A welcome change for authorised firms: the DFSA’s new client classification regime, March 2015

The client classification requirements set by the Dubai Financial Services Authority (DFSA) are changing on 1 April 2015. The changes, originally consulted upon in the DFSA’s September Consultation Paper No. 97 (CP 97) are intended to reflect developments and practice in the financial services industry and are, overall, a welcome change for authorised firms operating in the Dubai International Financial Centre (DIFC).

The new rules on the client classification regime are contained in Chapter 2 of the DFSA Rulebook’s Conduct of Business Module (COB). We summarise below the principal changes for DIFC authorised firms.

Client classification

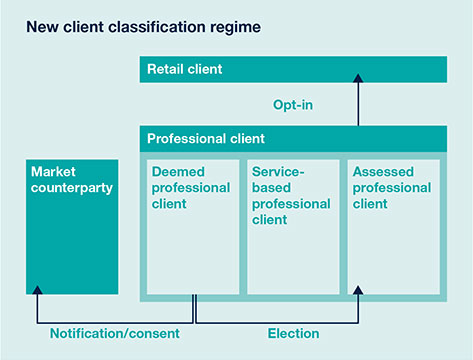

The purpose of the client classification regime is to ensure that the scope of regulatory protection provided to a person is appropriate in light of the person’s experience and resources. The current client classification regime was introduced in 2007 and requires authorised firms to classify a prospective client as a retail client, professional client or market counterparty before carrying on any financial services activity with that client. Essentially, greater regulatory protection is provided to retail clients, while more limited protections apply in respect of professional clients and market counterparties on the basis that an authorised firm transacts with such clients on an equal footing.

The new client classification regime adopts a more risk-based approach to client classification and provides authorised firms with much greater flexibility, primarily by:

- Expanding the categories of persons that can be classified as professional clients without the need for a detailed assessment of assets or expertise of such persons.

- Expanding the circumstances in which the professional client status of one person can be attributed to another person.

- Streamlining the process for classification of market counterparties.

- Allowing an authorised firm which is a branch or a member of a group to:

- Rely on client classification undertaken by its head office or another entity within the group, provided the risks of such reliance are addressed; and

- Provide a “bundle” of financial services to a client with another entity within the group.

The new regime also clarifies some aspects of the existing regime which authorised firms may have found difficult to interpret or implement.

Retail clients

Retail clients are those clients who do not fall within the categories of professional clients or market counterparties. As noted above, the rules applicable in respect of retail clients are more onerous and require authorised firms, for example, to carry out an assessment of the assets, experience and knowledge of the client.

Professional clients

Professional clients will fall within one of the following three sub-categories:

- “Deemed” professional clients: these comprise essentially institutional and wholesale clients with sufficient assets, experience and knowledge so that authorised firms can carry on financial services with or for such a client without the need to undertake a detailed assessment of the client’s assets or expertise. The authorised firm must have a reasonable basis for classifying a client within the list of “deemed” professional clients in COB Rule 2.3.4(1).

- “Service-based” professional clients: authorised firms will also not need to undertake an assessment of the assets, experience and knowledge of clients where the authorised firm is providing the following types of financial service to the client:

- Providing credit to an undertaking for use in the business activities of the undertaking or a related party of the undertaking (such as a controller or member of its group).

- Advising an undertaking on financial products or credit or arranging credit or deals in investments for the purposes of corporate structuring and financing.

- “Assessed” professional clients: these comprise clients who, based on an assessment of the client’s assets, experience and knowledge would be classified as professional clients. The key changes from the existing assessment regime are:

- The current net asset threshold of US$500,000 will be increased to US$1 million with effect from 1 April 2016.

- The professional client status of one person (the “primary account holder”) can be attributed to another person (the “joint account holder”) in the following circumstances:

- The joint account holder is a family member of the primary account holder.

- The account is used for the purposes of managing investments for the primary account holder and the joint account holder.

- The joint account holder has confirmed in writing that investment decisions relating to the joint account are generally made for, or on behalf of, him by the primary account holder.

Importantly, individuals can only be classified as “assessed” professional clients as only undertakings can be “deemed” and “service-based” professional clients.

All professional clients can opt-in to be treated as a retail client. Although originally the DFSA had proposed that only “service-based” and “assessed” professional clients would have a right to opt-in to being treated as a retail client, this proposal was amended following public comments.

Market counterparties

The existing rules in relation to market counterparties have been amended to clarify the notification and consent process. A person may be classified as a market counterparty if the person is a “deemed” professional client and the authorised firm has complied with the notification and consent procedures set out in COB Rule 2.3.9(2).

