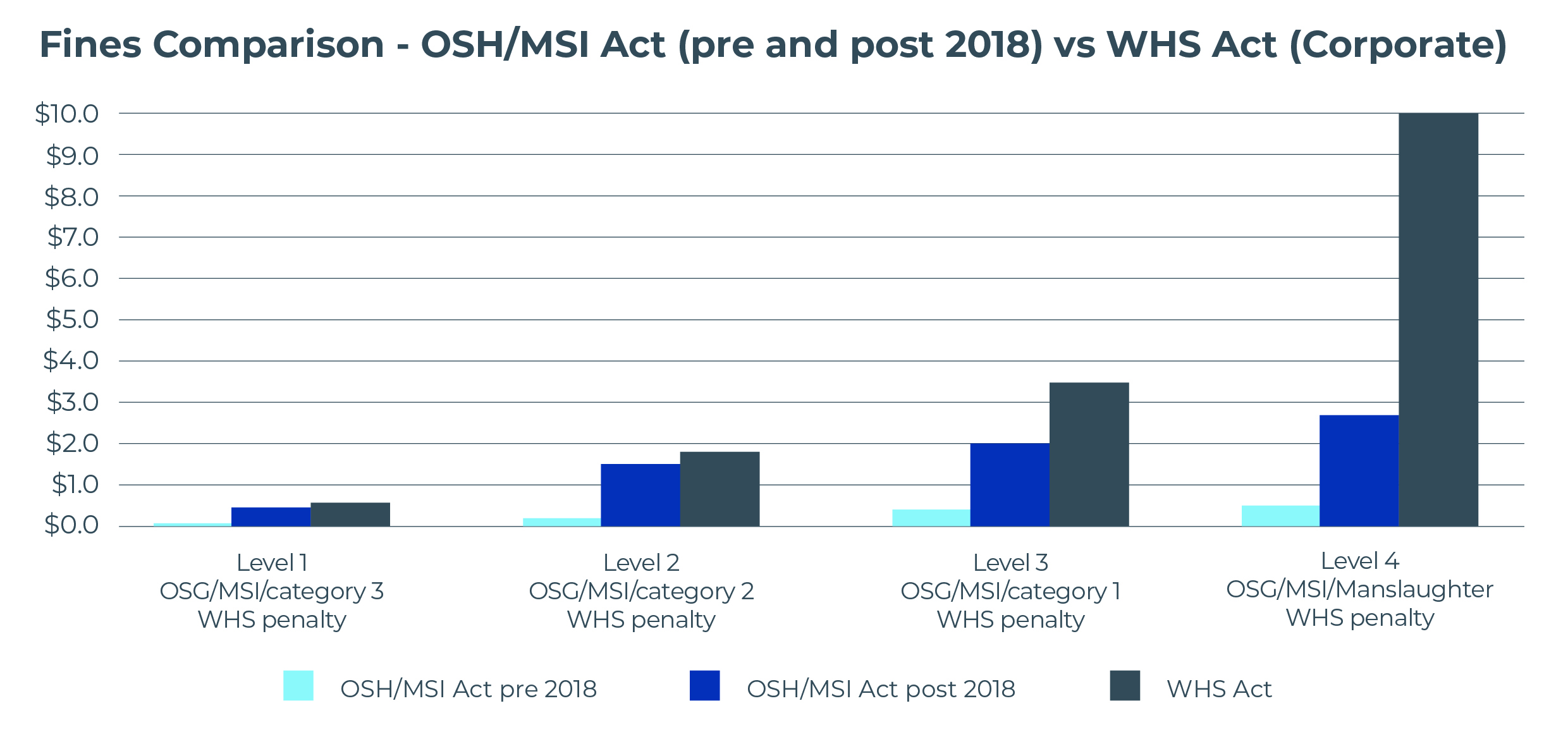

Corporate fines

As demonstrated in the table below, the maximum fine for a level 4 offence (breach of duty causing serious harm or death with the aggravating factor of gross negligence) in the pre–October 2018 OSH and MSI Act was a maximum of $500,000, in the post-October 2018 OSH and MSI Act this penalty increased to a maximum of $2.7 million2, and now the equivalent offence of industrial manslaughter in the WHS Act is a maximum of $10 million3.

