Sustainability Series: Part 3 – Sea Freight

As Parts 1 and 2 of this Sustainability Series set out,1,2 the transport sector is facing mounting pressure to reduce emissions due to the global climate crisis.

Shipping is another sector in which drastic and widespread changes are needed to achieve net-zero carbon emissions. Currently, 100,000 commercial vessels in operation are responsible for burning around 300m tonnes of fossil fuels each year. This results in approximately 1bn tonnes of carbon dioxide emissions – a 3% share of total global greenhouse gas emissions 3.

Why should the sector change?

The International Maritime Organisation (IMO) has set a goal to at least halve carbon emissions from the shipping industry by 2050. This requires wholesale changes in the industry. Maersk’s ‘the path we are on’ model, based on realistic forecasts predicts greenhouse gas emissions will be 20% higher by 2050 without any changes. If all shipowner decarbonisation commitments are delivered as promised, then a mere 22% of global shipping will reach net-zero by 2050. Companies which act inconsistently with their goals and commitments will suffer negative public opinion, increased regulatory scrutiny, and potentially even face legal challenges, all of which will severely affect profitability. Amid rapidly increasing public demand for the industry to become more environmentally friendly and increase supply chain transparency, the best approach for those involved in shipping is to prepare well in advance.

Legal and Regulatory Incentives

Policy and regulation are key to accelerate the transition towards net-zero. Under current legislation, taking the lead to invest in and commit to decarbonization is a high-risk strategy which relies on customer willingness to pay a premium. Therefore, regulatory frameworks need to penalise the use of fossil fuels and incentivise decarbonisation efforts. Under future regulations, emphasis should encourage companies to be transparent and collaborative, to work towards a more sustainable industry.

A strong regulatory push towards decarbonisation has already begun. In April 2020, the United States committed to pursuing zero emissions in the shipping industry by 2050 4. Following the UN Climate Change Conference (COP 26), the IMO agreed to begin revising the Initial IMO Strategy on Reduction of Greenhouse Gas emissions from ships so that it promotes a more ambitious approach to reducing carbon emissions. They will consider the final draft of this strategy in spring 2023.

In addition, the shipping industry must use 5% zero-carbon fuels by 2030 to meet the requirements of the Paris climate agreement 5. The Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) regulations adopted by the IMO will also come into force on 1st January 2023 and shipowners and managers need to prepare and ensure vessels are ready.

The EEXI determines the energy efficiency of all newbuild and existing vessels above 400GT and fall within the scope of MARPOL Annex VI. Under this framework, shipowners may be required to use technical modifications to alter their vessels’ emissions 6. Compliance with the EEXI will be exhibited in an International Energy Efficiency Certificate7.

The CII regulates the operational carbon intensity of vessels above 5,000GT that fall within the scope of MARPOL Annex VI, by measuring how efficiently a vessel operates. Managers will need to establish their vessel’s annual carbon intensity profiles and develop an approved Ship Energy Efficiency Management Plan (SEEMP) that will be kept onboard 8.

There is also a proposed EU law, which is an extension to the existing European Emissions Trading System (ETS) to require shipping companies to account for the carbon they produce while travelling to and from the EU, and between EU ports, along with a separate proposal for an EU fuel mandate which would enforce the use of low or zero-carbon fuels. 9,10

What are the solutions and challenges?

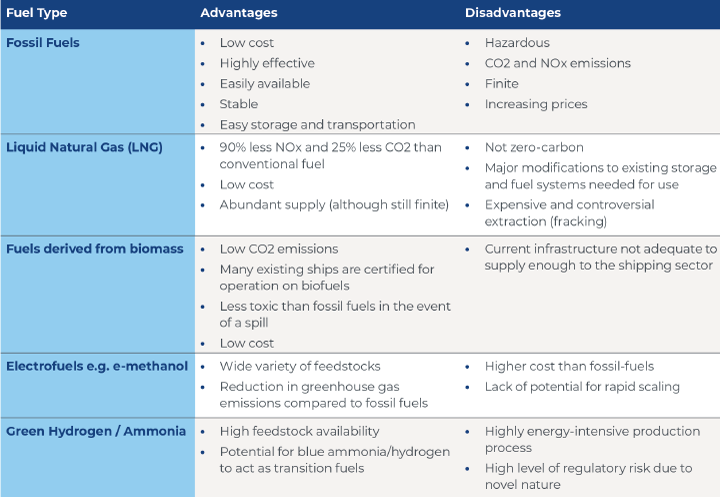

To achieve the set targets and adhere to increasingly stringent regulations, zero-carbon fuels (and the infrastructure required for them) must become available on a commercial scale. Currently, the most promising options are green hydrogen and green ammonia, both zero-carbon fuels and can be made using renewable electricity. Other alternatives are cleaner than fossil fuels but not zero-carbon fuels include, for example:

- carbon-containing electrofuels such as e-diesel and e-methanol;

- liquid natural gas (LNG); and

- fuels derived from biomass.

Hydrogen and ammonia are presently the most promising options as they are massively scalable whilst not containing carbon11. They can be produced and used for many different applications, similar to fuels derived from crude oil, meaning that the benefits of mass production are likely to extend beyond just shipping.

