Pushing Privatisation, August 2014

This Article first appeared in the August 2014 issue of Port Strategy and is reproduced with permission. www.portstrategy.com.

Although widely expected since the formation of the current Greek coalition government in June 2012, it was only in March and April of this year that parties were formally invited to submit an expression of interest for the acquisition of a majority stake (67%) in the share capital of Piraeus Port Authority (PPA) and Thessaloniki Port Authority (THPA).

The shares in PPA and THPA are owned, and the tender process for their sale is being conducted, by the Hellenic Republic Asset Development Fund (HRADF), an organisation staffed by ex-bankers and ex-lawyers from private practice, which was established by the Greek government with the primary aim of achieving value for the Greek state by selling a large range of state assets. These sales are part of a wider commitment of the Greek government to balance its books – a key term of its €240bn bailout agreement with the European Union and the International Monetary Fund.

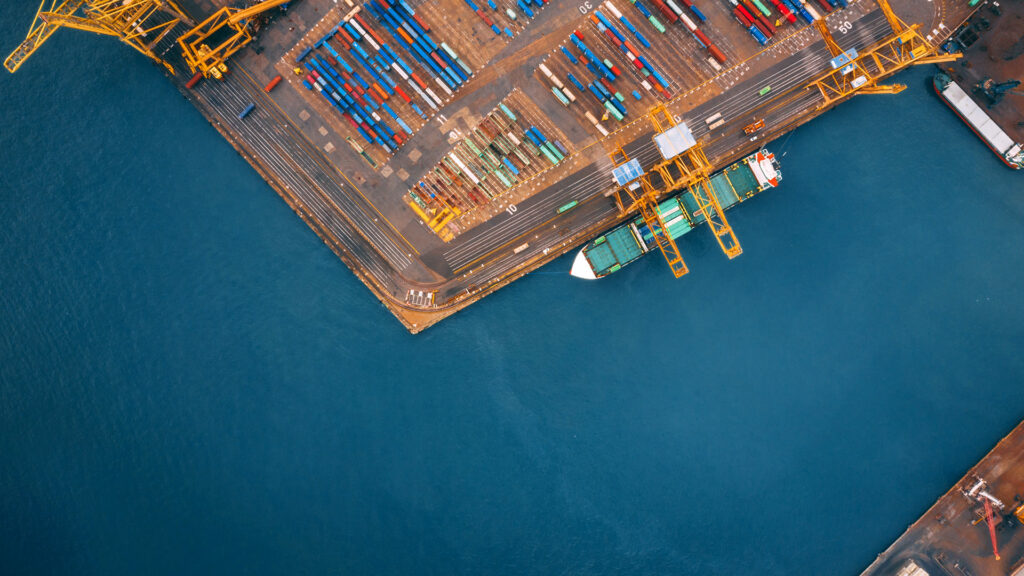

The ports of Piraeus and Thessaloniki are the two largest and busiest ports in Greece, and significant cargo ports in their own right within the Mediterranean generally. PPA recently announced a cargo traffic increase of 15% to 3.1m teu, a number which is likely to increase significantly if the proposed expansion of the container terminal run by COSCO Pacific (see below) is completed. For its part, THPA is reportedly sitting on a €100m cash reserve with increasing cargo traffic.

The ports’ main activities consist of berthing for ships, container and general cargo stevedoring services and storage, car stevedoring services and storage (in the case of PPA), and services provided to cruise and coastal ferry operators and passengers.

Second time lucky

This is not the first attempt to privatise these two ports. THPA was listed on the Athens Stock Exchange in 2001 and PPA in 2003, although in both cases the state retained a 74% stake in the companies and effectively the management of their respective businesses.

Rather unusually for landlord ports in Europe, both PPA and THPA hold a 50-year master concession from the Greek state which was granted to them in 2002 and 2001 respectively. In the majority of the other European landlord ports (other than most British ports which are completely privatised) the port authority owns the port and infrastructure directly, rather than through a limited lifetime concession. This means that the ownership of any new structures, buildings or improvements constructed by PPA/THPA during the term of the concession agreement will automatically vest with the Greek state.

Under the master concession, PPA has the right (or rather obligation) to grant sub-concessions in respect of the operation of parts of the port to third parties with a view to liberalising the provision of port services. THPA’s master concession contains similar provisions. Accordingly, following a protracted tender process in November 2008 PPA entered into an agreement with Piraeus Container Terminal (PCT), a subsidiary of Hong Kong listed port operator COSCO Pacific, under which PCT was granted the right to operate Piers II and III and the surrounding area of the container terminal facility of the port of Piraeus.

