What Does the Recent Federal Election Mean for the Gas and LNG Markets in Australia – and Why Does It Matter?

Australia held a federal election on 3 May 2025. Shortly after the polls closed, it became clear that the incumbent Prime Minister, Anthony Albanese, and his left-leaning Labor party would be returned to power with a landslide victory against the right-leaning Liberal-National Coalition party.

In this article, we consider the likely significance of this election result for Australia’s gas and LNG industry.

Why does it matter?

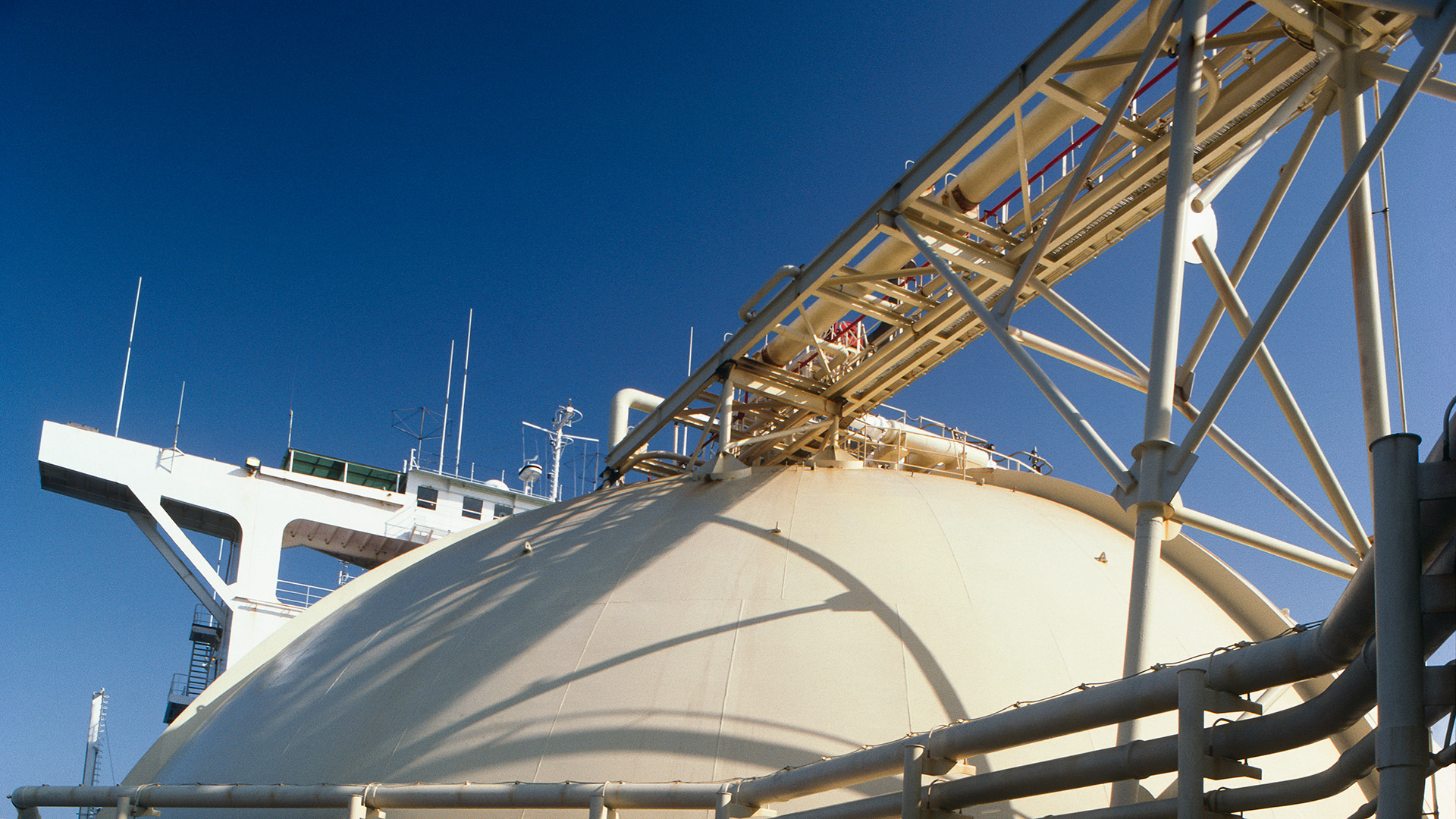

Australia is a globally significant producer of LNG. The IGU 2025 World LNG Report1 confirmed that Australia remained the world’s second largest exporter of LNG in 2024 (88 mtpa), behind the United States (98 mtpa) but in front of Qatar (77 mtpa). The success or otherwise of Australia’s LNG export business is inextricably linked to its domestic gas market and the Government policies which impact that market.

Policies before the 2025 federal election

At recent industry conferences, the CEO of Woodside (Meg O’Neill) and the former Managing Director of Chevron Australia (Mark Hatfield) commented that LNG producers long for stable and supportive policy, supported by an effective and efficient regulatory framework. Those comments were closely followed by observations about the attractiveness of investing in energy projects in the United States (and implicitly, the lack of attraction to making similar investments in Australia).