However, currently, both hydrogen and ammonia are not market ready. The main concern for hydrogen is that of transportation and storage as it takes up large amounts of cargo space12, whereas the main challenge for ammonia is safety. Ammonia is highly toxic and minor accidents can produce risks to crew and the environment.13 As a result, shipping giant Maersk, is opting for green methanol in the immediate future. Methanol is the most energy-dense fuel out of methanol, hydrogen and ammonia as well as being a liquid at room temperature, thus also making it the easiest to the handle14.

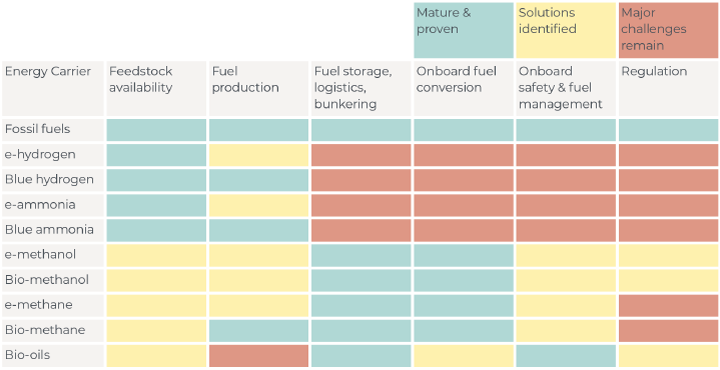

Figure 1 shows alternative fuels based on hydrogen and ammonia have mature and proven feedstock availability and production. However, both require major improvements in infrastructure to be viable candidates for widespread use. This will only come with wider interest in adopting zero-carbon fuels which will be largely driven by regulation.

Another promising feature of alternative fuels based on hydrogen and ammonia is that they can both be produced using a low-carbon method, yielding ‘blue’ fuels15. This could be exploited by taking a stepped approach, where transition is made from fossil fuels to ‘blue’ fuels, and then ultimately to completely renewable green fuels when methods of renewable electricity production are sufficiently mature16.

Although hydrogen and ammonia are currently the most promising, other alternative fuel options will play a key part in the transition. The transition will be years, if not decades, long and characterised by the use of a wide range of potential options. The advantages and disadvantages of the main fuel types for shipping are set out in figure 2.

The potential of battery power should also not be dismissed. The innovative Yara Birkeland17 have sparked talks of similar solutions for vessels up to 6000 TEU with a proportion of container capacity allocated for battery cells in container which could be exchanged for recharged ones at ports of call.

The Role of Ports

Ports themselves will play a major role in assisting the development, production, and delivery of zero-carbon fuels and reducing emissions18. Many ports have implemented or considering the addition of infrastructure such as LNG bunkering and cold ironing. Cold ironing is a viable solution which involves vessels turning off their diesel-powered engines and plugging into shore power whilst berthed, which lessens greenhouse gas emissions19. Port-based incentives also promote the reduction of emissions and are already offered at 28 of the 100 world’s biggest ports. The Panama Canal Authority also such incentivises greener ships by offering priority slot allocations20.

Conclusion

Although there are encouraging signs that the shipping industry is alert to the urgent need to push for decarbonisation, the uncertainty and cost involved in leading by example has left many lingering in the immediate safety of existing regulatory frameworks. However, such an approach will leave these parties exposed to significant risk in the near future as a widespread rapid transition to renewable fuels takes place.

How HFW can help

HFW has a wealth of experience in the transport and logistics sectors and can work with clients to achieve their sustainability goals by providing solutions for the transition to sustainable sea freight supply chains.

Footnotes:

- HFW Sustainability Series Part 1 – Road Transport Article. Available at: https://www.hfw.com/Sustainability-Series-Part-1-…

- HFW Sustainability Series Part 2 – Rail Freight Transport Article. Available at: https://www.hfw.com/Sustainability-Series-Part-2-R…

- https://www.zerocarbonshipping.com

- https://www.whitehouse.gov/briefing-room/statement…

- https://www.globalmaritimeforum.org/news/five-perc…

- https://www.hfw.com/Reducing-international-shippin…

- https://www.lr.org/en/eexi-energy-efficiency-exist…

- https://marine-digital.com/article_eexiandcii

- https://ec.europa.eu/clima/eu-action/transport-emi…

- https://ec.europa.eu/info/sites/default/files/fuel…

- https://oceanconservancy.org/wp-content/uploads/20…

- https://fuelcellsworks.com/news/maersk-exploring-o…

- https://www.maersk.com/news/articles/2019/10/24/al…

- https://fuelcellsworks.com/news/maersk-exploring-o…

- https://www.world-energy.org/article/17928.html

- https://www.zerocarbonshipping.com

- https://www.yara.com/news-and-media/press-kits/yar…

- https://oceanconservancy.org/blog/2021/09/23/zero-…

- https://www.porttechnology.org/news/what-is-a-gree…

- https://www.itf-oecd.org/how-ports-can-help-cut-sh…