Indonesia fuelling growth: a commitment to development, June 2015

The Jokowi administration has made no secret of its desire to drive the Indonesian maritime sector. In recent months the government has announced a number of projects that will attempt to kick-start this initiative.

Indonesia pushes towards vertical integration

Whilst it has been well documented, revitalised infrastructure may provide some much needed good news to the wider Indonesian coal sector. The drive towards modernisation and efficiency will ultimately prove beneficial to the country’s coal players.

New projects coming on-line

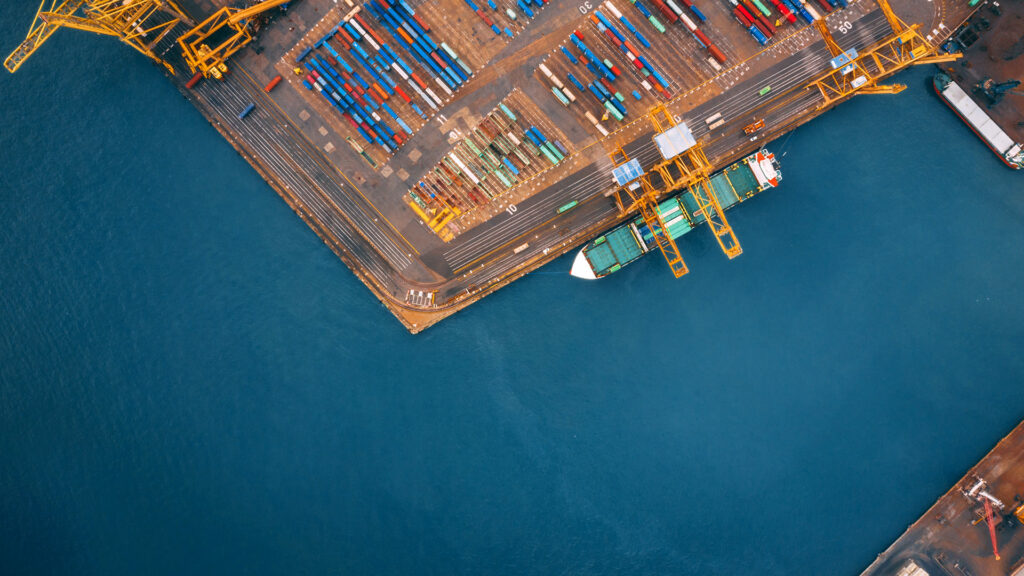

Indonesia has stated its aim to develop the country as a global maritime hub and accordingly the government has pledged to secure the growth of Indonesian infrastructure and maritime resources through, among other things, the development of an inter-island marine toll road, construction of waterways, ports and terminals and improving existing ports, ferries and piers, which will also help to support its mining, logistics and shipping sectors.

One of these projects is the Tarahan (South Sumatra) Coal Terminal that opened this month and now has become Indonesia’s largest commercial terminal having the ability to accommodate ships with a maximum capacity of 210,000 dead-weight tonnage (DWT). This increase in capacity should allow the Indonesian coal sector to address issues in efficiencies against its peer competitors.

Another significant project is the new Priok Port (or known as Kalibaru Port). Kalibaru Port is the busiest seaport, and one of the largest construction projects, in Indonesia. The first terminal is expected to be completed by mid 2015 and what is perhaps most noteworthy is that the project is being funded by the private sector including third party loans and funding from major shipping and port operators.

This development plan will result in broad-based growth which is expected across a number of sectors in the country. This is clearly good news for both the maritime industry and also the Indonesian mining sector and in particular coal.

Moreover, by 2025 infrastructure spending in Indonesia is expected to exceed US$165 billion, with matching government spending of approximately 7% per year.

This trend suggests that the Indonesian government has started to recognise the role of private capital in its national development. The spirit can also be seen from the enactment of the Negative List 2014 whereby the government has implemented regressive measures by significantly increasing the maximum percentage of foreign ownership in the construction of port sectors under the public-private partnerships (PPP) schemes.

Improving efficiencies

This is all welcome news. The Tarahan Coal Terminal and Kalibaru Port represent some good news for observers waiting to see how Jokowi will push on with such modernising projects. The Tarahan Coal Terminal will help to cement certain advantages for Indonesian mining business as it allows Indonesian coal producers to compete with Australian coal producers, while Kalibaru Port will provide significant support to the development of the national shipping industry.

Pursuant to the Master Plan for the Acceleration and Expansion of Indonesia’s Economic Development, the government has announced plans to invest more than US$90 billion in various “hard” infrastructure projects supported by the private sector through PPPs.

Progress has already begun. In 2015, up to 43 infrastructure construction projects worth US$52 billion will be offered to private investors which would include the construction of monorail, airports, toll roads, ports, and water infrastructure.

At a time when the focus of much of the economic stories in Asia seems to be on Chinese growth, Indonesia, the largest economy in South East Asia has continued to push its own development.

How we can help

A qualitative development in Indonesia’s infrastructure projects means that there will be more opportunities for the private sector to participate in the development by way of foreign direct investment and PPP schemes.

While these opportunities might have made the country an investment magnet, policy barriers to foreign direct investment are not getting easier. Foreign investors are strongly advised to seek professional advice from legal advisers familiar with the Indonesian shipping and mining sector and who have on the ground Indonesian experience.

With Indonesian qualified lawyers and lawyers who have worked on Indonesian transactions (including new entry investments for over 20 years) we can advise and direct you further on how to structure foreign investment models, should you be interested in starting your investment in Indonesia.

You may also be interested in the following briefings:

The new Indonesia Investment Negative List

http://www.hfw.com/The-New-Indonesia-Investment-Negative-List.

Proposed joint ventures in Indonesia

http://www.hfw.com/Proposed-joint-venture-in-Indonesia-October-2014.

News

The Singapore and London offices of Holman Fenwick Willan are advising both Argyle Street Management Limited and its bid vehicle, Asia Coal Energy Ventures (ACE) on its proposed all cash offer of London listed Asia Resource Minerals (LON: ARMS). The widely reported transaction is an all cash offer for ARMS at 56p per share that values the company at more than $200m. The board of ARMS has recommended the ACE offer.

Brian Gordon, Holman Fenwick Willan corporate Partner, says: “We are very pleased to be working with both Argyle Street Management and ACE on the transaction. The deal, which is yet to close, has involved considerable interaction with the UK Takeover Panel and a number of interested parties. Investor appetite for the Indonesian coal sector is currently strong, and with some Indonesian miners posting an impressive return on equity exceeding 20% it is clear to see why. Nonetheless, the requirements of bodies like the UK Takeover Panel must be adhered to in order to capitalise on this commercial benefit – we are pleased that we have been able to support ACE and Argyle Street Management in this regard.”

ACE’s director, Kin Chan says, “HFW exhibits the highest professionalism and technical knowledge of both UK Takeover process and complex Asian debt restructuring. Beyond that, the HFW team demonstrates an extraordinary level of dedication to the assignment and its client.”

The HFW team is led by Partners, Brian Gordon, James Lewis, Nick Hutton and Jayson Marks.

Download a PDF version of ‘Indonesia fuelling growth: a commitment to development, June 2015’