“In close to 20 years of practicing in safety law, the expected penalty range for a breach of duty resulting in serious harm or death offence has escalated from $40,000-$70,000 (10%-15% of the maximum penalty, which could be insured against) to $400,000-$800,000 (10%-15% of the maximum penalty which can’t be insured against).” – Simon Billing, HFW Partner.

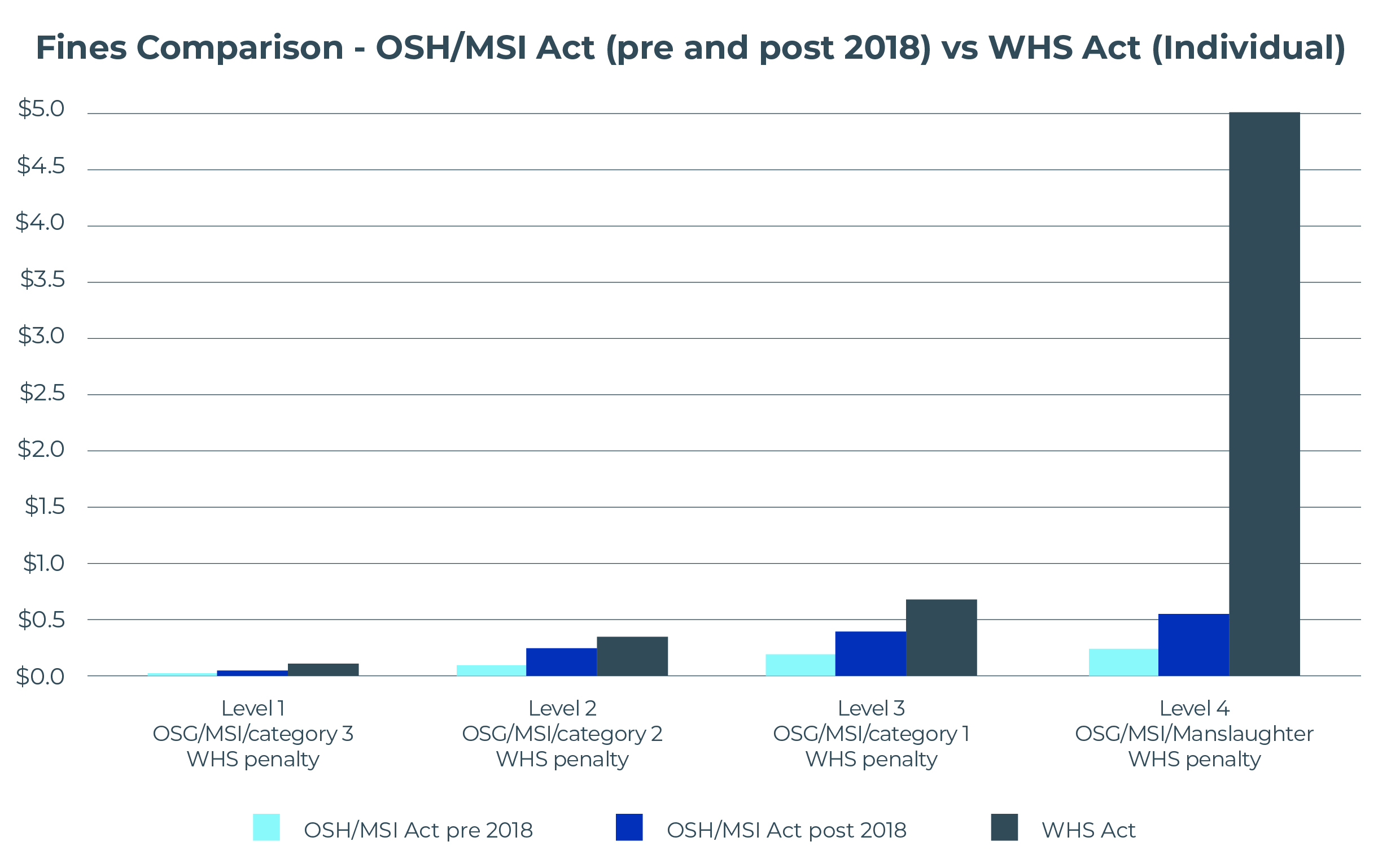

The table below shows that the penalties for individuals have also undergone similar significant increases. Under the pre–October 2018 OSH and MSI Act, the maximum penalty for a level 4 offence for an individual was $250,000, under the post-October 2018 OSH and MSI Act $550,000,4 and under the WSH Act, the maximum fine for an individual is now $5 million,5 an almost a ten-fold increase!

