Iran Sanctions Iranian ports operator designated

In a key development, Tidewater Middle East Co (“Tidewater”) was added to the list of Specially Designated Nationals (SDNs) by the US Department of the Treasury on 23 June 2011. This briefing considers the impact of the US designation on those who are subject to US legislation, as well as the wider ramifications on companies and individuals in the EU and elsewhere.

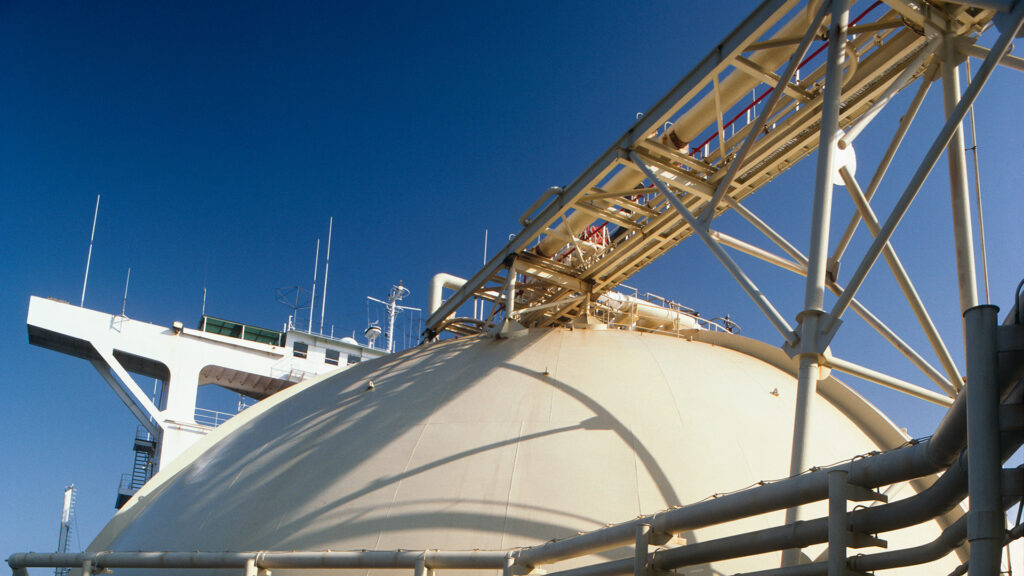

Tidewater is said to be part-owned by Iran’s Islamic Revolutionary Guard Corps (the “IRGC”), which is itself the subject of EU and UN sanctions. Tidewater is said to have operations at the main ports in Iran, and describes itself as the “largest and most active container operator in Iran”, performing “more than 90% of container operations in the ports”. While press reports suggest that Tidewater facilities only handle around 1% of Iran’s oil exports, Tidewater does appear to have extensive bulk cargo and general cargo operations.

Because of the extent of Tidewater’s operations in Iran, and the alleged links between Tidewater and the IRGC, enquires should be carried out by every company which trades to or from Iran, wherever that company is incorporated, to identify whether the particular port or terminal is operated by Tidewater (or another designated person).

All payments to Tidewater are prohibited under applicable US legislation and also arguably prohibited under applicable EU and UN sanctions. We therefore recommend that all enterprises which are involved in trading to or from Iran carefully review their operations to identify any direct or indirect payments which they are due to make to Tidewater. Appropriate legal advice and decisions can be taken on how to proceed.

For example, we understand that at least one major operator has announced that it will no longer call at the Iranian ports of Bandar Abbas, Bandar Khomeini and Assaluyeh.

It should be noted that the designation raises a number of issues of US law. We are not US lawyers (although we have strong connections with many US law firms) and US law advice should be obtained in respect of specific queries on US law.

US designation of Tidewater

Tidewater was designated on the basis that it is owned by (i) Mehr-e Eqtesad-e Iranian Investment Company, (ii) Mehr Bank and (iii) the IRGC, and that it has been used by the IRGC for “illicit shipments”.

Tidewater has operations at seven of the main ports in Iran, namely (i) the Shahid Rajaee Container Terminal at Bandar Abbas, (ii) Bandar Imam Khomeini Grain Terminal, (iii) Bandar Anzali, (iv) one terminal at Khorramshahr Port, (v) Assaluyeh Port, (vi) Aprin Port and (vii) Amir Abad Port Complex.

The US designation includes a number of aliases (Tide Water Company, Tide Water Middle East Marine Service and Tidewater Co. (Middle East Marine Services), but the designation makes clear that there is no connection between Tidewater Middle East Co and Tidewater (US), an international shipping company headquartered in the United States.