At the time, this was hailed as a great success for both sides, but it was soon followed by the Greek financial crisis and the ensuing deep, long-lasting recession in Greece and other parts of Europe. As a result, PPA and PCT commenced discussions in early 2013 to adjust the terms of the sub-concession culminating in an agreement announced in August 2013 which provides for the suspension of the annual guaranteed consideration payable by PCT to PPA and an infrastructure investment by PCT of €230m.

The investment is expected to increase PCT’s throughput capacity to 6.2m teu annually, thereby giving the port of Piraeus an aggregate maximum capacity (including the container terminal in Pier I operated by PPA itself) of 7.3m teu annually. The terms of the agreement are being reviewed by the European Commission.

THPA also sought to grant a sub-concession and after running an international tender it chose a consortium of Hutchison Port and Greek pharmaceutical group Alapis as the preferred bidder to modernise and run its cargo facilities. It is understood that the consortium had offered €3.1bn to operate the port for up to 35 years.

Pull out

However, while the sub-concession to PCT at the port of Piraeus went ahead, Hutchison Port and Alapis withdrew from the tender – the reasons for the withdrawal were not disclosed, but commentators speculated that the reasons lay in disagreements between the consortium partners, the downturn in the shipping market and/or the difficulty in raising the necessary finance for the deal.

The invitations to submit expressions of interest issued by HRADF for the current privatisation of PPA and THPA included selection criteria for bidders such as financial eligibility criteria (i.e. equity of at least €250m) and technical eligibility criteria, which in the case of PPA require a bidder to have operated at least two terminals in at least two countries for the last three years with a combined annual traffic of at least 1.5m teu for all terminals including at least one container terminal with an annual traffic of 750,000 teu or more, or 400,000 ro-ro units/vehicles for all terminals, including at least one terminal with an annual traffic of 200,000 ro-ro units/vehicles or more, or one million passengers for all terminals, including at least one terminal with an annual traffic of 500,000 passengers or more. The pre-qualification criteria relating to THPA largely follow the same lines as for PPA except that they have been adjusted to reflect the smaller size of the port of Thessaloniki.

In early June, HRADF announced it had received expressions of interest relating to the sale of the stake in PPA from APM Terminals, COSCO (Hong Kong) Group, International Container Terminal Services, Ports America Group Holdings and Utilico Emerging Markets Limited. It also announced interest for THPA from APM Terminals, Deutsche Invest Equity Partners, Duferco Participations Holding, International Container Terminal Services, Mitsui & Co., P&O Steam Navigation Company (DP World), Russian Railways/GEK TERNA and Yilport Holding. Inc.

Making agreements

As part of the sale of the stakes, HRADF may require the winning bidders to enter into shareholders’ agreements with HRADF to regulate the relationship between the shareholders, given that HRADF will be retaining 7% of its current 74% stakes in PPA/THPA, with the remaining circa 25% continuing as a free float (unless the bidder is able to acquire it by way of a takeover offer/squeeze-out).

Interestingly, HRADF is also contemplating that the master concession agreement with the Greek State will be renegotiated, and potentially amended, with a view to (among other matters): introducing more detailed parameters and specifications in respect of PPA’s ongoing obligations to provide, host and/or support a comprehensive range of port services and activities within the port of Piraeus; preserving the position and role of the port and observing its fundamental national importance as the primary seaport linking the Greek mainland and the Aegean islands; encouraging investment to help revitalise the shipbuilding and ship repair areas; fostering balanced growth of the various functions and activities within the port; detailing an appropriate process for the determination and approval by the Greek state of tariffs; establishing suitable incentives and update mechanisms to determine the levels of concession fees payable by the PPA to the Greek government, and agreeing on specific investments in the port. Amendments are also contemplated in the case of the master concession agreement between THPA and the Greek state.

While the desire by the Greek state to regulate a number of matters that it was hitherto able to control both at PPA and THPA was to be expected given that, if these sales complete PPA and THPA will be a step closer to truly privatised ports, it is interesting that no reference to a potential extension of the concession duration has been mentioned, which will likely have made these two ports and their development more attractive and bankable.

The retention both of a 7% stake in PPA and THPA and the ‘reversionary interest’ in both ports indicates that the Greek state is not quite ready to fully let go of these assets, as has been the case in the UK.

For more information, please contact Alex Kyriakoulis, Partner, on +44 (0)20 7264 8782 or alexis.kyriakoulis@hfw.com, or your usual contact at HFW.