“The increased risk of individual liability is real, particularly for directors and officers under the direct duty of due diligence which is broader and more easily prosecuted (than the previous indirect, attribution offence under the OSH Act and MSI Act due to the mental or intention element that had to be proved), with the company not able to indemnify them against the penalty under D&O or management statutory liability insurance.” – Simon Billing, HFW Partner.

Imprisonment

The scope for a prison sentence has also been dramatically increased. Under the pre–October 2018 OSH and MSI Act, individuals faced a maximum of 2 years imprisonment,6 compared to the post-October-2018 OSH and MSI Act, under which individuals faced a maximum of 5 years imprisonment.7

The WHS Act raises the stakes in this regard, quadrupling the maximum scope for imprisonment to 20 years.8 It is a bold warning that serious breaches of workplace safety now carry penalties on par with other major criminal offences.

“If manslaughter occurs during an aggravated home burglary, the mandatory minimum sentence is 15 years under the WA Criminal Code. If a company director or individual is convicted of industrial manslaughter under the WHS Act, 20 years is the maximum imprisonment sentence available!” – Simon Billing, HFW Partner.

Recent WorkSafe prosecutions

Some recent WA WHS prosecution sentencing outcomes are found in the table below:9

| Company | Fine imposed |

|---|---|

| The State of WA (Department of Justice) | $900,000 |

| W.A.S.S. Nominees (WA Salt) | $875,000 |

| Northern Star Mining Services | $750,000 |

| Monadelphous Engineering Associates | $685,000 |

| Boxline Industries | $600,000 |

| Vivian Plumbing and Civil | $600,000 |

| Swinging Bricklayers | $600,000 |

| Firm Construction | $600,000 |

| HA Hold Co | $595,000 |

| Hofmann Engineering | $567,000 |

| MT Sheds (WA) | $550,000 |

| L. & M. Radiator | $500,000 |

| Charman Australia | $450,000 |

| Alcoa of Australia | $400,000 |

| Lisson Nominees | $400,000 |

| Expressway-Civic | $390,000 |

| Wesbeam | $385,000 |

| K19 Mining | $350,000 |

“Companies are not lawfully able to insure or indemnify themselves against these fines, meaning the financial burden on many businesses is significant, if not quite damaging. However, your defence costs can still be covered by insurance.” – Simon Billing, HFW Partner.

Defending Prosecutions

WorkSafe does not provide online decision summaries of when a prosecution is unsuccessful, so accurate data on unsuccessful prosecutions is not easily accessed. When defending a prosecution, Worksafe is required to prove all elements of the offence beyond all reasonable doubt, that is, to the criminal standard of proof. This is often an onerous burden and is consistent with the presumption of innocence of a person (real or incorporate) who is accused of a crime.

“WorkSafe are not always successful in prosecuting companies alleged to have breached their duty under the WHS Act.

When a reasonable defence is available, requiring Worksafe to prove all elements of a charge to the criminal standard of proof and seeking an acquittal, can avoid both reputational and financial damage to your business. If convicted at trial, the penalty outcome can often be equivalent or lower than through simply pleading guilty and being sentenced, as the Court will have had the benefit of the trial evidence, often showing a thorough and sophisticated approach to safety management where an isolated mistake has resulted in harm or death to a person. Defence costs may also be indemnified by an insurer.” – Simon Billing, HFW Partner.

For advice on how to comply with your WHS obligations and protect your business or individuals from criminal liability in the event that a serious WHS incident occurs, contact the HFW team.

Footnote

- Section 272A of the WHS Act.

- Section 3A(4)(b) of the OSH Act.

- Section 30A(1) of the WHS Act.

- Section 3A(4)(a) of the OSH Act.

- Section 30A(1) of the WHS Act.

- Section 3A(4)(a)(i) of the OSH Act.

- Section 3A(4)(a)(i) of the OSH Act.

- Section 30A(1)(d)(a) of the WHS Act.

- Table includes penalties for breach of duty corporate offences under the post-October 2018 OSH Act and the WHS Act. https://prosecutions.commerce.wa.gov.au/prosecutions/index/page:1/sort:Charge.penalty_imposed/direction:desc; (1 July 2025) https://www.worksafe.wa.gov.au/publications/prosecution-summaries-convictions-under-whs-legislation (1 July 2025).