China-Australia Free Trade Agreement: an Australian perspective, December 2014

Following 10 years of discussions, last week China and Australia signed a Declaration of Intent to enter into a Free Trade Agreement (ChAFTA). There is still a way to go before the actual agreement is signed and comes into effect – the forecast is before the end of 2015 – after which the concessions will need to be phased in over a number of years.

Reports indicate that the Australian economy will benefit by around AUD$18 billion over 10 years, making the ChAFTA a significant agreement. If this number is anywhere near correct, then we should certainly be hailing the agreement as extremely positive. At the time of this article, there doesn’t however appear to be much news about it in China.

So who are the possible winners? The agreement looks like it will be a good thing for many Australian sectors, but in particular agriculture, resources, energy and manufacturing. Some of the winners in the agriculture sector are dairy, beef, sheep meat, wine, horticulture, barley, wool and seafood. For resources, energy and manufacturing it will be coal (coking and non-coking coal), copper, aluminium, iron ore, crude petroleum oils and liquefied natural gas (LNG) as well as a range of industries in the manufacturing sector. The benefits come in the form of tariff reductions.

The other winner is the services sector and includes legal services, financial services, education, construction and engineering services, health and aged care providers and shipping. The benefits in these areas come in the form of programmes to promote collaboration, improvements to market access and reducing barriers to labour mobility as well as a framework to protect intellectual property.

What do we think is in it for China? The most likely benefits are food and agricultural security, courtesy of Australia locking in the future for the export of highly sought after minerals and resources, importing quality health and aged care services and gaining expertise in valued services across a range of sectors.

It is expected that we will also see more investment by China into Australia as a result of relaxing some of the Foreign Investment Review Board (FIRB) thresholds for approval. For example, private Chinese investors can acquire Australian commercial property up to AUD$1.07 billion (up from AUD$54 million) before they need to get FIRB approval – this is in line with the rules for US, Japanese and New Zealand investors. The ChAFTA doesn’t apply to Australian residential property however, where the rules remain unchanged. In the case of rural land and agribusiness the Australian government has tightened the reins. Private Chinese investors need to get FIRB approval for rural land where it is above AUD$15 million (well down from AUD$248 million) and for agribusiness above AUD$53 million (again, well down from AUD$248 million). There are already early reports in the Australian press about private Chinese companies looking to buy Australian dairy farms. The same applies to beef and more will surely follow.

A major part of the deal that has been overshadowed by the big dollars that look to be on offer, is the facilitation of the movement of labour across China and Australia. This is important because it allows Australia and China to work more closely together. China and Australia propose to have four new classes of visas that will mirror each other to facilitate a specialised and skilled work force moving between Australia and China. The ability to work in each other’s country is going to be fundamental to deepening the relationship between China and Australia.

The Australian press are saying that Australia has worked “with” China before, but question whether Australia will be able to work “in” China? Many Australian companies are looking to get a head start (e.g. Ramsay Health Care recently announced a new joint venture in China) and there are many who already have a presence in China (eg. ANZ, Lend Lease). Indeed, many of our clients in construction, property, shipping, telecommunications and aged care are expecting more M&A activity between China and Australia.

Information about the ChAFTA can be found on the Australian Government’s website at: dfat.gov.au/fta/chafta/

Meanwhile, we have put together a snapshot below.

Agriculture

- One of the two big winners for Australia.

- Tariffs are to be removed across a number of agricultural and food sectors. These include dairy, beef, live animal exports, sheep meat, wine, horticulture, barley, wool, seafood, processed foods, hide, skins and leather.

- Notwithstanding the high demand in China, sugar, rice, cotton and grains such as wheat, canola and maize have not been included in the ChAFTA on the basis that these are “significantly sensitive staples” in China. Arrangements are to be reviewed after three years.

Resources, energy and manufacturing

- The other big winner for Australia. Last year, this sector was valued at over AUD$83 billion.

- Within the resources and energy sector, coking coal (metallurgical for steel making) and non-coking coal (thermal/steam coal for power generation) are major beneficiaries as a result of the immediate removal of tariffs.

- Certain transformed resources (that is, resources that are treated, transformed or converted) and energy products stand to also benefit from the immediate removal of tariffs. These include refined copper and alloys (unwrought), aluminium oxide (alumina), nickel mattes and oxides, unwrought aluminium, aluminium waste and scrap, unwrought nickel and titanium dioxide.

- There appear to be good reasons for targeting these resources and products as Australia is China’s second largest source of refined copper and alloys (worth around AUD$2 billion), China’s largest source of alumina (worth around AUD$1.3 billion), China’s largest market for unwrought zinc (worth over AUD$300 million), as well as China’s largest market for aluminium waste and scrap (over AUD$136 million).

- Australia’s exporters of iron ore, crude petroleum oils and liquefied natural gas (LNG) also stand to benefit from greater certainty by locking in zero tariffs on these major exports.

- Australia’s manufacturing sectors have faced tough times in the last few years. They are now expecting a boost from the removal of tariffs (to be introduced over the next four years) for car engines and automotive products, mining machinery, plastic products, diamonds and other precious stones, medical equipment and orthopaedic appliances, aluminium plates and sheets, make-up and hair products, centrifuges and pearls.

- China is Australia’s largest market for pharmaceuticals (worth over AUD$559 million). Australia’s manufacturers of vitamins and health products are also expecting a boost in the coming years with the removal of up to 10% on the tariff for pharmaceuticals.

Property

- Australians are speculating on the effect the ChAFTA will have on Australia’s property industry.

