Containing the ore outbreak

This article first appeared in the December 2010/January 2011 issue of Port Strategy and is reproduced with their kind permission. www.portstrategy.com

The world has, once again, been reminded of China’s massive effect on Australia’s economy with the signing of ten investment, trade and cooperation agreements between the two countries.

The June 2010 agreements are worth more than $10bn in total and, reflecting their importance to Australia’s national interests, were signed in front of Prime Minister Kevin Rudd and Vice President Xi Jinping.

Not surprisingly, seven of the ten agreements relate to resources and energy. Port infrastructure and development projects were the subject of three deals highlighting the important role that export infrastructure plays in Australia’s economy.

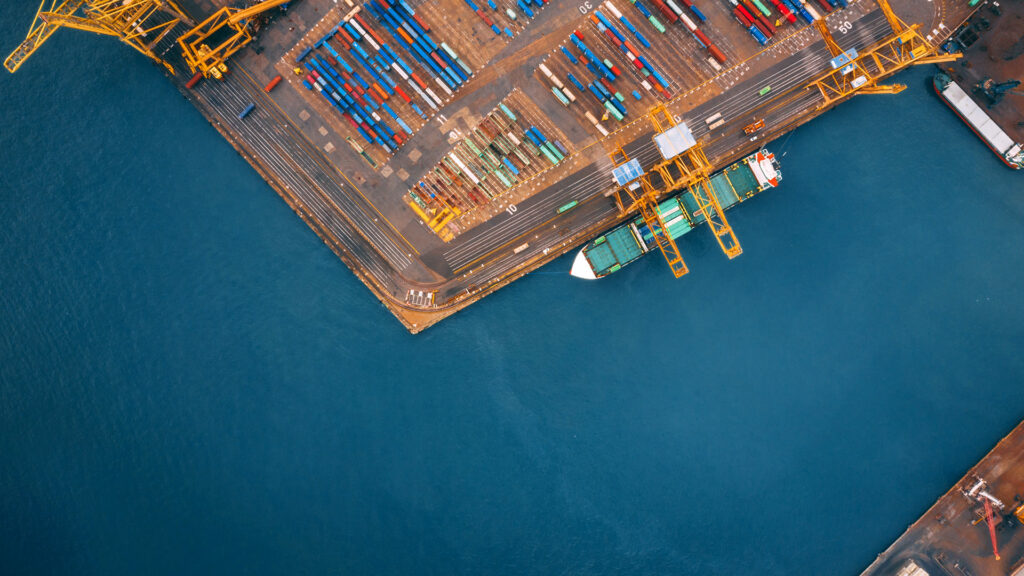

Chinese investment in Australian ports is part of a larger trend of port expansion driven by rapidly increasing mining capacity. Iron ore exports are forecast to increase 50% by 2015. All up, more than US$24bn in port investment is in the works at various stages of design, development and construction.

Australia’s two biggest miners, BHP and Rio Tinto, are both planning to expand their ports capacities in the north-west Pilbara region. Rio Tinto is aiming to increase its mining capacity from 220m tonnes to 330m tonnes over the next four years.

Rio Tinto’s Cape Lambert port will have its capacity increased from 80m to 180m tonnes per annum in two stages. The estimated cost of the upgrade is US$1.2bn which would include the construction of an additional 1.8km, four-berth jetty and wharf. This follows the recently completed expansion at Cape Lambert which increased capacity from 55m to 80m tonnes.

Rio’s other port, Parker Point in Dampier, expanded from 74m tonnes capacity in 2003 to 140m tonnes in 2008 (at a cost of US$1.4bn) and is currently undergoing further efficiency improvements and minor expansion to increase capacity by an additional 10m tonnes.

Port Hedland, which is used by BHP and other smaller miners, is also planning an expansion from 230m tonnes to 470m tonnes by 2013. It is already the world’s largest bulk minerals export port by volume. The projected cost is US$7.5bn. New berths, such as the recently opened Utah Point, will be dedicated to smaller miners.

The expansion at Port Hedland is key to Australia’s third largest miner, Fortescue Metals Group, which had its first shipment of iron ore in May 2008. Fortescue has developed quickly. It’s current mining capacity is 55m tonnes which will increase to 120m tonnes over the next two years.

However, the development of Cape Lambert has been thrown in doubt by the abandonment of BHP and Rio Tinto’s proposed US$116bn iron ore joint venture. Regulators in Australia, Germany, Japan, Korea, as well as the European Commission, decided to block the deal on the grounds of antitrust/competition concerns, after which the parties decided to walk away in October. Rio may scale back its expansion of Cape Lambert, which would have handled the capacity from the joint venture.

Ten kilometres west of Rio’s Cape Lambert port is the proposed Anketell Point port being developed by Aquila Resources. While still in the early stages of planning, Aquila has spent $145m on environmental and geological studies since it started looking into the project in 2007. Fortescue has a stake in the project and the port would be used to export iron ore from Fortescue’s proposed Solomon project.

Fortescue’s Solomon project had been put on hold earlier this year because of the uncertainty created by the Australian Government’s proposed mining tax. The proposed tax has since been renegotiated, and Fortescue has recently announced that it would continue development. The proposed port, if it is completed, could have a capacity of 350m tonnes and cost US$4.1bn.

Anketell Point is also being backed by Chinese mining interests. It would be used also by China Metallurgical Group Construction (MCC), which is developing a 15m tonne magnetite project near Cape Lambert. Construction of MCC’s Cape Lambert mine is forecast to begin in Q2 of 2012 with a target date for first ore shipments in 2015.

Aquila also has ties to China Development Bank (CDB). CDB is a strategic partner of Baosteel Group Corporation which holds a 15% stake in Aquila.

China will no doubt continue to drive Australia’s resources industry. The shift from customer to investor and producer will continue as Chinese companies develop projects in Australia. Key to such projects are rail and port infrastructure, and Chinese involvement in the Australian port industry has already begun.

Competition concerns over port access have been a constant and intense issue in Australia. The development of ports alongside mining projects, made possible by the sustained resources boom, will change the dynamics of the mining industry as a whole. However, competition concerns still remain and will likely reassert themselves as soon as port capacity becomes constrained again in the future.

In the meantime, port development, construction and management will be key areas of opportunities in Australia. We expect such opportunities to continue to increase to the benefit of China, Australia and the Asia-Pacific region.