Discharge of cargo without original bills of lading and letters of indemnity (LOI): one of the biggest risks a shipowner or charterer can take, March 2018

LOIs are an essential document to help world trade run smoothly. They are given by cargo interests and parties above them in the contractual chain to obtain cargo at a discharge port without delay in circumstances where the original bills of lading are not immediately available.

However, LOIs are fraught with danger and have lead to much recent litigation the latest reported case being THE SONGA WINDS discussed further below.

If delivery is not made in compliance with bills of lading then an owner may face a claim from the lawful holder of the bills for conversion. The owner may then have a liability for the full value of the cargo, with no applicable defences or standard P&I insurance cover (although the International Group have recommended LOI wording there is still no club cover). The LOI will effectively be the owner’s only ‘insurance’ and if the LOI provider does not arrange security the owner may be unable to release the vessel and could face a forced sale. In the liquid or dry bulk trade the value of cargoes could be tens of millions of dollars. If the LOI cannot be enforced an owner may become insolvent. Quick action is needed to pursue recourse against all parties in the charter and LOI chain if issues arise and to defend or delay the claim from the bill of lading holder to the extent possible.

The following English Court cases, including the SONGA WINDS published earlier this month, all consider situations where an owner has agreed to release cargo without production of original bills of lading only for a third party (usually the bank financing the purchase of the cargo) to later arrest the owner’s vessel claiming to be the lawful holder of the bills and that the cargo has been mis-delivered. The third party’s motive for pursuing the owner is usually that they are an easier (and more solvent) target than the cargo interest who defaulted under a financing or sale agreement. This means the owner and parties below them then have to rely on their LOIs.

- THE SONGA WINDS (Songa Chemicals AS v Navig8 Chemical Pool Inc [2018] EWHC 397).

- THE ZAGORA [2017] 1 Lloyd’s Rep. 194.

- JAG RAVI [2012] EWCA Civ 180.

- THE BREMEN MAX [2009] 1 Lloyd’s Rep. 81.

- THE LAEMTHONG GLORY [2005] 1 Lloyd’s Rep. 632.

Additionally, an owner needs to consider if the issuance of an LOI is being used to defraud the original consignee of their cargo. The owner should be particularly alert if the party named in the LOI does not match, or is not related to, the original consignee. If an LOI is found to assist in defrauding the original consignee then it may not be enforceable.

An owner can run into problems when attempting to call on the LOI they have accepted to protect themselves from this very scenario. It is now very clear (see THE BREMEN MAX) that if the cargo is not delivered to the party stated in the LOI then the LOI will not normally respond.

This principle has been tested and upheld in more recent cases (THE ZAGORA and THE SONGA WINDS) which found that delivery to an agent of the consignee complied with the usual wording in an International Group LOI permitting delivery to the consignee “or to such party as you believe to be or to represent [the consignee] or to be acting on behalf of [the consignee]”. Whether a party is an authorised agent of a consignee at the discharge port is a matter of fact, but this is rarely an easy task for a master particularly if parties at the discharge port have ulterior motives. Good evidence retention concerning what happened at the discharge port, including who the cargo was released to, is essential.

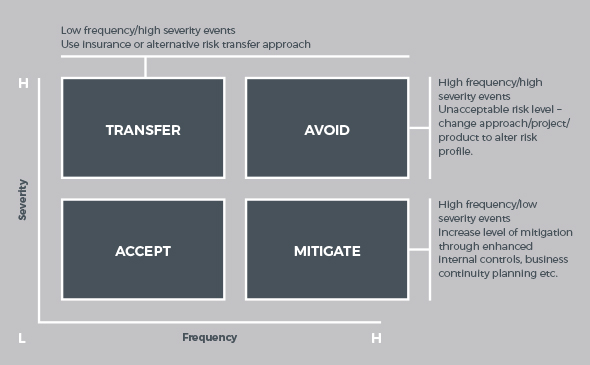

There is generally no P&I Club cover for LOIs and so the recipient must carry out due diligence checks on the financial standing of the issuer before acceptance. However, as the diagram below shows, frequently there is a chain of LOIs that mirrors the charter chain. Even if the issuer of the immediate LOI to the owner is not ‘good for their money’, Rory Butler and William Gidman of HFW have recently acted in two cases where owners / charterers have successfully relied on the Contracts (Rights of Third Parties) Act 1999 and the principle in THE LAEMTHONG GLORY to secure the release of the vessel and avoid all liabilities by directly enforcing an LOI issued by a more financially sound party further down the LOI chain. This approach is possible if an LOI not immediately issued to the owner is nevertheless addressed to ‘The Owners/Disponent Owners/Charterers of the [vessel]’. This wording has been found to confer a benefit on an owner permitting third party enforcement.

The flip side is that a party further down the LOI chain who does not want to have any direct liability to an owner should consider excluding the Contracts (Rights of Third Parties) Act and restricting the beneficiaries of the LOI.

Commentary has suggested e-bills of lading will solve this problem once and for all. While that may ultimately prove to be correct, some tech solutions present their own problems. On a related note the recently published judgment in MSC EUGENIA [2017] EWCA Civ 365 highlights the danger of cyber fraud which is also not usually covered by P&I insurance, and of releasing cargo against pin codes rather than bills of lading.

LOI Checklist

Getting an LOI right at the time of issuance and acting fast to enforce its terms is vital. Below is a general checklist of steps to consider, but specific legal advice should always be sought given the level of potential exposure.

For party receiving LOI

When drafting the LOI

- Is there a legitimate reason for the LOI?

- Is the issuer of the LOI of good financial standing and in what jurisdiction are their assets located?

- Is the recipient of the cargo under the LOI the same as the consignee under the bill of lading?

- Include wide wording ‘or to such party as you believe to be or to represent [the receiver] or to be acting on behalf of [the receiver]’ as per International Group recommended text.

- Ensure LOI addressed to a wide range of parties – ‘The Owners / Disponent Owners / Charterers of the [vessel]’.

- Ensure Contracts (Rights of Third Parties) Act is included (or at least not excluded).

- Ensure the validity of the LOI not time limited.

At delivery

- Ensure delivery is to the party named in the LOI or their agent.

- Obtain evidence confirming the identity and capacity of the party taking delivery.

- Ideally do not release the cargo from the port until the original bills of lading have been collected.

Enforcement

- Did delivery take place in compliance with the instructions in the LOI?

- Can an owner rely on the Contracts (Rights of Third Parties) Act?

- Anti-suit injunction required to prevent claim by third party in foreign jurisdiction contrary to law and jurisdiction of the bill of lading?

For party giving LOI

When drafting the LOI

- Exclude or narrow the wording thus do not use ‘or to such party as you believe to be or to represent [the receiver] or to be acting on behalf of [the receiver]’.

- Only address LOI to a single named party., normally your direct counterpart.

- Exclude the Contracts (Rights of Third Parties) Act.

- Time limit the validity of the LOI.

- Limit the level of liability.

Enforcement

- Did delivery take place in compliance with the instructions in the LOI?

- Ask owner for evidence confirming the identity and capacity of the party who took delivery.

- Can an owner rely on the Contracts (Rights of Third Parties) Act?

Rory Butler

Partner, London

T +44 (0)20 7264 8310

E rory.butler@hfw.com

William Gidman

Associate, London

T +44 (0)20 7264 8579

E william.gidman@hfw.com

Download a PDF version of ‘Discharge of cargo without original bills of lading and letters of indemnity (LOI): one of the biggest risks a shipowner or charterer can take, March 2018’