- The relaxation of Australia’s Foreign Investment Review Board (FIRB) rules will undoubtedly provide greater access to Chinese investors looking to buy Australian commercial real estate. Under the ChAFTA, private Chinese investors will be able to buy commercial property up to AUD$1.078 billion (up from just AUD$54 million), without requiring FIRB approval. This puts private Chinese investors on the same footing as US, Japanese and New Zealand investors.

- Some rural estate agents in Australia are saying that the ChAFTA has the potential to immediately increase rural land values in Australia by 15%. Others however argue that this is tempered by the Australian government’s changes to tighten the threshold for FIRB approval and to screen investment proposals by private Chinese investors in rural land and for agribusiness.

- For rural land, the FIRB threshold for approval has been tightened from AUD$248 million to AUD$15 million. For agribusiness the FIRB threshold has been tightened from AUD$248 million to AUD$53 million.

- The existing arrangement for Chinese foreign investment into residential real estate remains unchanged.

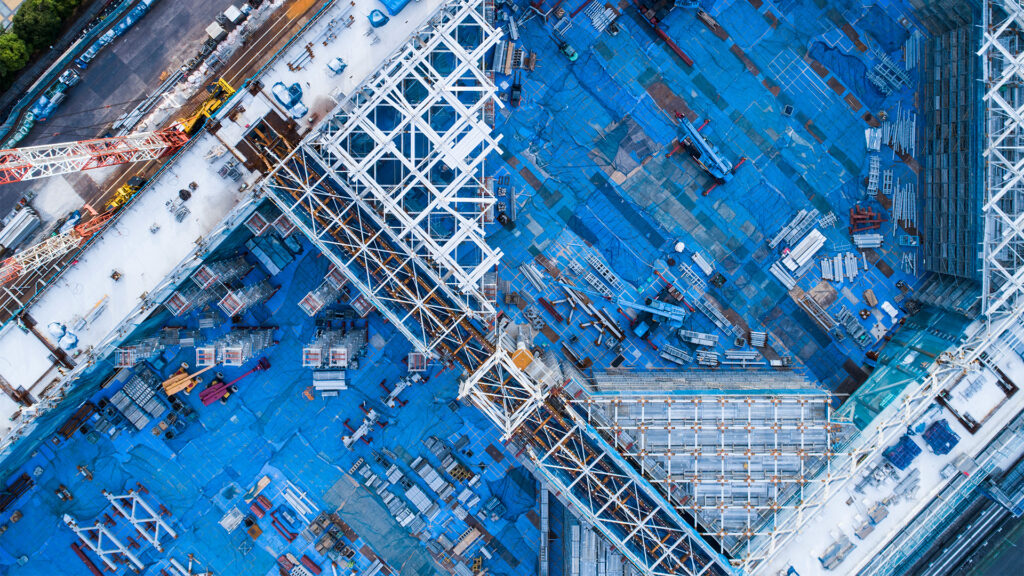

Construction and engineering services

- For the first time, China will give Australian construction companies (who are established in the Shanghai Free Trade Zone and who partner with Chinese companies) access to carry out construction work in Shanghai. These Australian companies will receive an exemption from business scope regulations under the ChAFTA that will allow them to work on a wide range of commercial projects in Shanghai.

- The ChAFTA also covers Australian architectural and engineering firms and will allow them to obtain broader business licenses to carry out work on construction projects in China.

- Reciprocally, Chinese companies who are registered in Australia will be able to apply for visas for Chinese workers to work on large infrastructure projects (above AUD$150 million) in Australia. Whilst there has been some debate about the potential impact on jobs and safety within the Australian the construction sector, other areas of the Australian industry appreciate that this arrangement may be required to attract Chinese capital investment into Australia’s infrastructure sector.

Health and aged care

- Australia has developed world leading standards in health and aged care. Under the ChAFTA, China has given wholly-owned Australian health and aged care providers unprecedented access to establish hospitals and aged care facilities in China to assist especially with its ageing population.

- Both countries expect to benefit as Australian health and aged care providers expand their services throughout East Asia and Chinese citizens will benefit from higher standards of health care.

- For the first time, Australian law firms will be able to establish commercial associations with Chinese law firms in the Shanghai Free Trade Zone. This will allow a law firm to offer Australian, Chinese and other international legal services by way of a commercial presence in China.

- Under the ChAFTA China has also opened up its financial services market to Australian banks and insurers. Australian banks will have the opportunity to open branches in China. Australian insurers will gain access to China’s statutory third-party liability motor vehicle insurance. Australian securities brokerage and advisory firms will be able to provide trading accounts, custody, advice and portfolio management to Chinese investors allowed to invest offshore.

- Australian higher education providers will benefit from better recognition – already a AUD$4 billion export market for Australia. Within the first year of the ChAFTA coming into force, China has agreed to promote better recognition of Australian education providers, including listing all Australian private higher education institutions registered on the Commonwealth Register of Institutions and Courses for Overseas Students (CRICOS) on its official website at the Ministry of Education. It will also include each countries’ respective Departments of Education working towards mobility of students and teachers, as well as researchers and academics via exchange programmes.

- The Australian Government is expecting over 1.5 million Chinese visitors to enter Australia by 2022-2023, and anticipates resulting income of AUD$10.2 billion. Under the initiatives, Australian tourism service providers will be able to construct, renovate and operate wholly Australian-owned hotels and restaurants in China.

As mentioned, there is still work to be done around the negotiating table before the agreement is signed, but indications of how the ChAFTA could work for Australia are very positive.

Download a PDF version of ‘China-Australia Free Trade Agreement: an Australian perspective, December 2014’