There has been a great deal of speculation about the likely effect on shipping lines of this designation. We understand from our discussions with US lawyers that the effect of the designation is as follows:

- Any assets of Tidewater in the US are frozen.

- It is prohibited for any US person (which would include (i) natural and legal US persons, (ii) foreign branches of US companies, and (iii) US branches of foreign companies) to enter into any transaction with Tidewater.

- Civil penalties in the event of breach include fines of up to US$250,000 per violation.

- Criminal penalties in the event of breach include fines of up to US$1 million or 20 years’ imprisonment

- US banks (and banks with a connection to the US) may refuse to process any payments in US Dollars if they consider that there is a connection between the payment and Tidewater.

- Non-US banks may also be reluctant to process any payments in US Dollars if they consider that there is a connection between the payment and Tidewater, because of the risk that the US authorities may take steps to exclude the non-US bank from the US banking system, under powers conferred by the US Iranian Financial Sanctions Regulations (the “IFSR”), which have a degree of extra-territorial effect.

The day after the designation of Tidewater (i.e. on 24 June 2011), the US Office of Foreign Assets Control (OFAC) issued a general licence (effective as of 23 June 2011) which authorises transactions between US persons and Tidewater, for the next two months, provided that:

- The transactions relate to exports of agricultural commodities, medicine, and medical devices to Iran or the Government of Iran, authorised pursuant to a valid TSRA license.

The goods are shipped under a contract entered into prior to 23 June 2011.

Those engaging in transactions pursuant to the general licence file reports with OFAC detailing the transactions within 30 days after such transactions take place.

Payments by EU companies and individuals

Tidewater is not currently expressly designated by the EU. However, if the information available to the US Department of the Treasury about the ownership and control of Tidewater is correct, and if the IRGC benefits from payments to Tidewater, then companies and individuals located in the EU and elsewhere will be unable to make payments to Tidewater.

This is because the EU sanctions prohibit funds being made available directly or indirectly to or for the benefit of a designated person. The IRGC and a number of related individuals and entities were designated by EU Regulation 961/2010. Mehr Bank was designated by EU Regulation 503/2011, on the basis that it is controlled by the IRGC and another entity which is itself controlled by the IRGC.

We have discussed the position with HM Treasury. They have advised us that any payments to Tidewater by an EU person or EU company would be in breach of the EU sanctions, unless the payer can be confident that funds provided to Tidewater will not then be made indirectly available to designated entities (i.e. Mehr Bank and/or the IRGC).

If the connections relied upon by the US authorities are unfounded, or if the paying party is confident that funds provided to Tidewater will not then be made indirectly available to Mehr Bank and/or the IRGC, the payments to Tidewater would still need to be processed in line with Article 21 of EU Regulation 961/2010 because they are transfers of funds to an Iranian person.

HM Treasury have advised us that in those circumstances they would require an explanation as to why any payment to Tidewater would not fall foul of Article 21(4), given the reason for the designation of the IRGC by the EU. The IRGC is said to be responsible for Iran’s nuclear programme, it is said to have operational control of Iran’s ballistic missile programme and undertaken procurement attempts to support Iran’s ballistic missiles and nuclear programmes.

Payments by other companies and individuals

Any payments to Tidewater by a company or individual in a country which has implemented UN Resolution 1929 (2010) may be in breach of the applicable domestic legislation. This is because that UN Resolution imposes an asset freeze in respect of the IRGC, which prohibits funds being made available to or for their benefit.

The terms of any applicable domestic legislation will need to be carefully reviewed to determine the risks in this regard.

Conclusions

In light of the very significant risks associated with payments to Tidewater, those who take a cautious approach may decide that the best course is to refuse to make any payments to Tidewater. Because Tidewater has operations at seven of the main ports in Iran, that is likely to have a very serious effect on trade to and from Iran.

The first stage should be to identify whether the port or terminal in question is operated by Tidewater (or another designated person).

Any companies which have existing commitments to trade to or from ports which are operated by Tidewater are in a very difficult position, and are advised to take legal advice on the ramifications of the designation of Tidewater, as well as the information about the alleged links between Tidewater and, amongst others, the IRGC.

In particular, any owners or charterers who are required to pay port dues or other charges to Tidewater should take legal advice before making any payment. Companies may also wish to review their long term charters and other contractual arrangements, in order to decide how best to deal with any future calls to Iranian ports.

For more information, please contact Anthony Woolich, Partner, on +44 (0)20 7264 8033 or anthony.woolich@hfw.com, or Daniel Martin, Associate, on +44 (0)20 7264 8189 or daniel.martin@hfw.com, or your usual HFW contact.

Download a PDF version of ‘Iran Sanctions Iranian ports operator designated’