Thought leadership

Assessing the impact of international trade sanctions, October 2015

Sanctions remain high on the commercial agenda, with businesses keen to understand the nature of the restrictions; the extent to which they can trade with countries which are subject to sanctions; and how to ensure compliance.

Sanctions against Iran – what effect will sanctions relief have?

There is a great deal of focus on Iran and the EU Regulation which is due on Adoption Day, around 18 October 2015. The EU Regulation is expected to set out in more detail the precise scope of sanctions relief which will follow on Implementation Day, likely to be some time after April 2016.

While the precise date for sanctions relief will depend on the speed and extent of Iranian performance under the Joint Comprehensive Plan of Action, many businesses are already considering whether the anticipated sanctions relief will result in meaningful opportunities for increased trade with the Islamic Republic, and decisions on how to proceed.

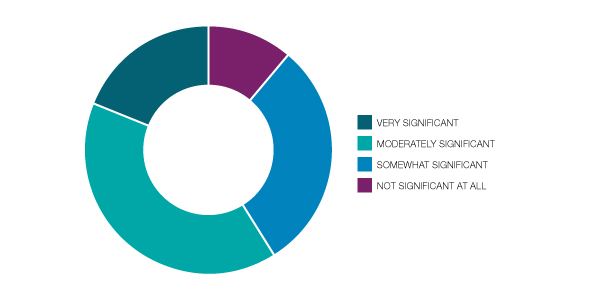

We recently asked some of our clients about the significance of opportunities in Iran for their business and what the main barriers were to their business operating in Iran. The following charts set out the findings in more detail.

It was fascinating to see that almost 60% of respondents considered that Iran presented a “very significant” or “moderately significant” opportunity. This shows the level of interest in Iran and the potential for trade with Iran to increase if sanctions are lifted. Traders, shipowners, banks and insurers will of course need to be confident that they can engage in lawful trade without infringing the remaining restrictions. There is no obligation on the US to relax restrictions under US sanctions on US persons or US dollar transactions. The remaining restrictions for non-US persons and non-US dollar transactions relate predominantly to Iran’s ballistic missile program and human rights violations, and include a continuing asset freeze against certain individuals and entities. Significant due diligence and planning will therefore be required.

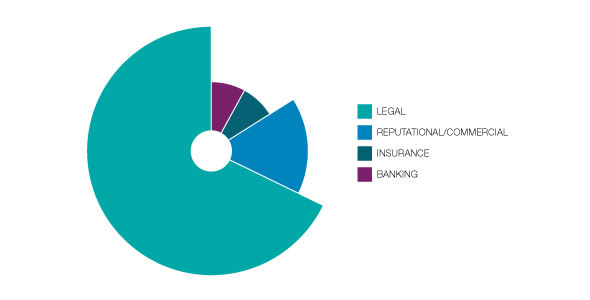

Almost 70% of respondents identified legal issues, as opposed to commercial/reputational, insurance or banking issues, as the main barrier to operating in Iran, showing the importance of getting the law right – particularly in this complex and dynamic arena.

However, the other issues should not be downplayed. The availability of finance and insurance to support trade with Iran will be critical to the success of the sanctions relief.

Other factors to consider when exploring opportunities in Iran include the need to get local input on trading requirements in Iran, the need to contract on suitable terms, and the need to continue to exercise appropriate due diligence, in light of the sanctions which remain.

Sanctions against Russian and Syria – what effect are sanctions having?

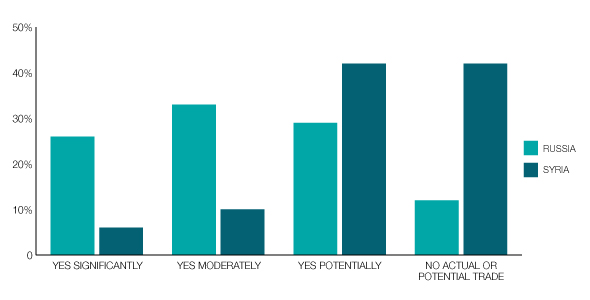

We asked the same clients about their level of trade with Syria and Russia. The tables below show the responses we received and the clear difference between clients’ exposure to Russia, where almost 60% of clients engage in at last some trade, and Syria, where the equivalent figure is only 16%.

This difference in the amount of trade with Russia and with Syria shows the potential impact on EU businesses of further sanctions against Russia, and the need for businesses to keep a close eye on developments in this regard.

These figures also show the potential impact on Russia of further restrictions, which may trigger further counter-measures from Russia, adding to the existing import ban on foodstuffs from the EU.

Finally, the limited trade may have a bearing on the modest impact of sanctions against Syria, but it is clear that trade with Syria could potentially increase significantly.

In order to assist clients to navigate the complex web of trade sanctions, we have prepared a special report which explains how your business can build an effective risk management programme. Please click here to view this report, hard copies are available on request.

The conclusions can be summarised as follows:

Political developments at a regional and national level present a host of difficulties for enterprises engaged in international commerce. Businesses may find themselves dealing with an uncertain and potentially volatile environment, and legal restrictions may severely restrict their ability to comply with their contractual obligations and pursue their commercial objectives.

Nowhere is this more true than in the field of international trade sanctions, where fast-moving political developments have resulted in a wide range of restrictions being imposed.

Sanctions have never been more complex or dynamic, with numerous programmes in place. The map opposite shows the large number of countries which were subject to some degree of EU or US restriction as of September 2015.

Businesses are forced to deal with onerous restrictions against Russia, with the ever-present threat of more restrictions being imposed, while also keeping on top of the developing situation with respect to Cuba and Iran, where the possible lessening of sanctions creates welcome opportunities, but also threats.

The consequences of violating sanctions are hugely significant, with not only reputations and commercial relationships at risk, but also the spectre of criminal penalties, including huge fines for businesses – sometimes running into millions or billions of dollars – and prison sentences for individuals.

This means that it is critical to understand and manage the risks, and be able to provide regulators with evidence of the actions taken to ensure compliance. That includes having a robust and effective risk management programme.

For more information, please contact Daniel Martin, Partner on +44 (0)20 7264 8189 or daniel.martin@hfw.com, or Anthony Woolwich, Partner on +44 (0)20 7264 8033 or anthony.woolich@hfw.com, or your usual contact at HFW.