Gas and electricity market regulation

New rules on market abuse and insider trading will apply to trading, contracts and capacity arrangements in gas and electricity markets across the EU.

Summary and timings

The European Regulation on Wholesale Energy Market Integrity and Transparency (the “Regulation”) was published in the Official Journal of the European Union on 8 December 2011, having been adopted on 25 October 2011. The Regulation enters into force on 28 December 2011

The Regulation prohibits insider trading (the use of inside information when trading) and market manipulation. It applies to transactions (both physical and derivative trades) in wholesale electricity and gas markets, in relation to production, supply and transport (including shipping), within the EU, or where delivery is in the EU. It applies to private contractual arrangements as well as energy exchanges.

From 28 December 2011, participants in gas and electricity markets must publish inside information (i.e. exclusive and price-sensitive information) before they enter into related transactions. It will also be possible in theory for private persons to bring damages actions for losses suffered as a result of insider trading and market manipulation.

The public enforcement apparatus, including the requirement to notify transactions, will likely take until 2013 to put in place. Companies will probably need to start registering with national regulatory authorities in the second half of 2012.

An EU regulator (the Agency for Cooperation of Energy Regulators (“ACER”)) will monitor the gas and electricity markets. Market participants will be required to provide information to ACER. This monitoring by ACER will facilitate enforcement action at the national level against companies involved in market manipulation and insider trading.

The following steps are due to be taken:

- ACER will publish guidance on what is meant by insider trading, inside information, and market manipulation, either before the end of December 2011, or soon thereafter.

- ACER will publish guidance on the data format for the registration of market participants by national regulatory authorities by 29 June 2012.

- The Commission will adopt Implementing Acts to provide detailed guidance on the types of transactions and capacity information that market participants will be required to report to ACER.

- Within three months of the date that the Implementing Acts are adopted, the national regulatory authorities must establish national registers of market participants, and transmit these to ACER.

- Starting six months after the date on which the Implementing Acts are adopted, market participants will be required to notify ACER of transactions caught by the Regulation.

- Before they enter into any transaction that requires notification to ACER, market participants will be required to register with the national regulatory authority of the country in which they are established.

- The requirement to notify transactions to ACER is likely to commence in winter 2012/2013.

- National regulatory authorities will be responsible for the enforcement of the prohibitions on insider trading and market manipulation. They are required to have the appropriate enforcement mechanisms in place by 29 June 2013.

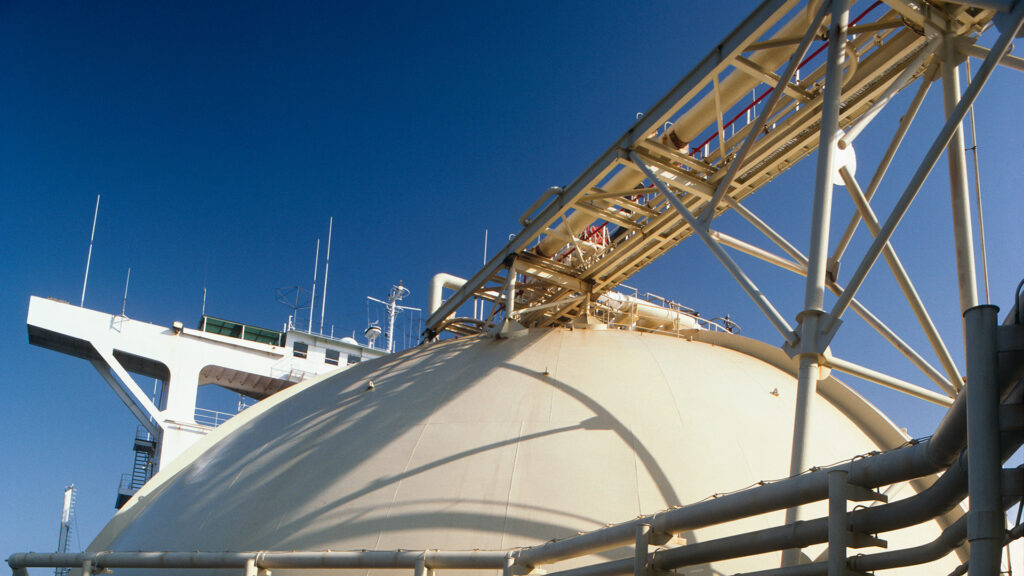

There is uncertainty at present over what types of agreement (such as, for example, LNG time charters) will be caught by the legislation, and what is meant by market manipulation and insider trading. These uncertainties should be addressed by the provisions of the Implementing Acts, and the guidance that ACER is due to publish.

The Regulation

The Regulation is intended to combat insider trading and market manipulation on “wholesale” gas and electricity markets. These markets fall outside the scope of current EU financial markets regulations. The Regulation does not apply to coal, oil or renewable energy.

The Regulation will apply to “market participants” in “wholesale energy markets.”

A market participant is any person who enters into transactions in a wholesale energy market.

A transaction in the wholesale energy market will be any transaction in which wholesale energy products are traded.

Wholesale energy products include physical and derivative contracts relating to the production, supply or transport of electricity or gas, within the EU, or where delivery is in the EU. They include private contracts as well as contracts concluded on energy exchanges which are not already regulated under the existing European regulatory framework. Transactions with end users who consume exceptionally large amounts will also be caught.

Market participants will be obliged to notify all transactions which fall within the scope of the Regulation to ACER. They will also be required to register with the national regulatory authority in the country in which they are established.

The Regulation prohibits insider trading and market manipulation. In summary:

- A person is guilty of insider trading if he uses inside information to inform a decision (or encourage another) to buy or sell a wholesale energy product. Inside information is information of a precise nature which has not been made public, which relates to a wholesale energy product, and which if it were to be made public, would significantly affect the price of that wholesale energy product. Inside information can relate to capacity, production, storage, consumption or transmission.

- A person is guilty of market manipulation if he enters into a transaction or disseminates information which gives a false or misleading signal to the market regarding the supply of or demand for a wholesale energy product.

These prohibitions build on the existing European regulatory framework for regulated financial markets. The Market Abuse Directive and the Markets in Financial Instruments Directive (MiFID), which are implemented in the UK under the framework of the Financial Services and Markets Act, prohibit market manipulation and insider trading on regulated financial markets. For an update on how MiFID 2 proposals could affect commodity derivatives trading please click here.

The rationale for the extended scope is that physical and financial trading in wholesale electricity and gas products and financial instruments are considered to be particularly vulnerable to insider trading and market manipulation. It is considered necessary for all market participants to have access to current information on market capacity and supply conditions.

For further information, please contact Anthony Woolich, Partner, on +44 (0)20 7264 8033 or anthony.woolich@hfw.com, or your usual contact at HFW.