These perspectives have been supported by a report from Wood Mackenzie in May 20252, commissioned by Australian Energy Producers,3 into global investment trends for natural gas exploration and production, LNG developments, and carbon capture and storage projects. The report concluded that exploration and appraisal expenditure in Australia lags behind peer group countries. This was largely attributed to political and regulatory uncertainty and complex, multi-layered, permit and approval processes which deter investment.

What underlies all this is the Labor Government’s introduction of a number of gas market interventions during its previous term in office (2022-2025). These were covered in previous editions of this bulletin4 and included:

- amendments to the Australian Domestic Gas Security Mechanism, an export control that permits the Government to limit LNG exports or require exporters to source additional gas when domestic shortfalls are identified.

- the introduction of the Mandatory Gas Market Code of Conduct, which implemented a price cap of AUD$12 per GJ for domestic gas sales contracts.

- a requirement that all new gas developments must be net zero from day one, requiring the use of carbon capture and storage or carbon offsets.

The first two of these interventions were aimed at securing affordable domestic gas supply but none of them had the effect of encouraging new supply – and most had the opposite effect. Australia has abundant gas reserves and, as many commentators have pointed out, the best way to achieve energy security and decrease domestic prices is to foster an environment that encourages investment in new projects.

For a period, policies that encouraged new gas supply were seen as antithetical to Australia achieving its net-zero ambitions. However, it was clear that Labor’s attitude to gas was changing with the release of its Future Gas Strategy in 2024. In that policy document, there was an acknowledgement from the Government that “New sources of gas supply [were] needed to meet demand during the economy-wide transition”.

Policies presented during the 2025 federal election

Ahead of the 2025 election, Australian Energy Producers urged the Labor and Coalition Parties to endorse polices that:

- boosted Australia’s gas supply to ease cost of living pressures.

- restored Australia’s global competitiveness for investment.

- delivered real emissions reductions with gas and carbon capture, utilisation, and storage.

- facilitated Australia remaining a reliable energy partner in our region.

The Labor and Coalition parties had very different energy policies heading into the election. However, both had a similar position on the importance of gas to Australia, particularly the role of gas in firming renewables as Australia looks to meet its net-zero ambitions. On this issue, in the context of a question about Woodside’s proposal to extend the North West Shelf gas plant (discussed further below), the Prime Minister commented “You can’t have renewables unless you have firming capacity. Simple as that. You don’t change a transition through, you know, warm thoughts”.

In the month prior to the election, Australia’s Energy Market Operator (AEMO) released the 2025 Gas Statement of Opportunities. In that report, which forecasts the adequacy of gas supplies in Central and Eastern Australia (i.e. everywhere other than Western Australia), AEMO forecast risks of peak day shortfalls from 2028, and a structural supply gap emerging from 2029. This increased the focus on gas supply as an issue. Labor was largely quiet on the topic of how it would increase supply, likely due to the comprehensive Future Gas Strategy and the significant gas market interventions it had implemented in its previous term in office.

The situation following the 2025 federal election

The early signs are that the re-elected Labor Government will follow through in taking a more positive approach to new gas supply.

On the subject of effective and efficient regulatory framework, it has suggested that it will tackle the red and green tape that inhibits the development of new gas projects. At last month’s Australian Energy Producers Conference (the AEPC), the Federal Minister for Resources (the Hon Madeleine King MP) said “I have heard your message that environmental approvals are complex and lengthy. Addressing this issue is a priority of government”. How the Government will do so remains to be seen.

Perhaps more importantly, on 28 May 2025 the Government conditionally approved Woodside’s proposal to extend the life of its North West Shelf gas plant to 2070. This approval was widely viewed as a litmus test for the Government’s sentiment towards gas projects, having remained stuck in limbo for six years, set back by delays and appeals from environmental interest groups. The proposal paves the way for the development of the Browse project, which is expected to backfill the plant once the North West Shelf JV’s own reservoirs deplete. The Browse project is a joint venture between Woodside, BP, MiMi (Mitsubishi Corporation and Mitsui) and PetroChina and the reservoirs underpinning it are vast (Brecknock, Calliance, and Torosa) with contingent resources of 13.9 trillion cubic feet of gas and approximately 390 million barrels of condensate.

2025 has also seen investment by Esso, Mitsui, and Woodside in the Kipper 1B project in the Gippsland Basin; ConocoPhillips receiving approval to drill exploratory wells in the Otway Basin; and new areas opened for gas exploration across the Cooper/Eromanga and Bowen/Surat Basins in Queensland.

Conclusion

LNG producers should take some comfort from these early developments following the federal election. However, while AEMO continues to forecast domestic gas shortfalls, the prospect of further market interventions is never far away. At the AEPC, the Federal Minister for Resources also made this plain, saying “this is my message to you today – a well-supplied domestic gas market at a reasonable price is fundamental to the social licence of this industry to operate”. Whilst signs of support for new supply are hopeful, the prospects for Australia’s LNG export business are likely to remain inextricably linked to the domestic gas market and related Government policy.

Footnote

- 2025 World LNG Report | International Gas Union.

- Woodmac Energy.

- Australia’s peak national body, representing its upstream oil and gas exploration and production industry.

- LNG bulletin July 2024 – HFW, LNG bulletin – HFW