An important clarification for the insurance industry is set out as guidance to COB Rule 2.3.9, which provides that the provision of reinsurance or insurance management services to an insurer will fall within COB Rule 2.3.9(2) so that an authorised firm simply needs to give prior written notification that a person is to be treated as a market counterparty and the person has not requested to be classified otherwise within the timeframe set out in the notice. This clarification addresses any uncertainty that may have existed under the existing client classification regime.

Trusts

Under the new regime, if an authorised firm intends to provide any financial service to a trust, it must treat the trustee of the trust, and not the beneficiaries of the trust, as its client. This is based on the position in the United Kingdom.

Reliance on client classification made elsewhere

Under the new client classification regime, an authorised firm which is a branch or a member of a group can rely on client classification undertaken by its head office or another entity within the group where:

- The authorised firm has reasonable grounds to believe that the client classification is substantially similar to the client classification rules prescribed by the DFSA.

- Any gaps between the client classification process are effectively addressed by the authorised firm.

The authorised firm should be able to demonstrate to the DFSA the due diligence process undertaken by the authorised firm in relation to the above. The DFSA’s response to public comments on CP 97 notes that as the DFSA’s regime is substantially aligned with the UK client classification regime (as a proxy for the EU regime), the gap analysis which an authorised firms needs to undertake in relation to a client classification made under the markets in financial instruments directive by an EU-based head office or group member should be straightforward.

Group clients and “bundle” of financial services

A further enhancement to the existing client classification regime is that authorised firms may be able to provide financial services as part of one or more (referred to in COB as a “bundle” of) financial services provided to the client by the authorised firm and its group members where:

- The client classification adopted by the authorised firm is consistent with the DFSA’s requirements for client classification and is appropriate for the overall bundle of financial services to be provided to the client.

- The client has a clear understanding of the arrangements whereby financial services are provided to the client by the authorised firm in conjunction with the other members of the group.

- Any risks arising from the arrangement are identified and appropriately and effectively addressed.

Next steps for authorised firms

Authorised firms will need to comply with the new client classification regime from 1 April 2015, with the exception of the increase of the asset test for “assessed” professional clients from US$500,000 to US$1 million, which will come into effect on 1 April 2016.

Importantly for authorised firms, transactions and client agreements which were in place prior to 1 April 2015 can remain in place and there is no need to reclassify existing clients in respect of the provision of continuing financial services. However, authorised firms would be well advised to:

- Review their existing policies and procedures, including their compliance manuals, and update these to reflect the new client classification regime; and

- Implement a procedure to ensure that from 1 April 2015, the classification of:

- All new clients; and

- Any existing clients to whom a new financial service or financial product is offered

…is in accordance with the new client classification regime in COB.

In relation to the increase in the asset threshold, from 1 April 2016, authorised firms will need to apply the new threshold both for all new clients and where new financial services or financial products are provided to existing “grandfathered” clients. Authorised firms should therefore consider the impact of the increase in the net asset test and prepare transitional plans for existing clients.

Impact on the insurance industry

The DFSA’s new client classification regime should be a welcome change for authorised firms as a more risk-based approach to client classification provides greater flexibility which is better suited to the business and operations of authorised firms operating in or from the DIFC.

Authorised firms will benefit from the expansion of the circumstances in which authorised firms do not need to undertake a detailed assessment of a client’s net assets, knowledge and experience before classifying them as professional clients and also from the ability for authorised firms which operate as part of a group to rely on client classification undertaken by group members and to provide financial services to a client in conjunction with other members of its group.

Of course, a risk-based approach means it is more important that authorised firms effectively document their client classification processes to ensure that they can evidence to the DFSA that they are properly applying and complying with the spirit of COB Chapter 2.

For the insurance industry, in particular, there are still certain aspects of the client classification regime that are not appropriate for authorised firms operating in the DIFC on a purely reinsurance basis. Under the new client classification regime, where an authorised firms is providing reinsurance or insurance management services to an insurer, the insurer (i.e. the client) will typically be classified as “deemed” professional client. However, to treat the insurer as a market counterparty, the authorised firm still needs to send a notice to the insurer providing the insurer a time frame within which the insurer would need to opt-in to being treated as a retail client, a process which seems nonsensical when applied to the reinsurance market. Further, certain aspects of COB Chapter 7 which apply in relation to dealings with a “client” in general (e.g. explaining a client’s duty of disclosure and explaining the nature of insurance) ought not apply when the client is itself an insurance company. The DFSA has noted that the application of the client classification regime to the reinsurance industry will be considered as part of a broader review of insurance-related financial services.

Download a PDF version of ‘A welcome change for authorised firms: the DFSA’s new client classification regime, March 2015’